EX-99.1

Published on November 10, 2022

Exhibit 99.1

LETTER TO SHAREHOLDERS Q3 Fiscal 2022 November 2022

Letter to Shareholders November 2022 Dear Shareholders, We are pleased to share our Q3 2022 financial results and operational highlights with you today. Our production capability is expanding, our battery performance is unmatched in the current market, and we have several blue-chip customers, among many others who are interested in working with us. Our general reporting approach will be to publish a quarterly shareholder letter detailing the results for the quarter, followed by a conference call on which we will briefly summarize the main highlights and host a Q&A session. Company Overview Since this is our first quarterly letter as a publicly traded company, we would like to take this opportunity to briefly introduce Amprius Technologies to our new investors. Amprius is a leader in ultra-high energy density lithium-ion batteries with its silicon nanowire anode platform. The team continues to improve its batteries in pursuit of game changing performance, offering batteries that provide superior performance compared to conventional graphite lithium-ion batteries. These next generation batteries have powered world record flights and enable extreme fast charge rates from 0% to 80% state of charge in approximately six minutes. How did we get here? Amprius was born in 2008 based on a concept developed by Stanford Universitys world-renowned Materials Science and Engineering Professor Yi Cui. For years, researchers have worked to increase the amount of energy stored in a lithium-ion battery. Amprius is developing a new large-scale manufacturing technique for advanced silicon electrodes that enable mass production of high-energy lithium-ion batteries and can bring next generation electric mobility and consumer electronics to market. We have spent over a decade transforming this technological concept into commercially available products. In 2014, we finalized our silicon nanowire anode structure design and its manufacturing process. Two year later, we built our first kWh scale manufacturing line in California and, in 2018, Amprius received its first purchase order from Airbus, beginning our journey towards commercialization. Last year, we initiated our large-scale manufacturing project to build a high-volume GWh scale facility in the United States to meet the overwhelming customer demand for our silicon nanowire anode batteries. Our business has four distinct advantages: Unmatched product performance Proven manufacturability Years of product commercialization experience A team of experienced business operators with a solid track record The high energy density of silicon is perhaps its most compelling characteristic. Our silicon nanowire anode enables us to take

Letter to Shareholders November 2022 full advantage of silicon as an anode material and mitigate the problem of silicon volume expansion. Amprius silicon anode uses 100%1 silicon and completely replaces graphite. Our silicon anode has achieved 3400 mAh/g capacity, making it the highest capacity anode in the industry, approximately ten times the capacity of a commercial graphite anode. However, not all silicon structures can work as an anode. Most silicon structures can be used as an additive in a graphite matrix and dont maintain structural integrity at high silicon concentration in real commercial applications. Amprius silicon nanowire structure has been proven in customers commercial applications. Today, Amprius delivers commercial batteries with the highest energy density and power density. Our batteries have up to 450Wh/ kg specific energy density, up to 1150 Wh/L volumetric energy density, and up to 10C high power charging capability. A few weeks ago, we hosted a demonstration of our batteries Extreme Fast Charge capability in which we charged one of our batteries from 0% to 80% in approximately six minutes. In addition, our batteries offer a wide operating temperature range of -30°C to 55°C, which is particularly important for the aviation market that we are currently supplying. Amprius is the only battery manufacturer in the commercial market with these performance levels. Public Company Listing on NYSE In the third quarter, we completed our business combination with Kensington Capital Acquisition Corp. IV and began trading on the NYSE on September 15, 2022. We could not have found a better partner than the Kensington team. This transaction provided Amprius with access to the capital markets and was a critical step on our roadmap to build scale that can fulfill market demand for our silicon nanowire anode batteries. The $71.8 million net cash proceeds from the transaction and PIPE 1 Actual percentage of silicon is 99.5-99.9%, which is within the range of acceptable purity levels for materials that are considered 100%.

Letter to Shareholders November 2022 investment will accelerate the development timeline of our GWh scale manufacturing facility. Following the close, Kensingtons Chairman and CEO Justin Mirro joined our Board. We are fortunate to continue working with Justin and for the support of the entire Kensington team. In the future, we expect to leverage the Kensington teams deep automotive and manufacturing expertise. Our long-term goal is to see our silicon nanowire anode technology become a mainstream technology, with applications across all electric mobility markets, including the electric vehicle (EV) industry. Target Markets for Amprius Batteries We are currently focused on addressing applications in the aviation market, which we expect will grow to a $50 billion TAM by 2025. The performance of our batteries enables the electrification of aviation, offering lighter weight and/or more energy dense batteries, overcoming current technology barriers that limit range and payload capacity. We are selling batteries and engaging with customers in three aviation market segments unmanned aerial systems (UAS), high altitude pseudo satellites (HAPS), and air transportation (eVTOL). Within each segment, Amprius customized batteries are the leader in product performance, and we currently offer 10 commercial SKUs across three platforms: high energy, high power, and balanced energy/power. We have a group of blue-chip aviation industry customers that currently use our batteries in real-world situations. Select Amprius customers include: Airbus (with its Zephyr HAPS program) AeroVironment Teledyne FLIR BAE Systems Early in the third quarter, we entered into a three-year Component Purchase Agreement with Teledyne FLIR, whose industry-leading UAS products are used by defense and security forces worldwide. The agreement sets forth the commercial terms under which both Amprius and Teledyne FLIR plan to expand their relationship over the next three years to address the expanding UAS market. Additionally, last month we announced a 3-year cooperation agreement with defense industry leader BAE Systems. We will initially work with BAE Systems Air business, delivering our lightweight high-energy batteries specifically developed for electrically powered flight applications. This agreement further validates the enormous potential of our silicon nanowire anode technology in rigorous aerial and military applications, as BAE intends to investigate business opportunities enabled by the use and supply of Amprius batteries in their electric product portfolio. Grants Awarded by the U.S. Department of Energy In addition to commercial customers, the U.S. Government has also consistently shown its support for Amprius and our innovative silicon anode technology.

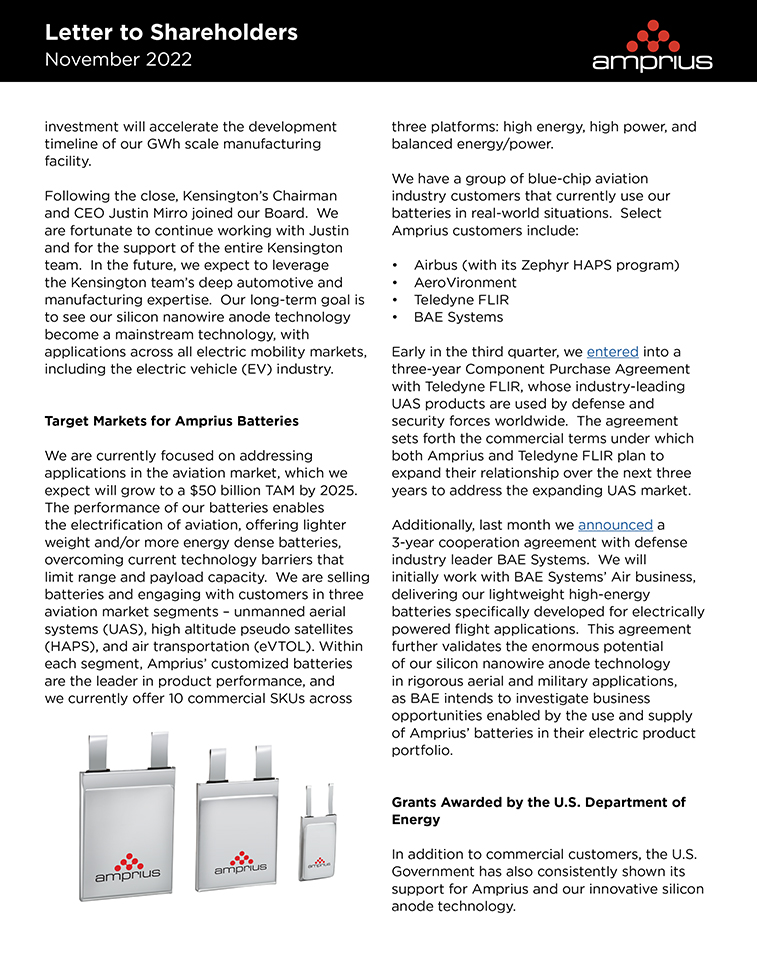

Letter to Shareholders November 2022 Last month, Amprius was awarded a $50 million cost share grant as a part of President Bidens Bipartisan Infrastructure Law, reflecting our companys position as a pioneer in electric mobility and reinforces the governments confidence in our technology. Amprius was among the first set of companies to receive funding under the Bipartisan Infrastructure Law. This cost sharing grant is dependent on the successful negotiation of a final contract, and among the terms to be finalized are the portion of relevant costs that will be covered by the grant. This non-dilutive funding is yet another catalyst to our production capacity expansion, as this grant is focused on expanding the domestic manufacturing of batteries for electric vehicles. Furthermore, this federal cost sharing grant is one of several grants previously awarded to Amprius as the national agenda begins to shift towards the electrification supply chain. In total, Amprius has received four grants from the U.S. Department of Energy. We have also been awarded funding for a second multi-year development program with the United States Advanced Battery Consortium to advance the development of high energy density and low-cost EV batteries. Centrotherm Tool Delivery Today, Amprius top priority is to quickly scale its production capacity to meet customer demand and accelerate growth, and we have made progress on this goal in several ways. We recently received the first large-scale silicon nanowire anode production machine from centrotherm at our California facility. We are customizing the machine for our production processes and must then complete tuning and testing before the machine goes on-line for production purposes. We expect this machine to provide us approximately ten times more production capacity by the end of 2023, which we intend to use for customer orders, as well as critical customer sampling and qualifications. Furthermore, it allows us to accelerate the development of our technological processes for building batteries at a GWh scale, since we have been limited to kWh scale to date. This expertise is necessary as we prepare to begin construction of our high-volume manufacturing facility. Building Our High-Volume Manufacturing Facility To take advantage of the tremendous opportunities in our target markets, Amprius must first build a large-scale manufacturing facility. Today, we have more customer inquiries than our capacity is able to serve, so we are diligently working towards expanding production at our current facility in Fremont, California. And, importantly, we are finalizing the location for our GWh scale manufacturing facility, which we have narrowed down to Texas or Georgia. We expect to announce the site location by the end of 2022.

Letter to Shareholders November 2022 In anticipation of our higher production capacity, we are making significant progress in technology and product development as well as customer acquisitions. We have developed a new battery design that has increased our battery specific energy density from 450Wh/ Kg to 500Wh/Kg. While this optimized design is still in development, we are excited to be developing the next generation of superior battery performance for our current and future customers. Additionally, an independent third-party lab recently validated the ability of our 390 Wh/ kg polymer electrolyte cell to successfully pass the nail penetration test per the requirements of section 4.7.4.4. of the MIL-PRF-32383 (Military Performance Specification), a test that is used to determine the feasibility of a specific product in combat scenarios. This is an important milestone for Amprius contract with the U.S. Army to develop 100%2 silicon anode lithium-ion batteries. We are proud of this accomplishment, as this is another significant step in the development of our technology and product portfolio. The increase in energy density performance, combined with the lower overall weight of the battery, have the potential to be used in many applications, including wearable devices doubling the run-time for mobile-powered devices. Additional details will be provided in an upcoming press release. On the commercial side, we are rapidly building our customer pipeline as our customers products are approaching commercial launch and our batteries are validated by more commercial applications. In the third quarter, we also added a vice president of infrastructure to our leadership team to spearhead our expansion efforts to scale production capacity. Andrew Huie brings over 30 years of facility development and management experience to Amprius and was most recently at Panasonic Energy of North America, working at Teslas first Gigafactory. He will lead the development of our high-volume manufacturing facility, focusing on factory planning, facility development and regulatory compliance. Financials Total revenue for the third quarter of 2022 was $0.8 million. Specifically, third quarter product revenue was $0.5 million, reflecting 9 customers sampled, including two leading eVTOL manufacturers. Third quarter development services revenue was $0.3 million, reflecting the delivery of cells and reports under contract with the U.S. Army for development of cells with gel electrolyte. Our third quarter GAAP gross profit margin was negative 180%; variation in gross margin period over period is based on the mix of product and services. Our third quarter GAAP operating expenses totaled $2.9 million, and our third quarter GAAP net loss was $4.2 million, or a loss of $0.06 per share. In the third quarter we strengthened our balance sheet, exiting the quarter with $73.8 million in cash and no debt, a net increase of $68.6 million from the second quarter of 2022, primarily driven by net cash received from the business combination with Kensington, discussed above. Going forward, we expect higher capital expenditures as we continue to invest in our Fremont, California facility, fully building out the 2MWh capacity at that location, while concurrently starting the design, site selection and construction of our GWh scale facility. 2 Actual percentage of silicon is 99.5-99.9% which is within the range of acceptable purity levels for materials that are considered 100%.

Letter to Shareholders November 2022 Summary It has been a long journey transforming our proprietary technology concept into a business poised to scale into high-volume production. We believe our established market leadership will enable us to extend our presence in the rapidly growing aviation markets while also serving other mobility-related markets like electric vehicles that require improvements in their electrification solutions. We continue to execute on our strategic growth plan of commercializing our proprietary silicon nanowire technology and capitalizing on robust market demand for next-generation batteries. Backed by our innovative products, strong balance sheet, a supportive base of customer partnerships, and a team of technology innovators and experienced business operators, we believe Amprius is uniquely positioned to advance the future of electric mobility today. The team at Amprius appreciates your continued support, and we look forward to what is ahead for our company and the battery industry. Sandra Wallach, CFO Quarterly Conference Call and Webcast: Date: Thursday, November 10, 2022 Time: 5:00 PM ET (2:00 PM PT) Toll-Free Number: +1 866-424-3442 International Number: +1 201-689-8548 Webcast: Register and Join

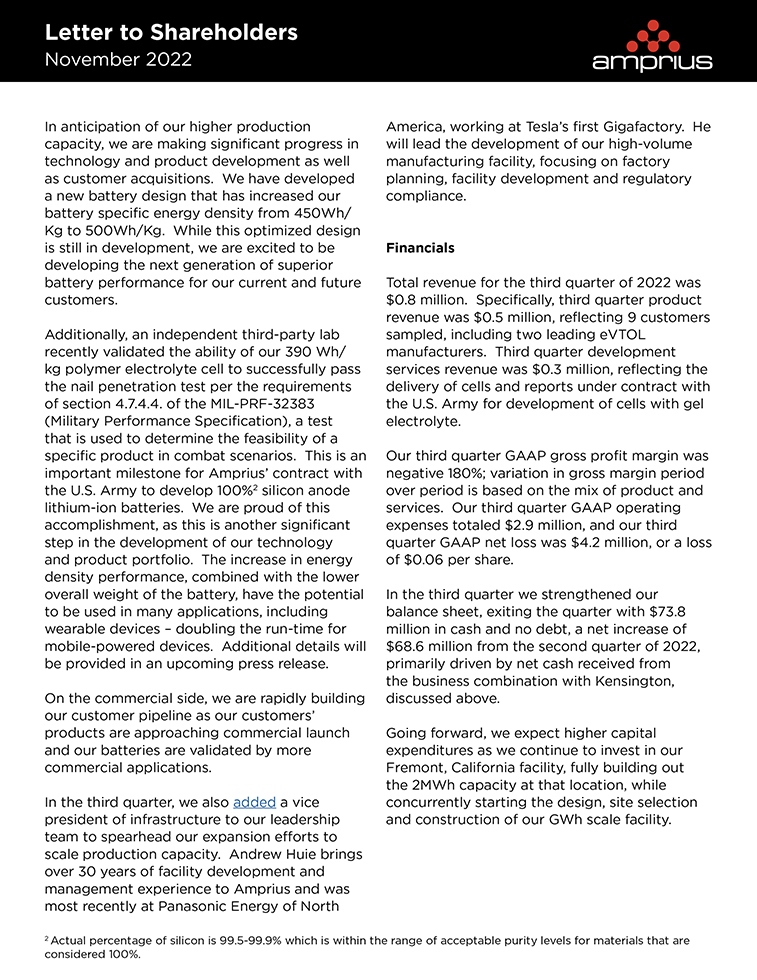

Letter to Shareholders November 2022 AMPRIUS TECHNOLOGIES, INC. (A CARVE-OUT OF AMPRIUS, INC.) CONDENSED BALANCE SHEETS (Unaudited, in thousands, except per share amounts) September 30, December 31, 2022 2021 ASSETS Current assets: Cash and cash equivalents $73,803 $11,489 Accounts receivable 782 262 Inventories, net 503 500 Prepaid expenses and other current assets 2,319 156 Deferred costs 412 1,769 Total current assets 77,819 14,176 Non-current assets: Operating lease right-of-use asset, net 2,830 Property and equipment, net 3,824 4,210 Deferred costs 1,425 141 Other assets 604 Total assets $86,502 $18,527 LIABILITIES AND STOCKHOLDERS EQUITY Current liabilities: Accounts payable $2,641 $359 Accrued and other current liabilities 2,183 1,446 Deferred revenue 795 2,363 Operating lease liabilities 517 Total current liabilities 6,136 4,168 Non-current liabilities: Deferred revenue 1,787 501 Operating lease liabilities 2,577 Total liabilities 10,500 4,669 Commitments and contingencies Stockholders equity: Common stock, $0.0001 par value, 950,000 shares authorized as of 8 7 September 30, 2022 and December 31, 2021, 84,254 and 65,772 shares were issued and outstanding as of September 30, 2022 and December 31, 2021, respectively Additional paid-in capital 162,825 89,252 Accumulated deficit (86,831) (75,401) Total stockholders equity 76,002 13,858 Total liabilities and stockholders equity $86,502 $18,527

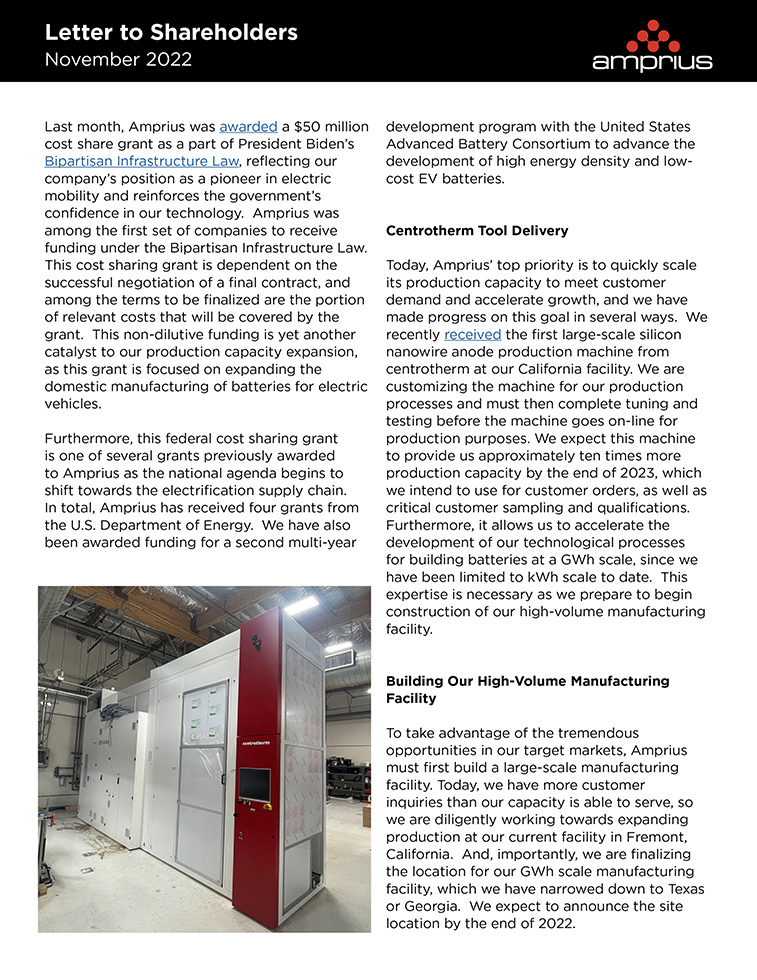

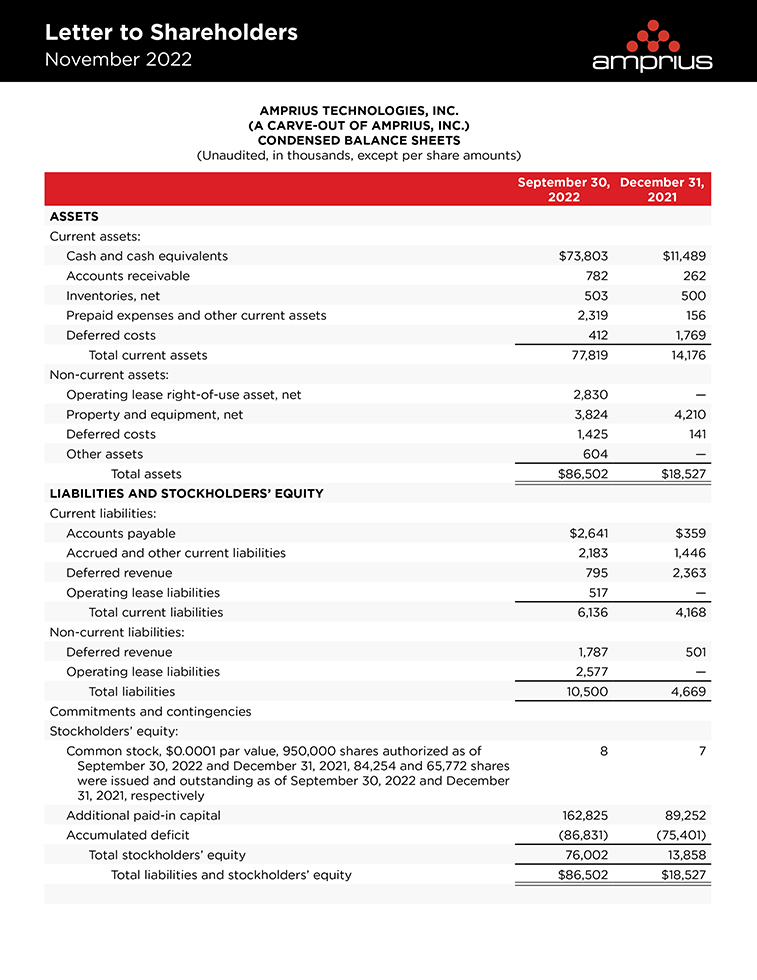

Letter to Shareholders November 2022 AMPRIUS TECHNOLOGIES, INC. (A CARVE-OUT OF AMPRIUS, INC.) CONDENSED STATEMENTS OF OPERATIONS (Unaudited, in thousands, except per share amounts) Three Months Ended Nine Months Ended September 30, September 30, 2022 2021 2022 2021 Revenue $816 $330 $3,617 $1,556 Cost of revenue 2,284 1,986 7,448 4,990 Gross loss (1,468) (1,656) (3,831) (3,434) Operating expenses: Research and development 488 327 1,340 978 Selling, general and administrative 2,367 1,154 6,223 2,508 Total operating expenses 2,855 1,481 7,563 3,486 Loss from operations (4,323) (3,137) (11,394) (6,920) Other income (expense), net: Interest income and other, net 79 (4) 118 (17) Gain on forgiveness of PPP loan 743 Total other income (expense), net 79 (4) 118 726 Net loss ($4,244) ($3,141) ($11,276) ($6,194) Weighted-average common shares outstanding: Basic and diluted 69,013 65,772 66,859 65,762 Net loss per share of common stock: Basic and diluted ($0.06) ($0.05) ($0.17) ($0.09)

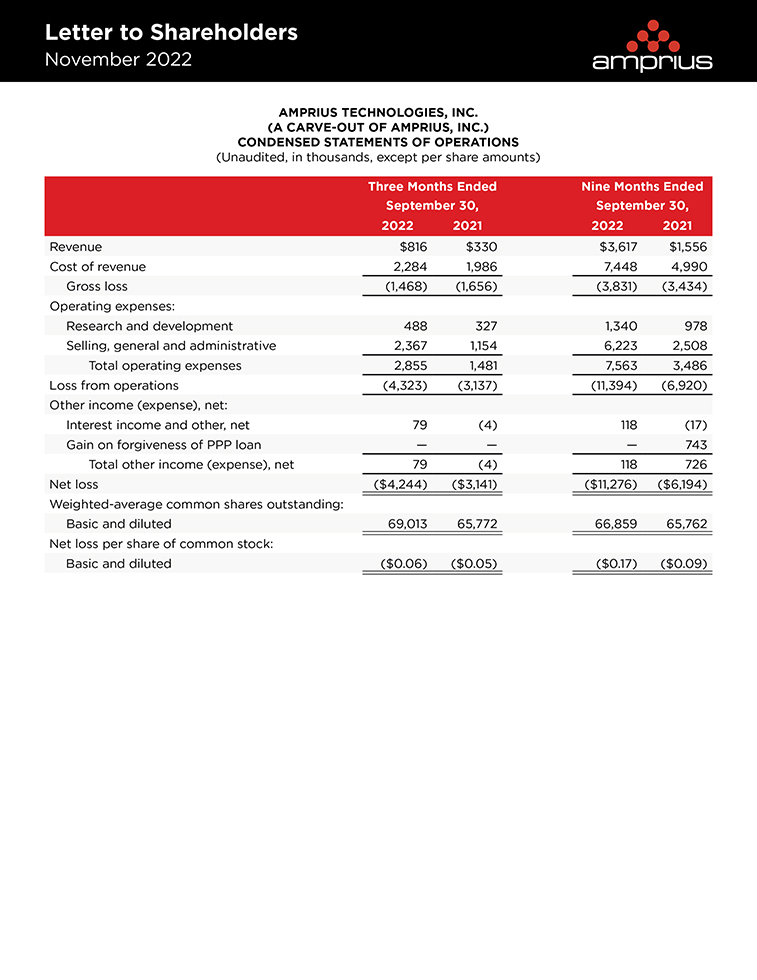

Letter to Shareholders November 2022 AMPRIUS TECHNOLOGIES, INC. (A CARVE-OUT OF AMPRIUS, INC.) CONDENSED STATEMENTS OF CASH FLOWS (Unaudited, in thousands) Nine Months Ended September 30, 2022 2021 Cash flows from operating activities: Net loss ($11,276) ($6,194) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 2,123 702 Depreciation and amortization 1,116 1,068 Non-cash operating lease expense 417 Gain on forgiveness of PPP loan and other 24 (743) Changes in operating assets and liabilities: Accounts receivable (520) (465) Inventories (3) 286 Prepaid expenses and other current assets (2,206) 38 Deferred costs 73 (1,020) Accounts payable 2,275 (1,837) Accrued and other current liabilities 425 380 Deferred revenue (282) 1,478 Operating lease liabilities (350) Net cash used in operating activities (8,184) (6,307) Cash flows from investing activities: Purchase of property and equipment (747) (276) Net cash used in investing activities (747) (276) Cash flows from financing activities: Proceeds from exercise of stock options 8 1 Proceeds from issuance of common stock in connection with 71,090 business combination and PIPE investment, net of issuance costs Capital contributions from Amprius Holdings 505 19,692 Payment of costs in connection with a stock purchase agreement (25) Net cash provided by financing activities 71,578 19,693 Net increase in cash and cash equivalents 62,647 13,110 Cash, cash equivalents, and restricted cash, beginning of period 11,489 2 Cash, cash equivalents, and restricted cash, end of period $74,136 $13,112 Components of cash, cash equivalents, and restricted cash: Cash and cash equivalents $73,803 $13,112 Restricted cash included in other assets 333 Total cash, cash equivalents, and restricted cash $74,136 $13,112

Letter to Shareholders November 2022 Forward-Looking Statements This Letter to Shareholders includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Amprius management teams expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as estimate, plan, project, forecast, intend, expect, anticipate, believe, seek or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding Amprius future commercial products, Amprius ability to produce its products at a commercial level, the time required to customize and commission the initial volume manufacturing tools, development of the latest high-density battery design, and selection of the site for large scale manufacturing. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of Amprius management and are not predictions of actual performance. These forward-looking statements are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Amprius control. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; risks related to the rollout of Amprius business and the timing of expected business milestones; the effects of competition on Amprius business; supply shortages in the materials necessary for the production of Amprius products; the termination of government clean energy and electric vehicle incentives or the reduction in government spending on vehicles powered by battery technology; delays in construction and operation of production facilities; delays in customizing and commissioning the centrotherm machine and other high volume tools; the risk that the high volume tools do not achieve sufficient quality or yield or meet cost targets; and risks related to market, supply chain, financial and other factors that could delay site selection and build-out of the large-scale manufacturing facility. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in the Risk Factors section of Amprius current report on Form 8-K filed with the Securities and Exchange Commission (the SEC) on September 16, 2022 and other documents filed by Amprius from time to time with the SEC, all of which are available on the SECs website at www.sec.gov. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius expectations, plans or forecasts of future events and views as of the date of this press release. These forward-looking statements should not be relied upon as representing Amprius assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.