EX-99.1

Published on November 6, 2025

March 2023 LETTER TO SHAREHOLDERS Q3 2025 Exhibit 99.1

Letter to Shareholders November 2025 - 1 - Amprius has been producing commercial batteries since 2018, and we believe no other commercially available lithium-ion batteries on the market today can match the performance of our silicon anode cells. Commercial Wins Amprius finds itself at a very fortunate point in time: at the intersection of a fast-growing electric aerospace market with an industry-leading set of battery products. This advantaged situation, coupled with strong execution by our team, allowed us to achieve record revenue in the third quarter. We attracted new customers, continued to optimize our operations and released compelling new products. In the third quarter, we shipped batteries to 159 end customers, 80 of whom are new to the Amprius platform. The remaining 79 are repeat customers. We don’t ship to every customer in every quarter, but we do expect to gain new customers every quarter. Company Overview Amprius is a pioneer and a leader in the silicon anode battery space. At Amprius, we develop, manufacture, and market high-energy density and high-power density silicon anode batteries with applications across all segments of electric mobility, including the aviation and light electric vehicle industries. Today, Amprius commands performance leadership with its combination of energy density, power density, charging time, operating temperature range, and safety. Amprius’ portfolio of batteries delivers: • 450 Wh/kg specific energy density and 1,150 Wh/L volumetric energy density, available commercially since early 2022 • 500 Wh/kg, 1,300 Wh/L battery platform, with third-party validation • Up to 10C continuous power capability and balanced high-energy and high-power designs • An extreme fast charge rate of 0-80% state of charge in about six minutes • A wide operating temperature range of -30°C up to 60°C • Safety design features that enable us to pass the United States military’s benchmark nail penetration test Fellow Shareholders, In the third quarter, Amprius generated a record $21.4 million in revenue, up 42% from the second quarter and 173% from the prior year period. We also shipped batteries to 159 end customers, bringing our total customer count to 444. We continue to innovate and are excited to share our updates from the quarter.

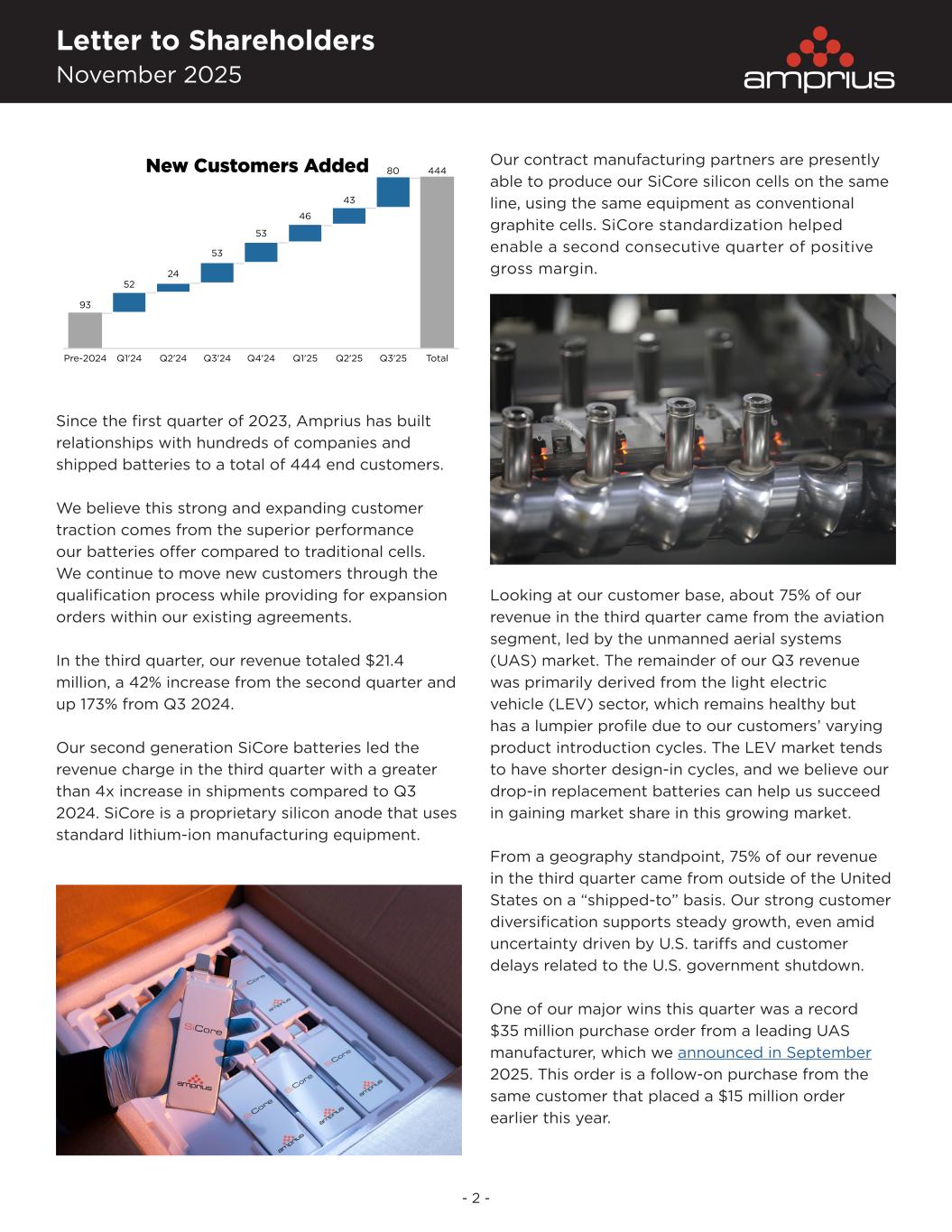

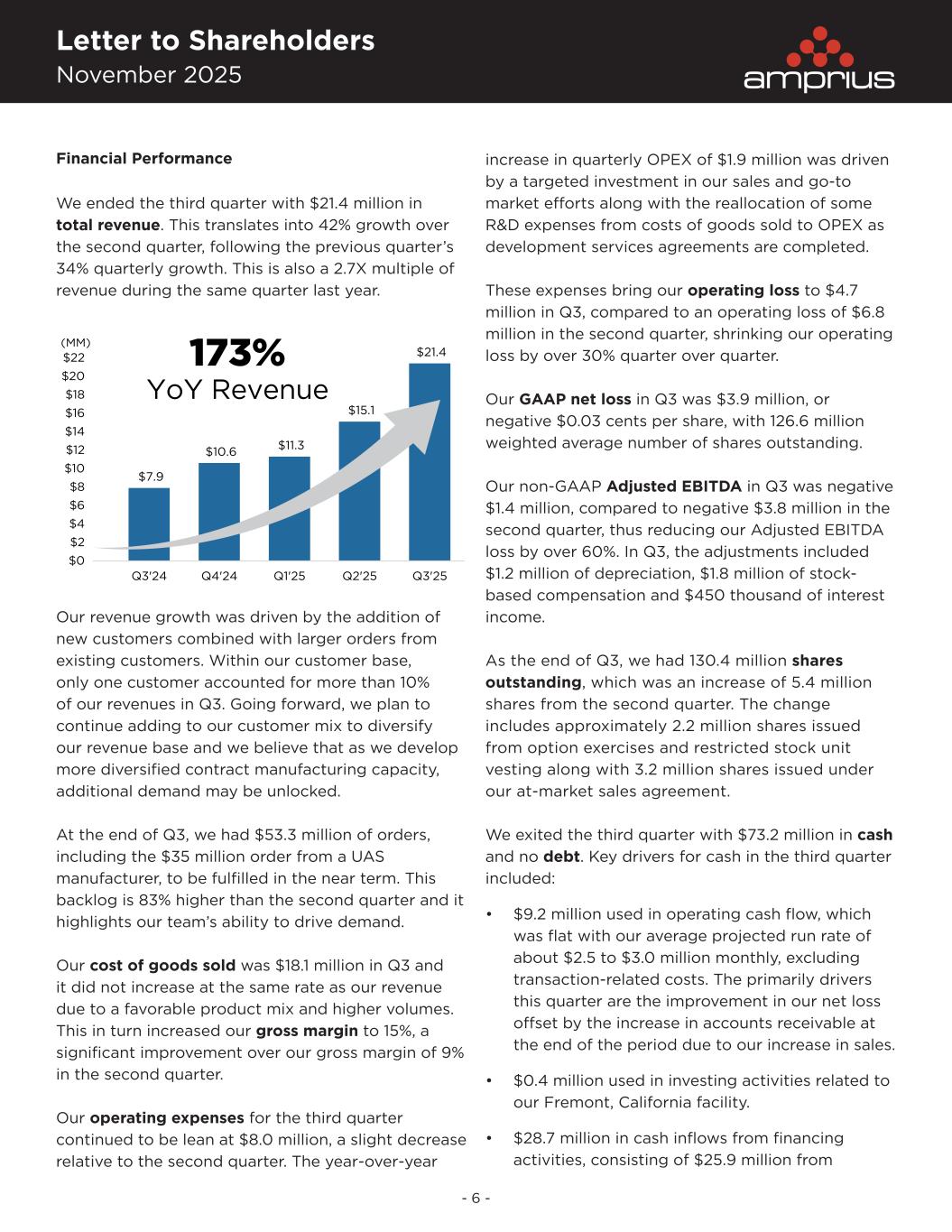

Letter to Shareholders November 2025 - 2 - Since the first quarter of 2023, Amprius has built relationships with hundreds of companies and shipped batteries to a total of 444 end customers. We believe this strong and expanding customer traction comes from the superior performance our batteries offer compared to traditional cells. We continue to move new customers through the qualification process while providing for expansion orders within our existing agreements. In the third quarter, our revenue totaled $21.4 million, a 42% increase from the second quarter and up 173% from Q3 2024. Our second generation SiCore batteries led the revenue charge in the third quarter with a greater than 4x increase in shipments compared to Q3 2024. SiCore is a proprietary silicon anode that uses standard lithium-ion manufacturing equipment. Our contract manufacturing partners are presently able to produce our SiCore silicon cells on the same line, using the same equipment as conventional graphite cells. SiCore standardization helped enable a second consecutive quarter of positive gross margin. Looking at our customer base, about 75% of our revenue in the third quarter came from the aviation segment, led by the unmanned aerial systems (UAS) market. The remainder of our Q3 revenue was primarily derived from the light electric vehicle (LEV) sector, which remains healthy but has a lumpier profile due to our customers’ varying product introduction cycles. The LEV market tends to have shorter design-in cycles, and we believe our drop-in replacement batteries can help us succeed in gaining market share in this growing market. From a geography standpoint, 75% of our revenue in the third quarter came from outside of the United States on a “shipped-to” basis. Our strong customer diversification supports steady growth, even amid uncertainty driven by U.S. tariffs and customer delays related to the U.S. government shutdown. One of our major wins this quarter was a record $35 million purchase order from a leading UAS manufacturer, which we announced in September 2025. This order is a follow-on purchase from the same customer that placed a $15 million order earlier this year. 93 52 24 53 53 46 43 80 444 Pre-2024 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Total New Customers Added

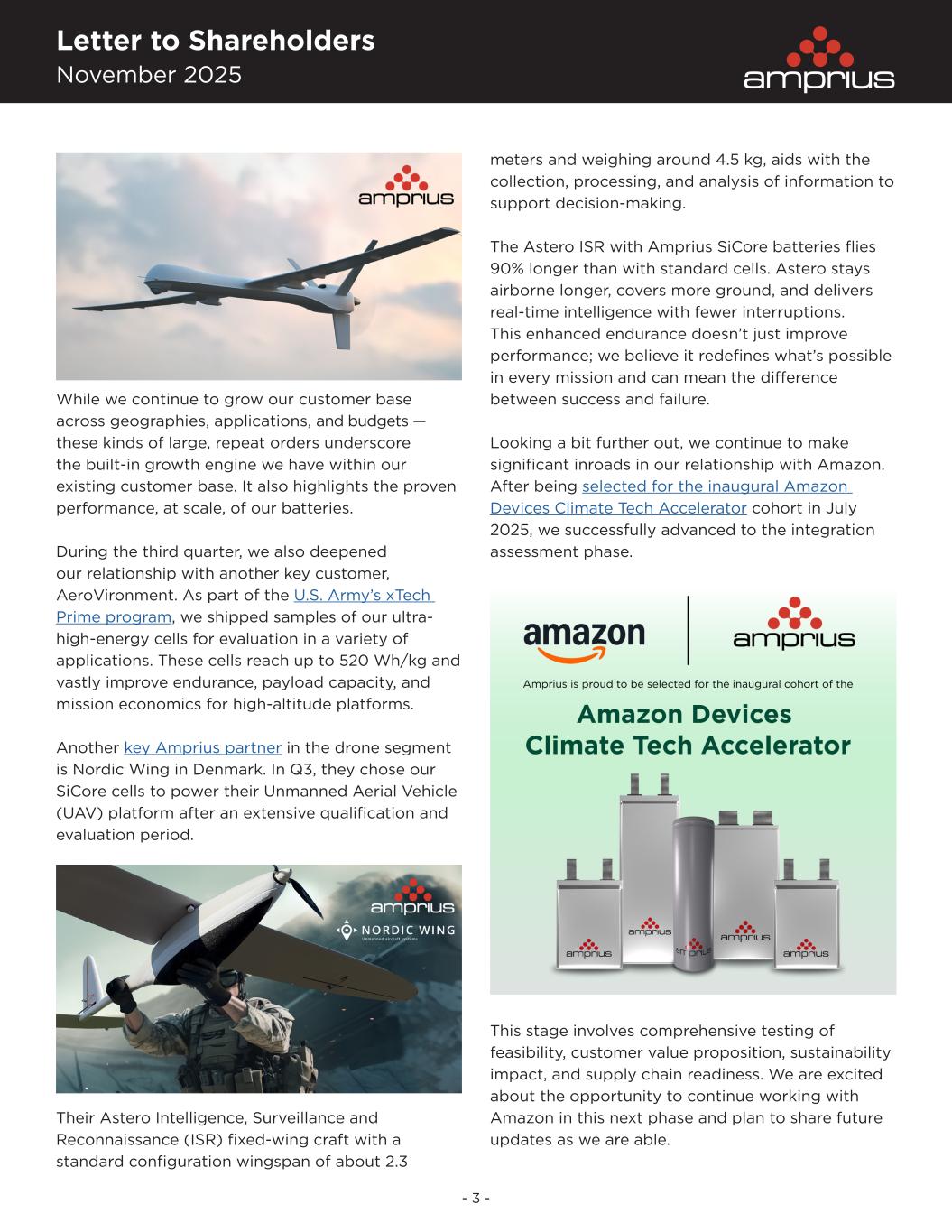

Letter to Shareholders November 2025 - 3 - While we continue to grow our customer base across geographies, applications, and budgets — these kinds of large, repeat orders underscore the built-in growth engine we have within our existing customer base. It also highlights the proven performance, at scale, of our batteries. During the third quarter, we also deepened our relationship with another key customer, AeroVironment. As part of the U.S. Army’s xTech Prime program, we shipped samples of our ultra- high-energy cells for evaluation in a variety of applications. These cells reach up to 520 Wh/kg and vastly improve endurance, payload capacity, and mission economics for high-altitude platforms. Another key Amprius partner in the drone segment is Nordic Wing in Denmark. In Q3, they chose our SiCore cells to power their Unmanned Aerial Vehicle (UAV) platform after an extensive qualification and evaluation period. Their Astero Intelligence, Surveillance and Reconnaissance (ISR) fixed-wing craft with a standard configuration wingspan of about 2.3 meters and weighing around 4.5 kg, aids with the collection, processing, and analysis of information to support decision-making. The Astero ISR with Amprius SiCore batteries flies 90% longer than with standard cells. Astero stays airborne longer, covers more ground, and delivers real-time intelligence with fewer interruptions. This enhanced endurance doesn’t just improve performance; we believe it redefines what’s possible in every mission and can mean the difference between success and failure. Looking a bit further out, we continue to make significant inroads in our relationship with Amazon. After being selected for the inaugural Amazon Devices Climate Tech Accelerator cohort in July 2025, we successfully advanced to the integration assessment phase. This stage involves comprehensive testing of feasibility, customer value proposition, sustainability impact, and supply chain readiness. We are excited about the opportunity to continue working with Amazon in this next phase and plan to share future updates as we are able.

Letter to Shareholders November 2025 - 4 - Breakthrough Technology Advancements All of these recent customer wins further demonstrate our ability to scale up to meet volume purchase orders, which we believe will continue to increase as we expand our customer funnel and continue to extend the state-of-the-art performance that our cells provide. State of the art includes external testing. We rigorously test new products both at our internal laboratories and at external laboratories where they are tested against international safety standards. This includes the United Nations 38.3 standards maintained by the International Electrotechnical Commission and, for our customers in India, the Bureau of Indian Standards. This quarter, we introduced two new SiCore pouch and three new SiCore cylindrical cells that are optimized for unmanned aerial systems, high altitude platform systems, and electric airplane duty cycles. We call these our balanced power and energy cells. Electric aerospace platforms typically require balanced cells: high power and high discharge rate capability for takeoff and landing, and high energy to enable long range. Products like these balanced cells further differentiate Amprius from traditional battery players. Many of our end-customers are competing in shoot-outs and fly-offs for their own contracts. They need to demonstrate best-in-class performance. We help them win. Our batteries give them more kilometers, allow additional kilograms, and provide more watt hours that support their onboard, intelligent components Market Growth & Engagement We believe that the electric aerospace market is on the cusp of a multi-year transformation, propelled by defense and commercial demand for a new era of AI-driven autonomy. McKinsey estimates this market is $40-50 billion today growing to $80 billion by the end of the decade. About 10% of a drone’s bill of materials is for the batteries. Recent regulations and policy changes appear to be market accelerators. The U.S. executive orders over the summer that promote domestic drones is one piece of evidence. A second is the proposed changes to the Beyond Visual Line of Sight (BLVOS) rules that the US federal aviation authority is debating. BVLOS is a significant unlock for drones. We expect these policy actions will accelerate adoption timelines and open new opportunities across the board. We’ve already experienced strong traction from the defense market and expect growing interest from these customers in the year ahead. We expect to benefit from the One Big Beautiful Bill’s increased funding for defense and unmanned systems applications. Anecdotally, we have already seen the optimism surrounding the government funding translating to strong buyer intent. Last month, we exhibited at AUSA conference in Washington DC where we met with dozens of defense contractors that were either interested in or already using our products for their drones.

Letter to Shareholders November 2025 - 5 - We also attended several other U.S. and international conferences: Commercial UAV Expo in Las Vegas, Defense and Security Equipment International in London, and the Drone X Expo, also in London. At all of these events, we heard the same message: drones are an important part of the future, and Amprius batteries are at the forefront of innovation to power them. As a key component supplier for unmanned drone systems, we have had our own success working with the U.S. government. As we previously discussed, we are working closely with the Defense Innovation Unit (DIU). Our DIU contract gives us funds to increase the capacity of our Fremont, California pilot line to 10 MWh and expand our capabilities to support quick turn SiCore customer prototypes. Since our last update, we have received an additional $1.5 million follow-on contract, bringing our DIU contract total to $12.0 million. Our program mandate includes qualifying individual lithium- ion battery components from National Defense Authorization Act (NDAA) compliant suppliers, which will allow us to work more seamlessly with the Department of Defense. This effort is part of a large momentum shift to US domestic production of batteries. Manufacturing Capacity Update As we progress on building out an NDAA compliant supply chain and production capacity for customers that require it, we have continued to utilize our contract manufacturers to support our rapid growth. As a reminder, we have over 1.8 GWh of capacity available to us through our partners, including our most recent added partner in South Korea. For some perspective, our SA08 cell is our best- selling battery with an energy rating of 38 watt hours. 1.8 GWh over 38 watt hours works out to be ~50 million cells per year. We believe we have tremendous headroom on manufacturing capacity. This capital-efficient model provides production- grade cells for qualification today and supports our ramp to volume while still allowing configuration control and aerospace-aligned quality systems. We are also opportunistically sourcing additional partners to provide us with greater geographic diversification and operating flexibility. Strong Momentum to Close Out 2025 We are carrying this momentum into the fourth quarter. A few weeks ago, we announced that ESAero, another leading UAS company, chose our SiCore SA08 cells to power their group 1 and group 2 UAVs that support defense, security, logistics, and public safety applications “Amprius offered the best combination of advanced battery technology, production readiness, and cost competitiveness to meet the demands of this program.” — Andrew Gibson, CEO and President of ESAero We have talked extensively about the defense applications for our batteries. We also see a large and growing opportunity in public safety markets. According to a Police1 article, more than 1,500 US police departments have Drone-As-First-Responder (DFR) programs. The drone systems are tied into 911 emergency systems and are dispatched to help find a lost child, monitor smash and grab suspects, and assess if a fire is a spark or an inferno. We look forward to continuing to support the drone sector as it scales and evolves into more mission critical and business critical use cases. Last month we also made the exciting announcement that Ricardo C. Rodriguez joined Amprius as our new Chief Financial Officer. Ricardo has a proven track record of driving growth with financial discipline in high-performance markets and he will serve as a valuable guide as we expand our commercial reach, scale global manufacturing, and reinforce Amprius’ leadership in advanced battery technology. He is a tremendous addition to our leadership team.

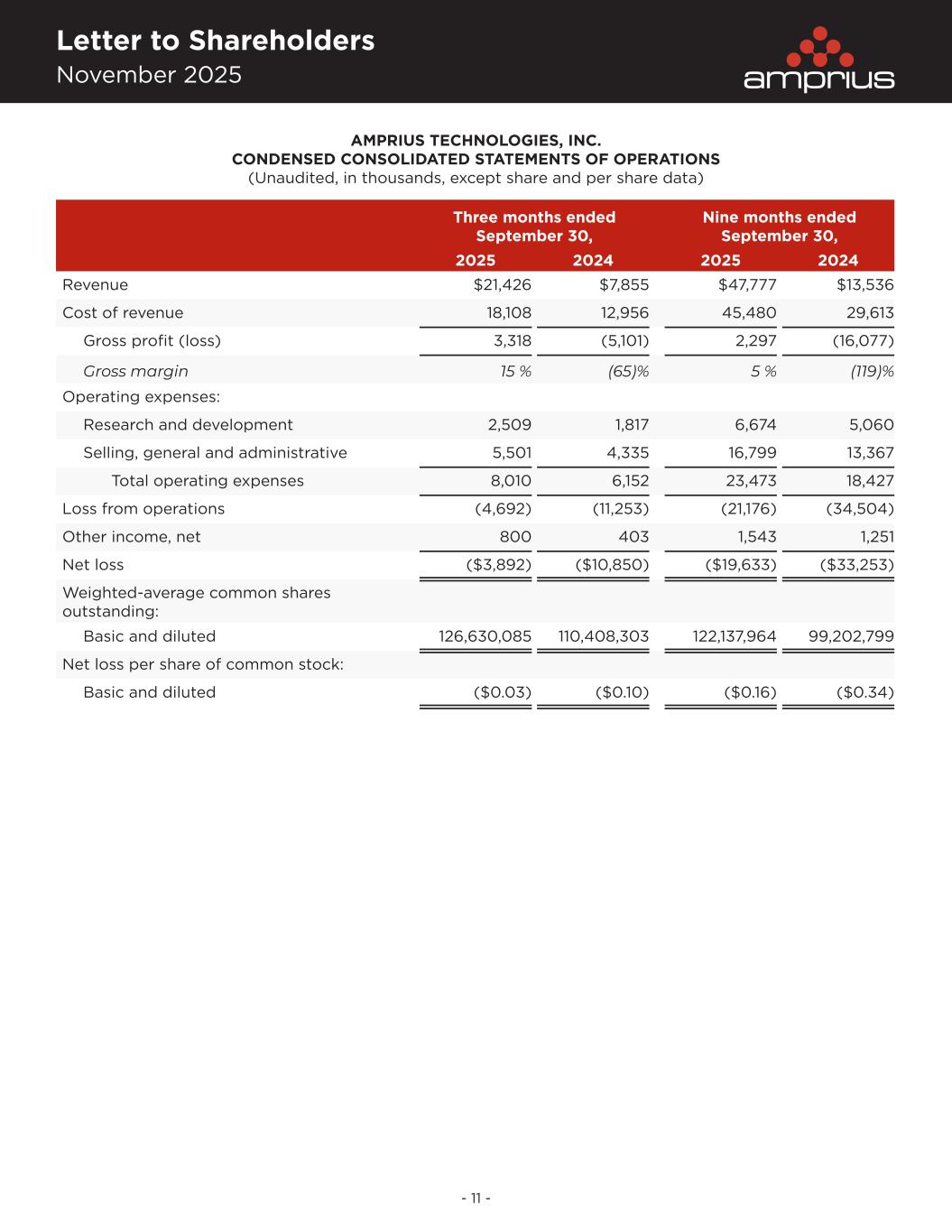

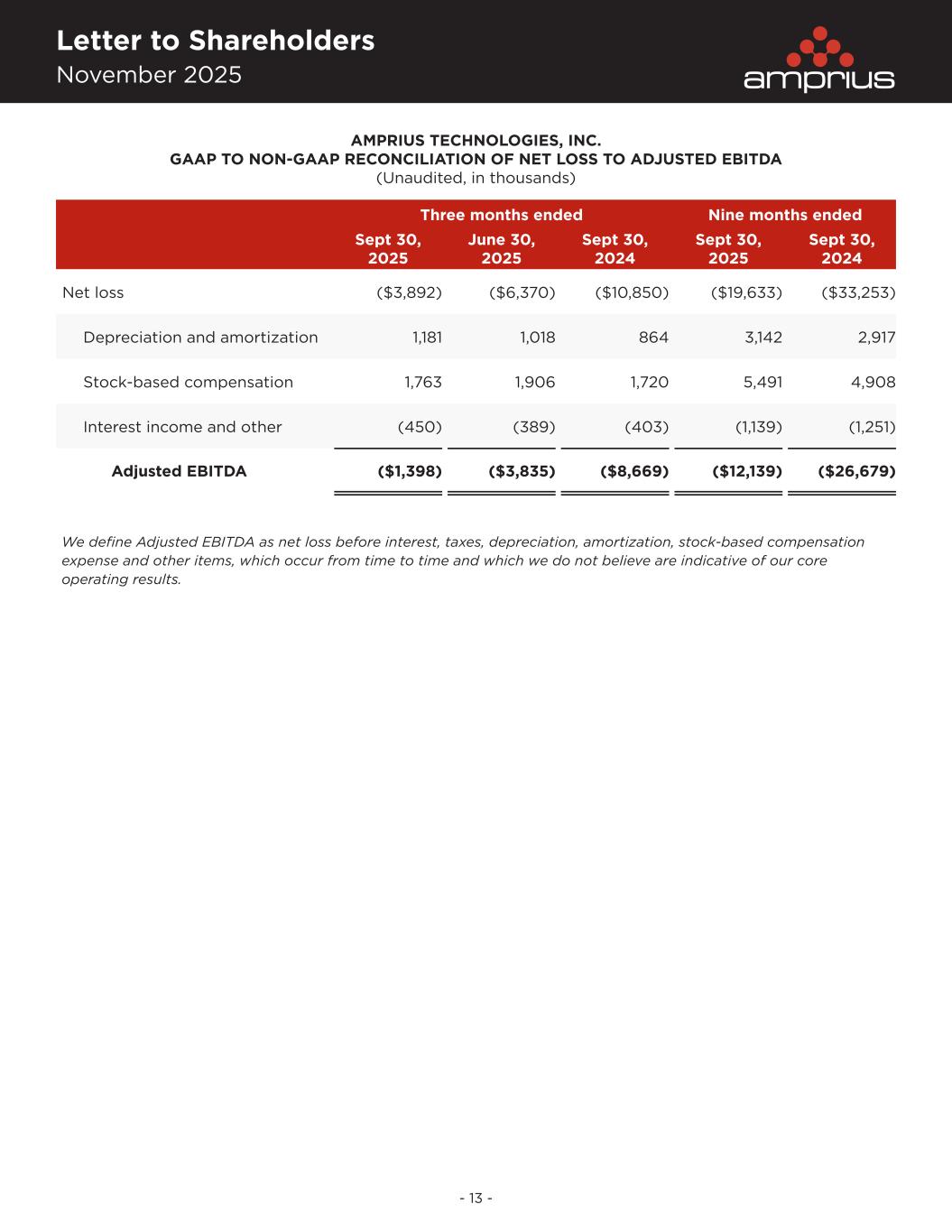

Letter to Shareholders November 2025 - 6 - Financial Performance We ended the third quarter with $21.4 million in total revenue. This translates into 42% growth over the second quarter, following the previous quarter’s 34% quarterly growth. This is also a 2.7X multiple of revenue during the same quarter last year. Our revenue growth was driven by the addition of new customers combined with larger orders from existing customers. Within our customer base, only one customer accounted for more than 10% of our revenues in Q3. Going forward, we plan to continue adding to our customer mix to diversify our revenue base and we believe that as we develop more diversified contract manufacturing capacity, additional demand may be unlocked. At the end of Q3, we had $53.3 million of orders, including the $35 million order from a UAS manufacturer, to be fulfilled in the near term. This backlog is 83% higher than the second quarter and it highlights our team’s ability to drive demand. Our cost of goods sold was $18.1 million in Q3 and it did not increase at the same rate as our revenue due to a favorable product mix and higher volumes. This in turn increased our gross margin to 15%, a significant improvement over our gross margin of 9% in the second quarter. Our operating expenses for the third quarter continued to be lean at $8.0 million, a slight decrease relative to the second quarter. The year-over-year increase in quarterly OPEX of $1.9 million was driven by a targeted investment in our sales and go-to market efforts along with the reallocation of some R&D expenses from costs of goods sold to OPEX as development services agreements are completed. These expenses bring our operating loss to $4.7 million in Q3, compared to an operating loss of $6.8 million in the second quarter, shrinking our operating loss by over 30% quarter over quarter. Our GAAP net loss in Q3 was $3.9 million, or negative $0.03 cents per share, with 126.6 million weighted average number of shares outstanding. Our non-GAAP Adjusted EBITDA in Q3 was negative $1.4 million, compared to negative $3.8 million in the second quarter, thus reducing our Adjusted EBITDA loss by over 60%. In Q3, the adjustments included $1.2 million of depreciation, $1.8 million of stock- based compensation and $450 thousand of interest income. As the end of Q3, we had 130.4 million shares outstanding, which was an increase of 5.4 million shares from the second quarter. The change includes approximately 2.2 million shares issued from option exercises and restricted stock unit vesting along with 3.2 million shares issued under our at-market sales agreement. We exited the third quarter with $73.2 million in cash and no debt. Key drivers for cash in the third quarter included: • $9.2 million used in operating cash flow, which was flat with our average projected run rate of about $2.5 to $3.0 million monthly, excluding transaction-related costs. The primarily drivers this quarter are the improvement in our net loss offset by the increase in accounts receivable at the end of the period due to our increase in sales. • $0.4 million used in investing activities related to our Fremont, California facility. • $28.7 million in cash inflows from financing activities, consisting of $25.9 million from $7.9 $10.6 $11.3 $15.1 $21.4 $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 $22 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 173% YoY Revenue (MM)

Letter to Shareholders November 2025 - 7 - the issuance of common stock under our at-market sales agreement and $2.8 million of proceeds from option exercises. We still have approximately $20.1 million left on the sales agreement as of September 30, 2025. Financial Outlook We have made the decision to strategically invest in diversifying our supply chain and expanding manufacturing capacity within our Fremont facility to include electrode manufacturing. We are doing this in collaboration with the U.S. Government Defense Innovation Unit and have secured a contract for $12.0 million awarded in the third quarter. With what we know today, we expect this funding to cover the majority of our capital investment in the next several quarters as we work to develop a growing and resilient source of supply in a dynamic trade environment. As we have previously stated, regarding the Colorado facility, the designs for this project are effectively complete, and we are continuing to monitor the larger industry dynamics associated with building a factory in the United States. Changes in demand, supply, battery cost structure, government incentives, trade tariffs, and other considerations, including the timing and availability of funding will influence our decision on the next steps and timing. We have secured adequate capacity for the foreseeable future through our contract manufacturing network and plan to further expand that without deploying additional capital. Looking ahead, we remain focused on delivering next-generation lithium-ion performance that raises the bar for energy density and sustained power without compromising safety or reliability. We are also broadening our product portfolio to better align with customer requirements and unlock new market opportunities, while converting a growing number of customer engagements into formal qualifications and deployments, particularly across mobility-centric platforms. As demand scales, we will continue to leverage our contract manufacturing partners’ capacity to efficiently translate that demand into revenue with disciplined quality and minimal additional capital investment. We are excited about the future ahead and look forward to meeting and reconnecting with many of you as we attend several upcoming investor conferences. Thank you for your continued interest and support of Amprius Technologies Best, Summary Ricardo Rodriguez CFO Dr. Kang Sun CEO Tom Stepien President Quarterly Conference Call and Webcast: Date: Thursday, November 6, 2025 Time: 5:00 PM ET (2:00 PM PT) Toll-Free Number: 866-487-3442 International Number: +1-201-689-8520 Webcast: Register and Join

Letter to Shareholders November 2025 - 8 - Forward-Looking Statements This Letter to Shareholders includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Amprius’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “will” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the ability of Amprius to serve more customers, bring in additional revenue and expand applications, the strategic benefits of Amprius’ Fremont, California pilot line to its business, the ability of Amprius to further expand this pilot line and the benefits of such expansion to Amprius, the benefits of the existing governmental award and recent governmental policies to Amprius’ business, the capacity of Amprius’ contract manufacturing partners with respect to SiCore batteries, Amprius’ ability to meet customers demand with contract manufacturing capacities, the development and size of the addressable markets for Amprius’ batteries and the benefits of the expansion of such addressable markets, the potential application and performance of Amprius’ batteries, the ability of Amprius to secure additional contract manufacturers that can offer greater geographic diversification and operating flexibility, Amprius’ liquidity position, capital strategy, strategic business plans, and Amprius’ financial and business performance. These statements are based on various assumptions, whether or not identified in this letter, and on the current expectations of Amprius’ management and are not predictions of actual performance. These forward-looking statements are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Amprius’ control. These forward-looking statements are subject to a number of risks and uncertainties, including market demands for SiCore batteries; the ability of Amprius to deliver high performance products to customers at acceptable prices and meet their demands via the contract manufacturing arrangements; third-party producers of Amprius batteries continuing to produce such batteries in the expected quantities and caliber and at the expected prices; Amprius’ customers continuing to purchase batteries directly from Amprius; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; Amprius’ liquidity position and its ability to raise additional capital; the possibility that Amprius may be adversely affected by economic, business or competitive factors, including supply chain interruptions and developments in alternative technologies, and may not be able to manage other risks and uncertainties; the effect of macroeconomic factors, such as increased tariffs and related retaliatory actions, trade barriers, economic downturns and other business interruptions affecting the global economy and capital markets, on Amprius’ business; changes in governmental policies impacting Amprius’ customers and addressable markets; and changes in other domestic and foreign business, market, financial, political and legal conditions. More information on these risks and uncertainties that may impact the operations and projections discussed herein can be found in the documents Amprius filed from time to time with the SEC, all of which are available on the SEC’s website at www.sec.gov. If any of these risks materialize or Amprius’ assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this letter. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this letter. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.

Letter to Shareholders November 2025 - 9 - Non-GAAP Financial Measure To supplement our financial results presented on a basis in conformity with generally accepted accounting principles in the United States (“GAAP”), we use the non-GAAP measure Adjusted EBITDA, which excludes from our GAAP net loss, interest, taxes, depreciation and amortization, as well as other significant expenses including stock-based compensation, that we believe are helpful in understanding our past financial performance. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. Management believes that this non-GAAP financial measure reflects our ongoing business in a manner that allows for meaningful comparisons and analysis of trends in its business, as it excludes expenses and gains not reflective of ongoing operating results or that may be infrequent and/or unusual in nature. We also adjust for the effect of stock-based compensation expenses noting that such expenses will recur in future periods. Although stock-based compensation is a key incentive offered to our employees, we continue to evaluate our business performance internally excluding stock- based compensation expenses. Management also believes that this non-GAAP financial measure provides useful information to investors in understanding and evaluating our operating results and future prospects in the same manner as management and in comparing financial results across accounting periods and to those of peer companies. This non-GAAP measure may not be comparable to similarly titled measures presented by other companies. In this press release, we provided a reconciliation of Adjusted EBITDA to net loss, the most directly comparable GAAP financial measure.

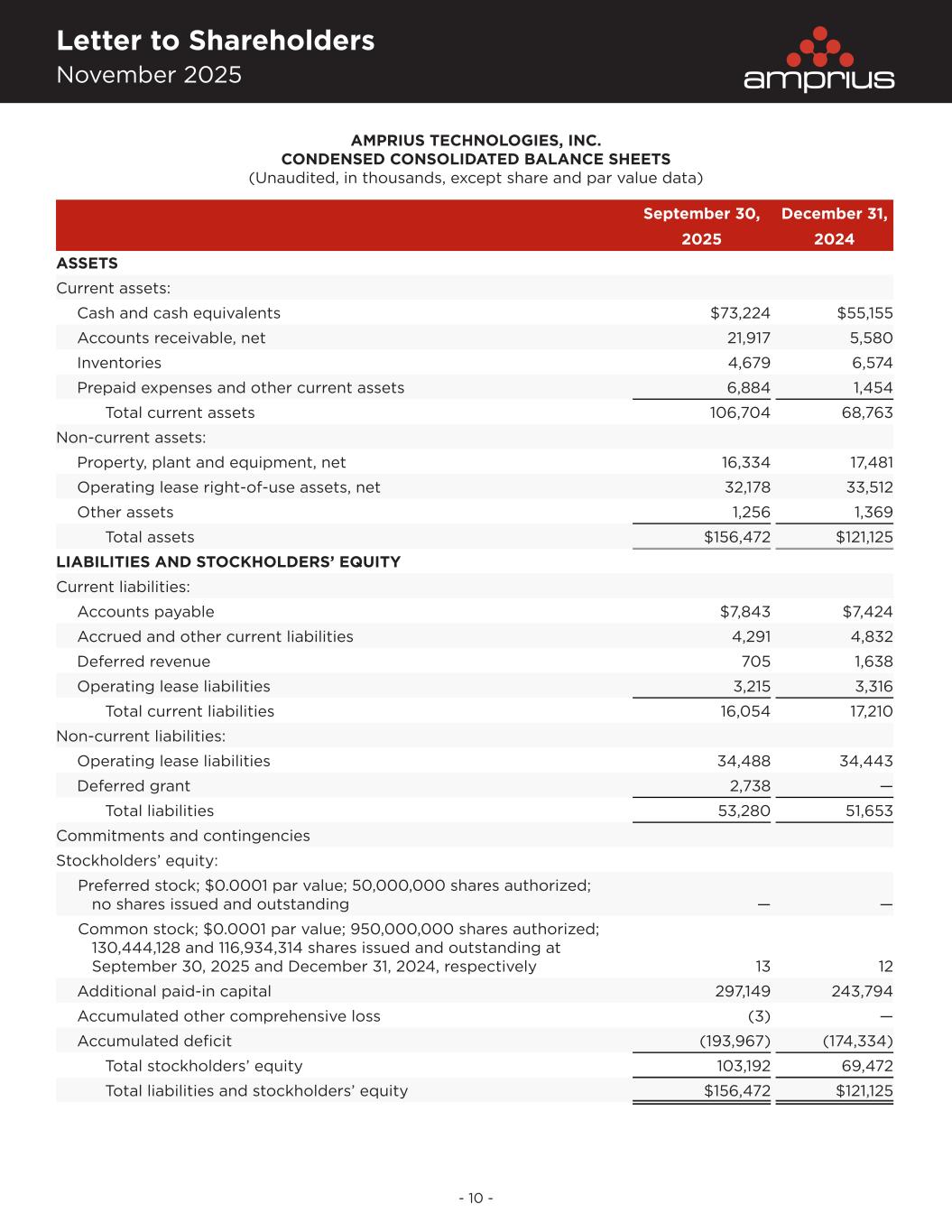

Letter to Shareholders November 2025 - 10 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited, in thousands, except share and par value data) September 30, December 31, 2025 2024 ASSETS Current assets: Cash and cash equivalents $73,224 $55,155 Accounts receivable, net 21,917 5,580 Inventories 4,679 6,574 Prepaid expenses and other current assets 6,884 1,454 Total current assets 106,704 68,763 Non-current assets: Property, plant and equipment, net 16,334 17,481 Operating lease right-of-use assets, net 32,178 33,512 Other assets 1,256 1,369 Total assets $156,472 $121,125 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $7,843 $7,424 Accrued and other current liabilities 4,291 4,832 Deferred revenue 705 1,638 Operating lease liabilities 3,215 3,316 Total current liabilities 16,054 17,210 Non-current liabilities: Operating lease liabilities 34,488 34,443 Deferred grant 2,738 — Total liabilities 53,280 51,653 Commitments and contingencies Stockholders’ equity: Preferred stock; $0.0001 par value; 50,000,000 shares authorized; no shares issued and outstanding — — Common stock; $0.0001 par value; 950,000,000 shares authorized; 130,444,128 and 116,934,314 shares issued and outstanding at September 30, 2025 and December 31, 2024, respectively 13 12 Additional paid-in capital 297,149 243,794 Accumulated other comprehensive loss (3) — Accumulated deficit (193,967) (174,334) Total stockholders’ equity 103,192 69,472 Total liabilities and stockholders’ equity $156,472 $121,125

Letter to Shareholders November 2025 - 11 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in thousands, except share and per share data) Three months ended September 30, Nine months ended September 30, 2025 2024 2025 2024 Revenue $21,426 $7,855 $47,777 $13,536 Cost of revenue 18,108 12,956 45,480 29,613 Gross profit (loss) 3,318 (5,101) 2,297 (16,077) Gross margin 15 % (65)% 5 % (119)% Operating expenses: Research and development 2,509 1,817 6,674 5,060 Selling, general and administrative 5,501 4,335 16,799 13,367 Total operating expenses 8,010 6,152 23,473 18,427 Loss from operations (4,692) (11,253) (21,176) (34,504) Other income, net 800 403 1,543 1,251 Net loss ($3,892) ($10,850) ($19,633) ($33,253) Weighted-average common shares outstanding: Basic and diluted 126,630,085 110,408,303 122,137,964 99,202,799 Net loss per share of common stock: Basic and diluted ($0.03) ($0.10) ($0.16) ($0.34)

Letter to Shareholders November 2025 - 12 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, in thousands) Three months ended September 30, Nine months ended September 30, 2025 2024 2025 2024 Cash flows from operating activities: Net loss ($3,892) ($10,850) ($19,633) ($33,253) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 1,763 1,720 5,491 4,908 Depreciation and amortization 1,181 864 3,142 2,917 Amortization of deferred costs — 1,246 — 1,246 Non-cash operating lease expense 1,286 1,286 3,857 3,857 Other non-cash items (374) — 444 — Changes in operating assets and liabilities: Accounts receivable, net (10,776) (2,852) (16,781) (3,325) Inventories (345) (1,137) 1,895 (1,934) Deferred costs — (87) — (467) Prepaid expenses and other current assets (1,584) (469) (2,495) (654) Other assets 6 6 26 (6) Accounts payable 4,276 1,226 467 3,287 Accrued and other current liabilities 220 1,135 (538) (1,383) Deferred revenue (135) (1,334) (933) (1,617) Operating lease liabilities (872) (283) (2,579) (843) Net cash used in operating activities (9,246) (9,529) (27,637) (27,267) Cash flows from investing activities: Purchase of property, plant and equipment (414) (1,333) (2,043) (6,834) Net cash used in investing activities (414) (1,333) (2,043) (6,834) Cash flows from financing activities: Proceeds from issuance of common stock in connection with the At Market Issuance Sales Agreement, net 25,858 — 44,053 10,861 Proceeds from issuance of common stock upon exercise of stock warrants — — — 14,384 Payment of equity financing costs — (540) — (756) Proceeds from exercise of stock options 2,833 — 3,899 96 Net cash provided by (used in) financing activities 28,691 (540) 47,952 24,585 Net increase (decrease) in cash, cash equivalents and restricted cash equivalents 19,031 (11,402) 18,272 (9,516) Effect of exchange rate changes on cash, cash equivalents and restricted cash equivalents 4 — (3) — Cash, cash equivalents and restricted cash equivalents, beginning of period 55,645 47,703 56,411 45,817 Cash, cash equivalents and restricted cash equivalents, end of period $74,680 $36,301 $74,680 $36,301 Reconciliation of cash, cash equivalents and restricted cash equivalents shown on the condensed consolidated balance sheets: Cash and cash equivalents $73,224 $35,045 $73,224 $35,045 Restricted cash equivalents included in prepaid expenses and other current assets 200 — 200 — Restricted cash equivalents included in other assets 1,256 1,256 1,256 1,256 Total cash, cash equivalents and restricted cash equivalents $74,680 $36,301 $74,680 $36,301

Letter to Shareholders November 2025 - 13 - AMPRIUS TECHNOLOGIES, INC. GAAP TO NON-GAAP RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA (Unaudited, in thousands) Three months ended Nine months ended Sept 30, 2025 June 30, 2025 Sept 30, 2024 Sept 30, 2025 Sept 30, 2024 Net loss ($3,892) ($6,370) ($10,850) ($19,633) ($33,253) Depreciation and amortization 1,181 1,018 864 3,142 2,917 Stock-based compensation 1,763 1,906 1,720 5,491 4,908 Interest income and other (450) (389) (403) (1,139) (1,251) Adjusted EBITDA ($1,398) ($3,835) ($8,669) ($12,139) ($26,679) We define Adjusted EBITDA as net loss before interest, taxes, depreciation, amortization, stock-based compensation expense and other items, which occur from time to time and which we do not believe are indicative of our core operating results.