EX-99.5

Published on July 25, 2022

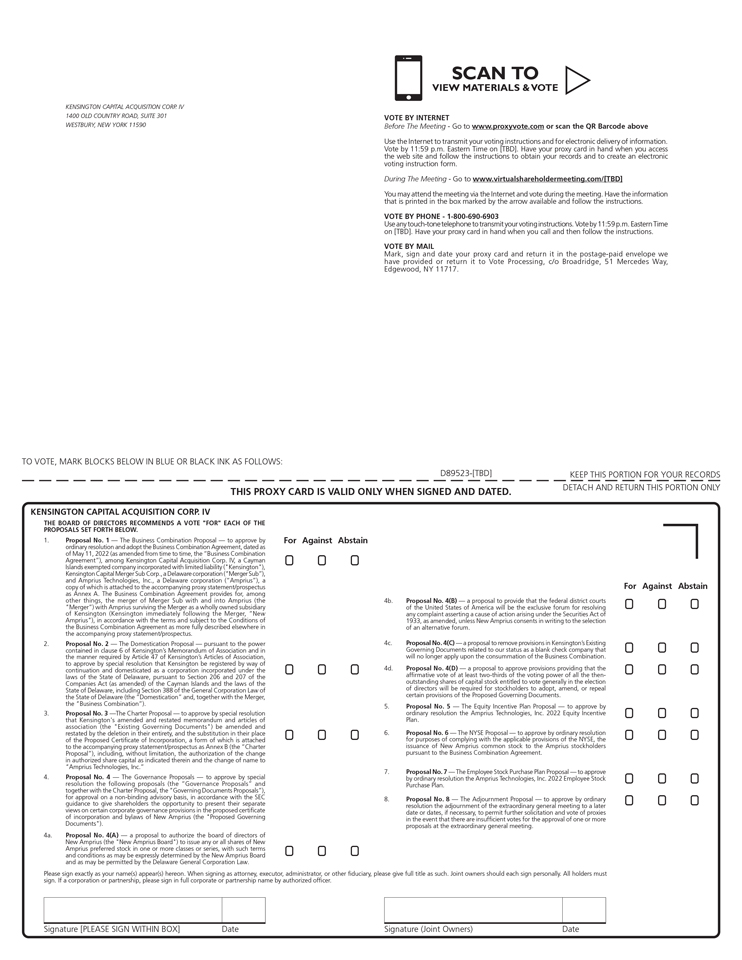

Exhibit 99.5

SCAN TO VIEW MATERIALS & VOTE KENSINGTON CAPITAL ACQUISITION CORP. IV 1400 OLD COUNTRY ROAD, SUITE 301 WESTBURY, NEW YORK 11590 VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 p.m. Eastern Time on [TBD]. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/[TBD] You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 p.m. Eastern Time on [TBD]. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. D89523-[TBD] KENSINGTON CAPITAL ACQUISITION CORP. IV THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE PROPOSALS SET FORTH BELOW. For Against Abstain 1. Proposal No. 1 The Business Combination Proposal to approve by ordinary resolution and adopt the Business Combination Agreement, dated as of May 11, 2022 (as amended from time to time, the Business Combination Agreement), among Kensington Capital Acquisition Corp. IV, a Cayman Islands exempted company incorporated with limited liability (Kensington), Kensington Capital Merger Sub Corp., a Delaware corporation (Merger Sub), and Amprius Technologies, Inc., a Delaware corporation (Amprius), a copy of which is attached to the accompanying proxy statement/prospectus as Annex A. The Business Combination Agreement provides for, among other things, the merger of Merger Sub with and into Amprius (the Merger) with Amprius surviving the Merger as a wholly owned subsidiary of Kensington (Kensington immediately following the Merger, New Amprius), in accordance with the terms and subject to the Conditions of the Business Combination Agreement as more fully described elsewhere in the accompanying proxy statement/prospectus. Abstain Against For 4b. Proposal No. 4(B) a proposal to provide that the federal district courts of the United States of America will be the exclusive forum for resolving any complaint asserting a cause of action arising under the Securities Act of 1933, as amended, unless New Amprius consents in writing to the selection of an alternative forum. 4c. Proposal No. 4(C) a proposal to remove provisions in Kensingtons Existing Governing Documents related to our status as a blank check company that will no longer apply upon the consummation of the Business Combination. 2. Proposal No. 2 The Domestication Proposal pursuant to the power contained in clause 6 of Kensingtons Memorandum of Association and in the manner required by Article 47 of Kensingtons Articles of Association, to approve by special resolution that Kensington be registered by way of continuation and domesticated as a corporation incorporated under the laws of the State of Delaware, pursuant to Section 206 and 207 of the Companies Act (as amended) of the Cayman Islands and the laws of the State of Delaware, including Section 388 of the General Corporation Law of the State of Delaware (the Domestication and, together with the Merger, the Business Combination). 4d. Proposal No. 4(D) a proposal to approve provisions providing that the affirmative vote of at least two-thirds of the voting power of all the then-outstanding shares of capital stock entitled to vote generally in the election of directors will be required for stockholders to adopt, amend, or repeal certain provisions of the Proposed Governing Documents. 5. Proposal No. 5 The Equity Incentive Plan Proposal to approve by ordinary resolution the Amprius Technologies, Inc. 2022 Equity Incentive Plan. 3. Proposal No. 3 The Charter Proposal to approve by special resolution that Kensingtons amended and restated memorandum and articles of association (the Existing Governing Documents) be amended and restated by the deletion in their entirety, and the substitution in their place of the Proposed Certificate of Incorporation, a form of which is attached to the accompanying proxy statement/prospectus as Annex B (the Charter Proposal), including, without limitation, the authorization of the change in authorized share capital as indicated therein and the change of name to Amprius Technologies, Inc. ! 6. Proposal No. 6 The NYSE Proposal to approve by ordinary resolution for purposes of complying with the applicable provisions of the NYSE, the issuance of New Amprius common stock to the Amprius stockholders pursuant to the Business Combination Agreement. 7. Proposal No. 7 The Employee Stock Purchase Plan Proposal to approve by ordinary resolution the Amprius Technologies, Inc. 2022 Employee Stock Purchase Plan. 4. Proposal No. 4 The Governance Proposals to approve by special resolution the following proposals (the Governance Proposals and together with the Charter Proposal, the Governing Documents Proposals), for approval on a non-binding advisory basis, in accordance with the SEC guidance to give shareholders the opportunity to present their separate views on certain corporate governance provisions in the proposed certificate of incorporation and bylaws of New Amprius (the Proposed Governing Documents). 8. Proposal No. 8 The Adjournment Proposal to approve by ordinary resolution the adjournment of the extraordinary general meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for the approval of one or more proposals at the extraordinary general meeting. 4a. Proposal No. 4(A) a proposal to authorize the board of directors of New Amprius (the New Amprius Board) to issue any or all shares of New Amprius preferred stock in one or more classes or series, with such terms and conditions as may be expressly determined by the New Amprius Board and as may be permitted by the Delaware General Corporation Law. ! Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer.

Important Notice Regarding the Availability of Proxy Materials for the Extraordinary General Meeting: The Notice and Proxy Statement is available at www.proxyvote.com. D89524-[TBD] KENSINGTON CAPITAL ACQUISITION CORP. IV Extraordinary General Meeting of Shareholders [TBD] This proxy is solicited by the Board of Directors The undersigned hereby appoints Justin Mirro and Daniel Huber (together, the Proxies), and each of them independently, with full power of substitution, as proxies to vote the Class A ordinary shares or Class B ordinary shares of Kensington Capital Acquisition Corp. IV (the Company or Kensington) that the undersigned is entitled to vote (the Shares) at the extraordinary general meeting (the meeting) of shareholders of the Company to be held on [TBD] at 10:00 a.m., Eastern time, via live webcast at www.virtualshareholdermeeting.com/[TBD], and at any adjournments and/or postponements thereof. For purposes of the Cayman Islands law and the amended and restated memorandum and articles of association of Kensington, the physical location of the extraordinary general meeting will be at the offices of Hughes Hubbard & Reed LLP, One Battery Park Plaza, New York, NY 10004. The Shares shall be voted as indicated with respect to the proposals listed on the reverse side and in the Proxies discretion on such other matters as may properly come before the meeting or any adjournment or postponement thereof. The undersigned acknowledges receipt of the accompanying proxy statement/prospectus and revokes all prior proxies for said meeting. THE SHARES REPRESENTED BY THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO SPECIFIC DIRECTION IS GIVEN AS TO THE PROPOSALS, THIS PROXY WILL BE VOTED FOR EACH OF PROPOSAL NOS. 1, 2, 3, 4, 5, 6, 7 AND 8. PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY. The proxy statement/prospectus is available at www.sec.gov or via www.autospac.com. The proxy statement/prospectuscontains important information regarding each of the proposals listed on the reverse side. You are encouraged to read the proxy statement/prospectus carefully. Continued and to be signed on reverse side