EX-99.1

Published on May 10, 2023

LETTER TO SHAREHOLDERS Q1 Fiscal 2023 March 2023

Letter to Shareholders May 2023 - 1 - Company Overview Amprius Technologies develops and manufactures ultra-high energy density lithium-ion batteries based on our proprietary silicon anode technology. Today, Amprius delivers commercially available batteries with 450 Wh/Kg specific energy density and 1150 Wh/L volumetric energy density. Our batteries also have up to 10C power capability and enable the extreme fast charge rate of 0-80% state of charge in approximately six minutes. Amprius batteries are built for the toughest of operating environments, with the durability to pass the United States Military’s benchmark nail penetration test as well as the versatility to operate in an extremely wide temperature range of -30°C up to 55°C. It is our belief that there is no one else in the commercial market that can perform at these levels. Amprius has over 80 patents and extensive know-how in silicon anode and silicon anode manufacturing technologies. Amprius has been in commercial battery production since 2018, so the Company has many years of manufacturing experience for high energy density and high-power density lithium-ion batteries. Our business has four distinct advantages relative to other battery manufacturers: • Unmatched technical and product performance • Years of product commercialization experience endorsed by industry leaders • Proven manufacturability, with a pathway to higher volume manufacturing capacity • A team of seasoned business operators with a solid track record Our near-term goal is to scale our manufacturing capabilities to achieve our long-term vision of becoming a mainstream battery solution with applications across all segments of electric mobility, Fellow Shareholders, Amprius is off to a fast start in 2023. In the first quarter, we built on our momentum with several accomplishments that represent important steps toward our long-term goals, including new technology breakthroughs, continued commercial success, and additional developments for our production capacity expansion. We are pleased to share our financial results and operational highlights with you below. As is our custom, this shareholder letter will be followed by a conference call, on which we will briefly summarize the main highlights before hosting an interactive Q&A session.

Letter to Shareholders May 2023 - 2 - including the aviation and EV industries. Based on our accomplishments in the first quarter of 2023, we’ve already made significant progress in expanding our existing capabilities to maintain our industry-best performance at scale. We have highlighted these accomplishments below. Disruptive Technology Advancements In March, we announced Amprius’ new battery platform, which is independently verified for 500 Wh/kg specific energy density and 1350 Wh/L volumetric density. Our 500 Wh/kg battery platform was purpose-designed to serve the needs of certain strategic customer projects such as AALTO HAPS, the Airbus subsidiary developing high-altitude pseudo satellites. We expect to be able to ship prototypes to these select customers before the end of 2023. Amprius’ 500 Wh/kg and 1350 Wh/L battery platform not only enhances our customer applications, it also demonstrates the robust product roadmap for our silicon anode technologies. We plan to continue moving along that roadmap to deliver the most advanced lithium-ion batteries available on the market. Industry Recognition Independent experts have long recognized our breakthrough technology. We received reviews from several industry experts in the first quarter, with a few highlighted below. Munro Live, a YouTube channel that explores the latest battery technology, first highlighted our 500Wh/kg battery platform in March to its audience of over 370,000 subscribers. Following the success of that video, their team visited Amprius Lab in Fremont, California to see our operations firsthand. The Munro Live team, led by Sandy Munro, participated in a full factory tour where we walked them through our entire operation. You can watch Nobody Has Anything Like This: Amprius Factory Tour here. “This to me is as eye-opening as it gets… I can’t begin to tell you how excited I am about your future. You guys have something that nobody else has.” — Sandy Munro, Host of Munro Live Also, as part of a broader tech series, CNBC technology sector specialists visited the Amprius facility, and discussed their visit in Why Porsche, Mercedes and GM are betting on silicon-anode batteries. The story focuses on our high- performance batteries’ silicon structure and fast-charging capabilities, highlighting that these qualities can be utilized in future EVs. Lastly, as we announced earlier this month and after a rigorous selection process, Amprius high-energy density batteries were selected by the University of Michigan’s solar car team for their upcoming 3,000-kilometer race at the World Solar Challenge in Australia. Batteries used in this race must provide exceptional performance in tough conditions. Our leading performance characteristics are undeniable, Photo Credit: University of Michigan Solar Car Team

Letter to Shareholders May 2023 - 3 - and should provide the team with an edge for the event. We look forward to working with their team in the coming months. Continued Commercial Success Commercially, this quarter was highlighted by successes both across our existing customers as well as through new customer opportunities. We shipped to 19 customers in the first quarter, including several new accounts. Among a series of ongoing business development opportunities, we kicked off a new technical engagement this quarter with a leading aerospace OEM, codifying next steps towards testing and evaluation of Amprius batteries. Also, as we announced in April, we expanded our relationship with AeroVironment to be the supplier of a key power element in the AeroVironment Switchblade 300 Block 20 missile. The integration of our lightweight battery cells into the Block 20 system is expected to increase the flight time by at least 50% – allowing for longer endurance and extended loitering capability. We expect to continue our regularly scheduled commercial shipments to AeroVironment as well as to Teledyne Flir, two repeat customers and strong partners for Amprius. In addition, we continue to see significant demand for our products, especially in the eVTOL markets, because of battery weight and performance. We have received significant interest from other existing battery pack manufacturing partners for sizable, expanded contracts to serve the larger aviation segment, including several in the hundreds of megawatts through 2025 and beyond. Our pipeline of interested partners continues to grow, and we believe that our efforts to build out our manufacturing capacity will lead to additional new and expanded orders in the coming years. Path to Commercial Scale As we think about our goals for the next several years, our primary focus remains on expanding capacity to meet demand and ultimately achieve a sustainable cost structure at scale. After a transformational 2022, with several strategic moves including two cost-sharing grants that we were selected to receive from the U.S. Department of Energy, or U.S. DOE (more information here and here), we continued to make important strides towards our goals in our first quarter. First, we recently expanded our facility at Amprius Lab in Fremont, California to accommodate our first large-scale anode production machine from centrotherm. We have leased the remaining 25,000 square feet at our existing facility, which we expect to allow us to both finalize our high- volume manufacturing processes and increase our capacity for silicon anode battery production to approximately 2 MWh, or 10 times our current production, exiting 2023. We look forward to better serving strategic aviation customers’ needs and supporting prototyping and qualification projects with new customers who are currently in our backlog. Second, in April, we leased the previously announced site in Brighton, Colorado as the location for our approximately 775,000 square foot large-scale production facility, the first mass production site for next-generation battery technology in the U.S. The selection of Colorado for our gigawatt-scale factory marks an important milestone for Amprius. The initial phase of our buildout will provide a potential of up to 5 GWh, with expansion capabilities for up to a Photo Credit: AeroVironment

Letter to Shareholders May 2023 - 4 - total potential manufacturing capacity of 10 GWh. As a reminder, Amprius Fab is already equipped with the electrical power and existing structural layout needed for a GWh scale lithium-ion battery factory, which will reduce build-out costs and time to market with the goal of being operational in 2025. Also, Brighton is closer to some of our materials distributors in the Northwestern U.S. than our other location finalists, which we expect will lead to lower operational costs over the long term. We are aiming to begin retrofitting the facility towards the end of the summer. Overall, this new facility will transform our long-term production capabilities. In the near-term, we will continue to develop and ship cutting-edge products from Amprius Lab in Fremont while we refine our manufacturing processes to de-risk the start of our mass production at Amprius Fab in Brighton in the coming years. Management Updates Enabling our entire operation here at Amprius is our exceptional team and ongoing support from our Board of Directors. We added six employees to bolster our continued efforts, and will continue to search for great talent as we scale our team. Also, we recently announced that we have expanded our Board and appointed Kathleen Bayless as an independent director and our Audit Committee chair. She brings extensive management and board experience and we look forward to her unique perspectives on our Board moving forward. We’re excited to have her on our team as we work to execute our growth strategy. Financial Performance Turning to our financials, we closed out the first quarter with $0.7 million in revenue, compared to $2.1 million in Q1 2022. This decrease was partially due to a decrease of $1.5 million in development services revenue and a decrease of $0.1 million for the quarter year-over-year in product revenue, both partially offset by an increase of $0.2 million in government grant revenue. Of note, due to the timing of customer shipments, we ended the quarter with both $0.5 million more in product inventory than in the same quarter last year and $2.5 million in increased deferred revenue pending final delivery of performance obligations later this year. As we’ve noted in previous quarters, our product revenue is driven by customer purchase orders arriving at uneven times throughout the year, and development services revenue is intermittent based on revenue recognition timing. However, as mentioned earlier, we shipped to nearly 20 customers this quarter, including 4 new customers, and believe that our business development efforts continue to gain traction. Once our capacity expands and more customers transition to commercial orders, we expect to see a more even ramp in product revenue. Our GAAP gross margin was negative 504% in the first quarter, primarily due to non-recurring start up charges for our large-scale manufacturing facility. These charges included both a $1.4 million broker charge for our economic incentives’ negotiation and $0.3 million of pre-construction design firm start-up costs. As the build out continues, we expect that more one-time charges are likely to arise. Still, we forecast that our GAAP gross margin will begin to normalize as we reach our capacity expansion goals in the coming years. Moving now to operating expense management, our GAAP operating expenses for the first quarter

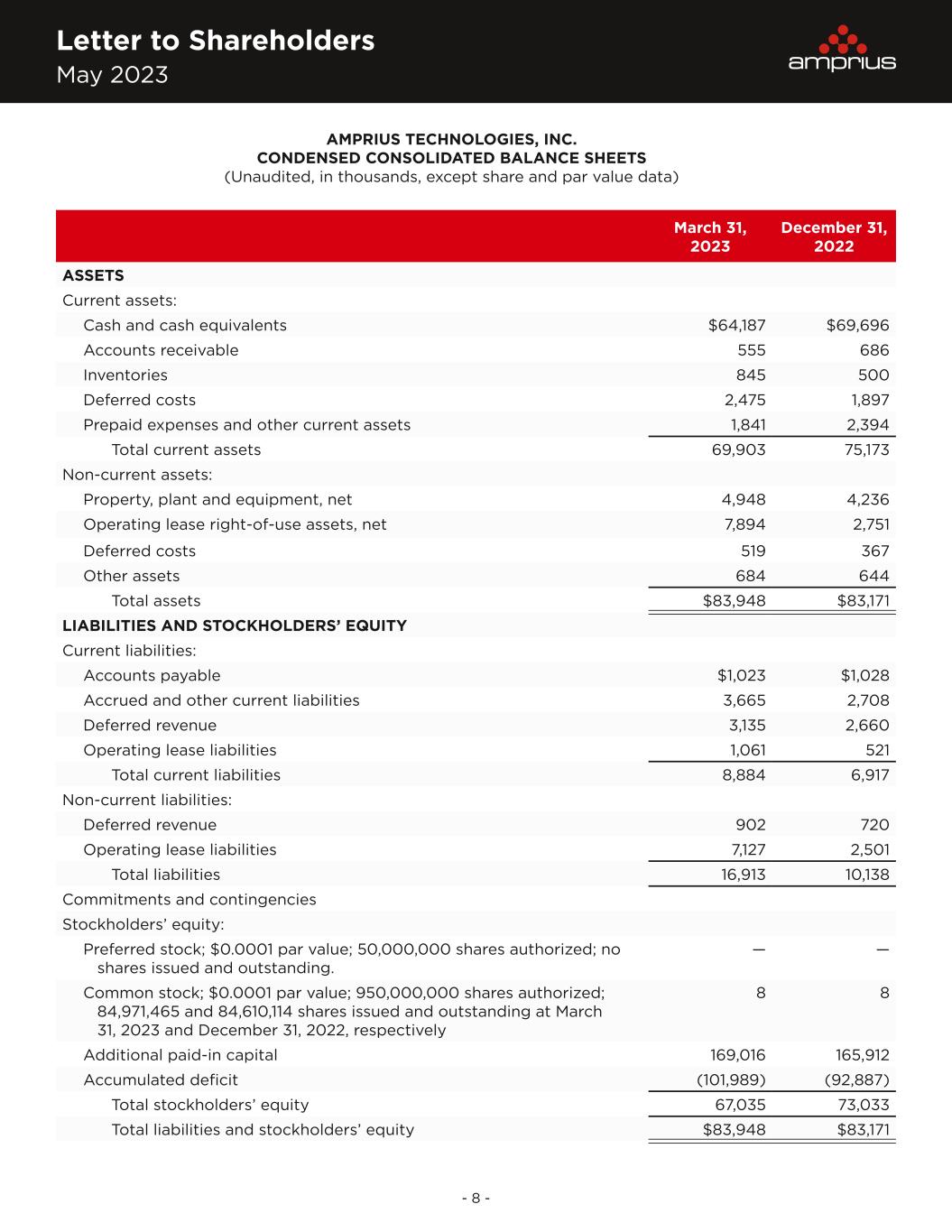

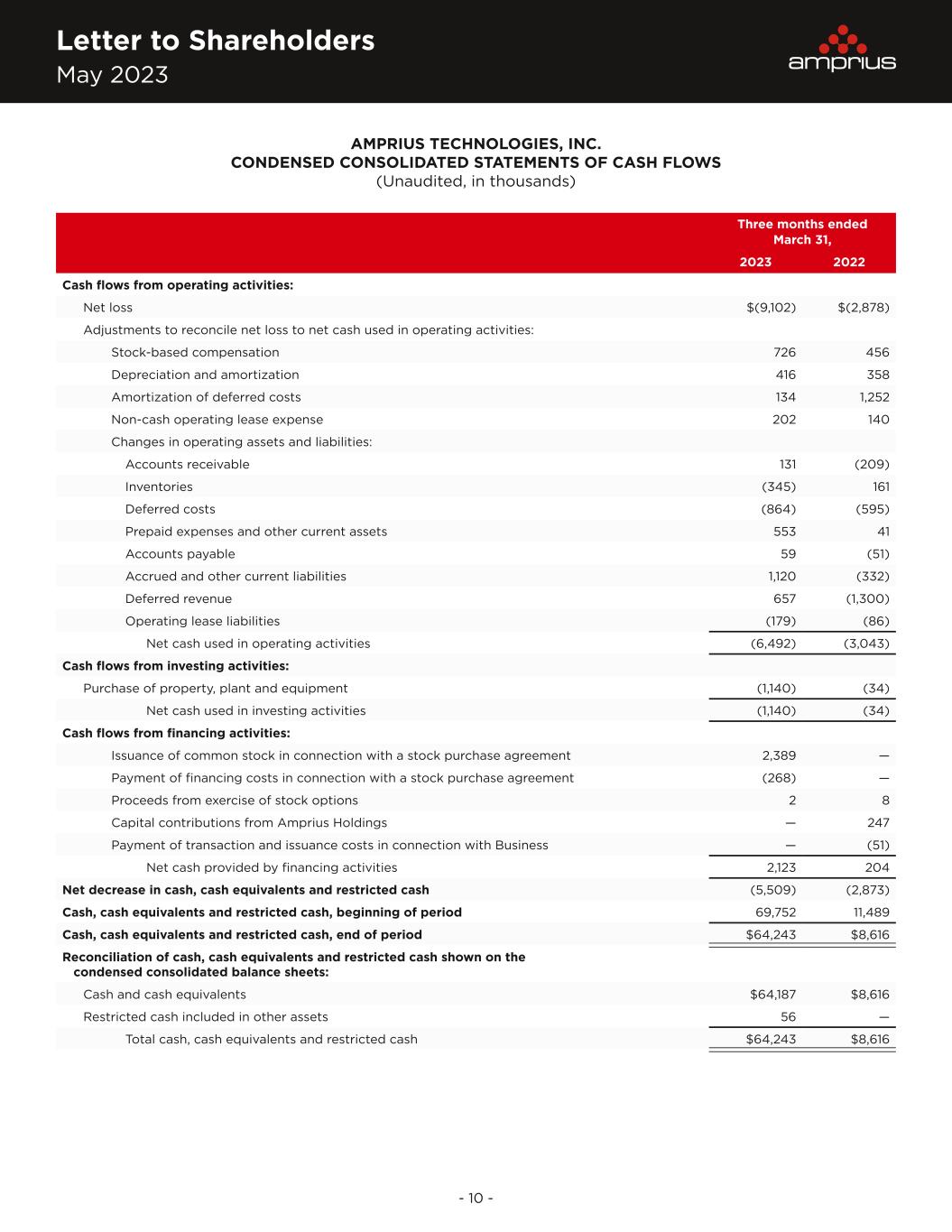

Letter to Shareholders May 2023 - 5 - increased to $6.3 million, largely due to increased public company costs and additional investment in R&D staffing. Our GAAP net loss for the first quarter of 2023 was $9.1 million, or a net loss of $0.11 cents per share. Amprius had 85.0 million shares outstanding at March 31, 2023. As of March 31, 2023, there were 65 full time employees, primarily based in our Fremont, California location, and our share-based compensation was $0.7 million for the first quarter. Turning now to the balance sheet, we exited the first quarter with $64.2 million in cash and no debt. The key drivers of our cash activity for the quarter were: • $6.5 million used in operating activities. As we discussed previously, our run rate for cash used in operating activities is projected to be around $2.0 million per month in addition to 2022 audit costs and transaction related expenses • Other drivers include $1.1 million in investment into the expansion of our Amprius Lab facility in Fremont, and $2.1 million in financing cash inflow related to usage of our committed equity facility. These activities resulted in a total net use of cash of $5.5 million for the quarter. Considering our business achievements and ongoing projects, we believe we have been efficiently using capital to drive Amprius forward. Lastly, we entered into a merger agreement on May 9, 2023 with our 77% stockholder, Amprius, Inc. Amprius, Inc. is a holding company that is owned by our legacy stockholders, many of whom continue to drive our growth as employees and members of management. The proposed merger transaction, if approved, will eliminate our controlling stockholder and result in these legacy stockholders holding our shares directly. Immediately following the merger, the company will no longer have a single, majority stockholder and no stockholder of the company will own more than 15% of our shares. Currently, the shares of stock held by Amprius, Inc. are subject to a lock-up that expires on the one-year anniversary of the closing of the business combination (subject to certain exceptions as set forth in our Bylaws). The shares of the company to be issued to the stockholders of Amprius, Inc. in the merger will be subject to the same lock-up restrictions expiring no later than September 14, 2023, and will be subject to the same exceptions. All of the individual stockholders of Amprius, Inc. will be subject to these restrictions. The proposed merger was approved by the board based on the recommendation of a special, independent board committee. Under the merger agreement, the stockholders of Amprius, Inc. will receive new shares of our common stock based on a discounted exchange ratio relative to what Amprius, Inc. owns today. We will also assume all options and warrants outstanding at Amprius, Inc. The merger is conditioned on, among other items, the approval of a majority of shares held by stockholders of Amprius Technologies that are not affiliated with either Amprius, Inc. or held by any of our directors or officers. We expect that the special meeting to approve the merger will occur in the third quarter of this year. For more information, please reference the Form 8-K filed earlier today, on May 10, 2023. Financial Outlook Moving to our outlook, we still expect to be limited by manufacturing capacity until we exit 2023, when our new 2 MWh capacity is projected to come online. Regarding revenue, we have several ongoing development services programs with performance obligations that we expect to complete within 2023, which means that we should see increased revenue recognition weighted more heavily towards the latter part of the year. We anticipate that our general and administrative costs will continue at the higher rate we experienced exiting 2022 when accounting for additional public company expenses. Also, we plan to continue to be lean on other operating expenses as we strategically add critical mass to our Amprius Lab and Amprius Fab operating

Letter to Shareholders May 2023 - 6 - units and allocate the majority of our capital to scaling up our manufacturing. To this end, we expect higher capital expenditures going forward as we continue to fully build out the 2 MWh capacity at Amprius Lab and design and construct our gigawatt-hour scale Amprius Fab facility. Our spending pattern is dependent on several factors outside of our control, including the timing of rezoning approval for the Colorado site, so we expect to provide more specific projections as we have additional information to share. As we work to fund capital requirements for our scale-up in excess of our previously noted cost-sharing grants from the U.S. DOE, we expect that we will continue to have strong support from the U.S. Inflation Reduction Act (IRA) as we access Production Tax Credits at the anode and cell levels. In addition, we have received over $10 million in state and local incentive packages related to our gigawatt-scale facility, which are the result of significant partnerships built in Colorado through our selection process. We believe that these tailwinds will enhance our economics as we accelerate our scale to meet our massive market. Overall, with the strength of our balance sheet and multiple vehicles to generate additional funding through both equity, such as warrants and our Committed Equity Facility, and non-dilutive sources, such as grants, loans, and incentives, we believe we will have enough cash to execute on our strategic plan. Summary Amprius continues to deliver our next generation, commercially available, lithium-ion batteries to our expanding customer base. Our market leading technology and position in the aviation space are reflective of our unmatched performance in real world applications and our batteries’ ability to solve real world problems. As shown by our recent increase in battery specific energy density from 450 to 500 Wh/kg, we are continuing to work to enhance our product performance and set new industry standards. We’re looking forward to several exciting milestones over the rest of 2023. Our focus is on building out scale to serve significant demand in the U.S. and to support U.S. based supply chain resiliency. With that in mind, we are: 1. Further proving out our large-scale manufacturing process and parameters at Amprius Lab in Fremont, where we expect to operationalize our 2MWh production line by the end of the year; and 2. Moving swiftly to prepare the build out of Amprius Fab, our gigawatt-scale facility in Brighton, Colorado, for the first 500 MWh demonstration program with the U.S. Department of Energy. While those steps are in process, we are using our limited capacity to provide the necessary samples to potential customers moving through the technical-to-commercial validation process, including delivering prototypes of our 500 Wh/kg batteries to select customers.

Letter to Shareholders May 2023 - 7 - Amprius has a tremendous opportunity ahead, with a product portfolio that positions us to both grow in the aviation market and expand to other industries seeking batteries with stronger performance and faster charge times. We are continuing to build on our early lead with technological advancements and strategic partnerships. Through the private and public sector, we believe we will have access to the necessary capital and are building the capacity to become a leading commercial provider in the sustainable mobility sector. Finally, we believe we have the right team in place to execute our mission and deliver what we’ve planned and promised over the last decade. Quarterly Conference Call and Webcast: Date: Wednesday, May 10, 2023 Time: 5:00 PM ET (2:00 PM PT) Toll-Free Number: 866-682-6100 International Number: 862-298-0702 Webcast: Register and Join Dr. Kang Sun, CEO Sandra Wallach, CFO

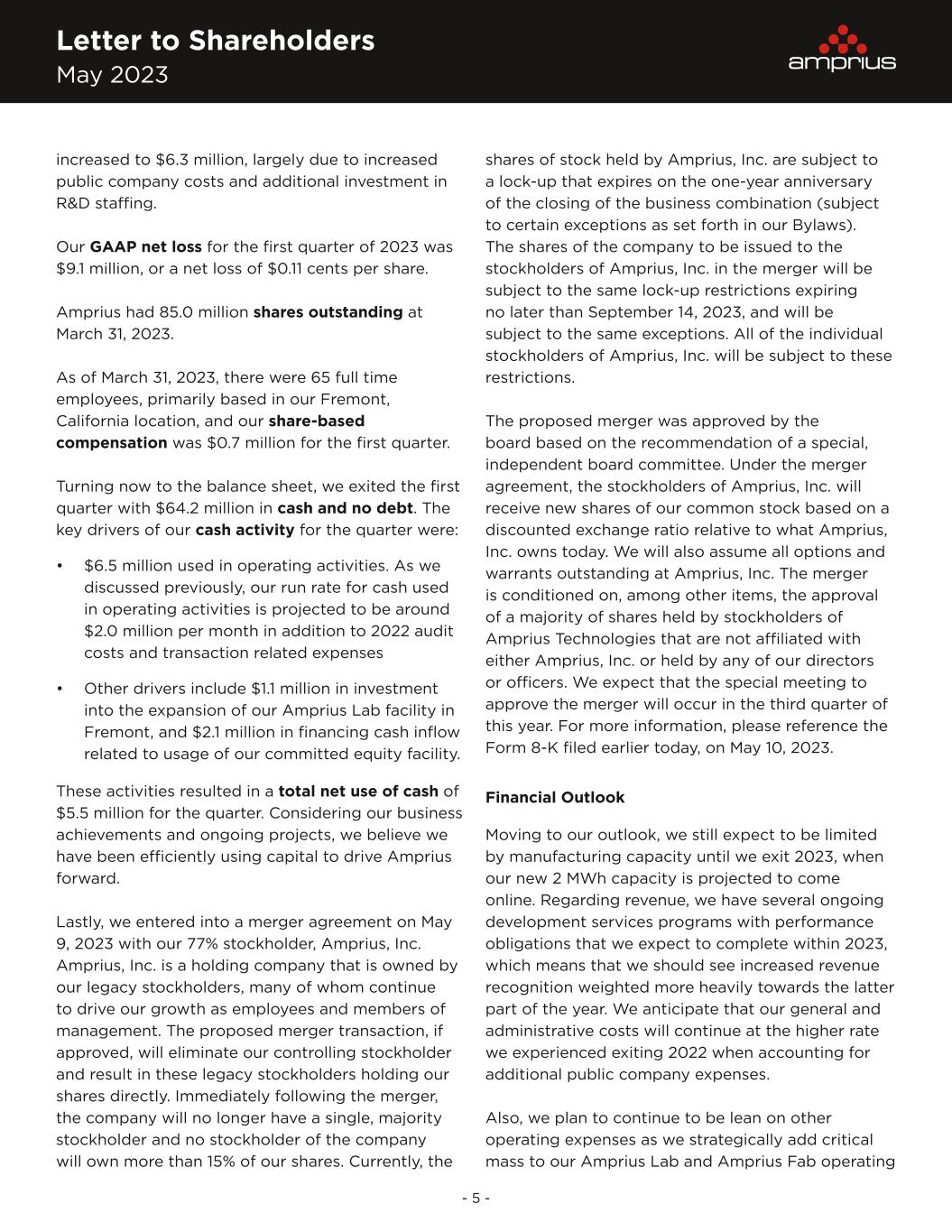

Letter to Shareholders May 2023 - 8 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited, in thousands, except share and par value data) March 31, 2023 December 31, 2022 ASSETS Current assets: Cash and cash equivalents $64,187 $69,696 Accounts receivable 555 686 Inventories 845 500 Deferred costs 2,475 1,897 Prepaid expenses and other current assets 1,841 2,394 Total current assets 69,903 75,173 Non-current assets: Property, plant and equipment, net 4,948 4,236 Operating lease right-of-use assets, net 7,894 2,751 Deferred costs 519 367 Other assets 684 644 Total assets $83,948 $83,171 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $1,023 $1,028 Accrued and other current liabilities 3,665 2,708 Deferred revenue 3,135 2,660 Operating lease liabilities 1,061 521 Total current liabilities 8,884 6,917 Non-current liabilities: Deferred revenue 902 720 Operating lease liabilities 7,127 2,501 Total liabilities 16,913 10,138 Commitments and contingencies Stockholders’ equity: Preferred stock; $0.0001 par value; 50,000,000 shares authorized; no shares issued and outstanding. — — Common stock; $0.0001 par value; 950,000,000 shares authorized; 84,971,465 and 84,610,114 shares issued and outstanding at March 31, 2023 and December 31, 2022, respectively 8 8 Additional paid-in capital 169,016 165,912 Accumulated deficit (101,989) (92,887) Total stockholders’ equity 67,035 73,033 Total liabilities and stockholders’ equity $83,948 $83,171

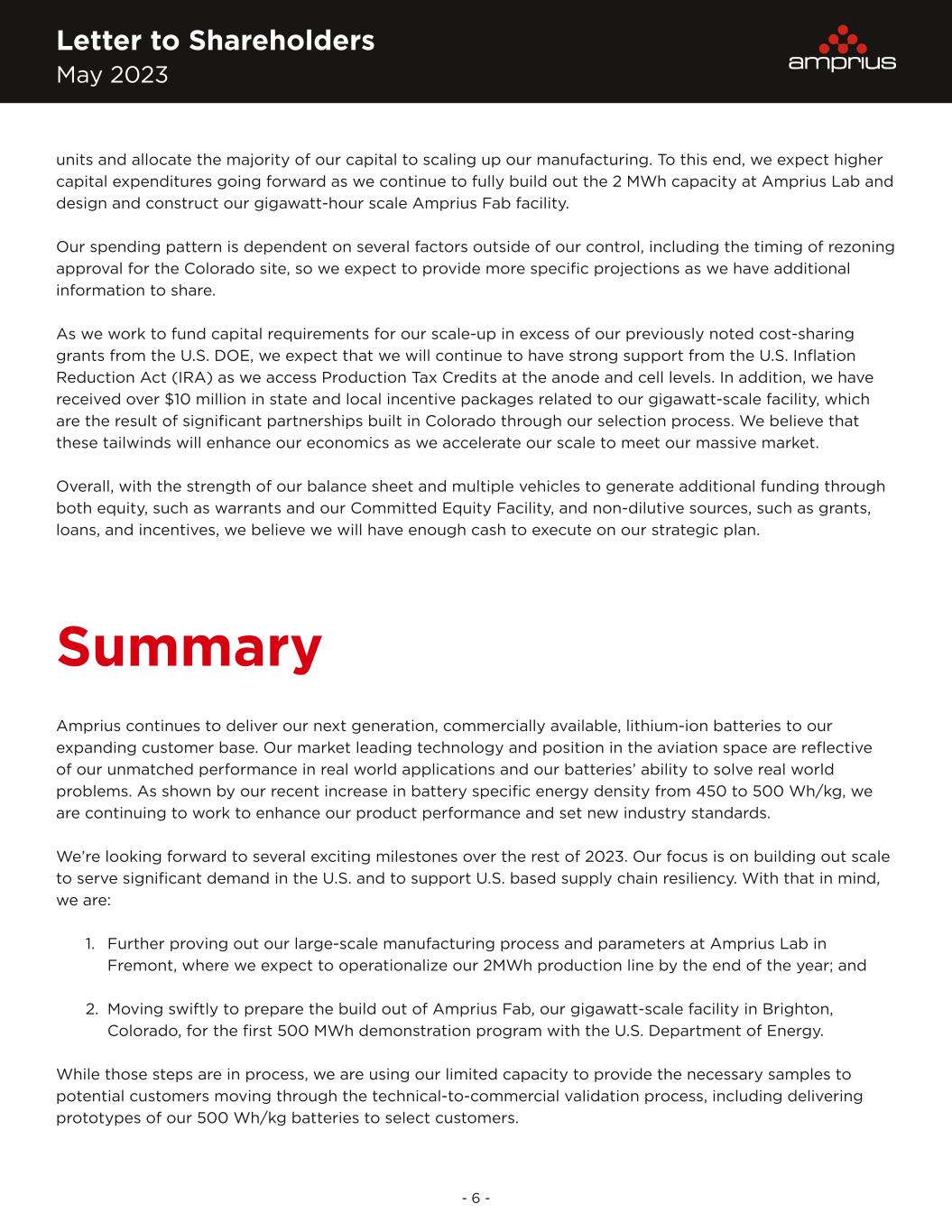

Letter to Shareholders May 2023 - 9 - Three months ended March 31, 2023 2022 Revenue $679 $2,110 Cost of revenue 4,104 3,149 Gross loss (3,425) (1,039) Gross Margin (504)% (49)% Operating expenses: Research and development 800 369 Selling, general and administrative 5,526 1,502 Total operating expenses 6,326 1,871 Loss from operations (9,751) (2,910) Other income, net 649 32 Net loss ($9,102) ($2,878) Weighted-average common shares outstanding: Basic and diluted 84,645,097 65,774,528 Net loss per share of common stock: Basic and diluted ($0.11) ($0.04) AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in thousands, except share and per share data)

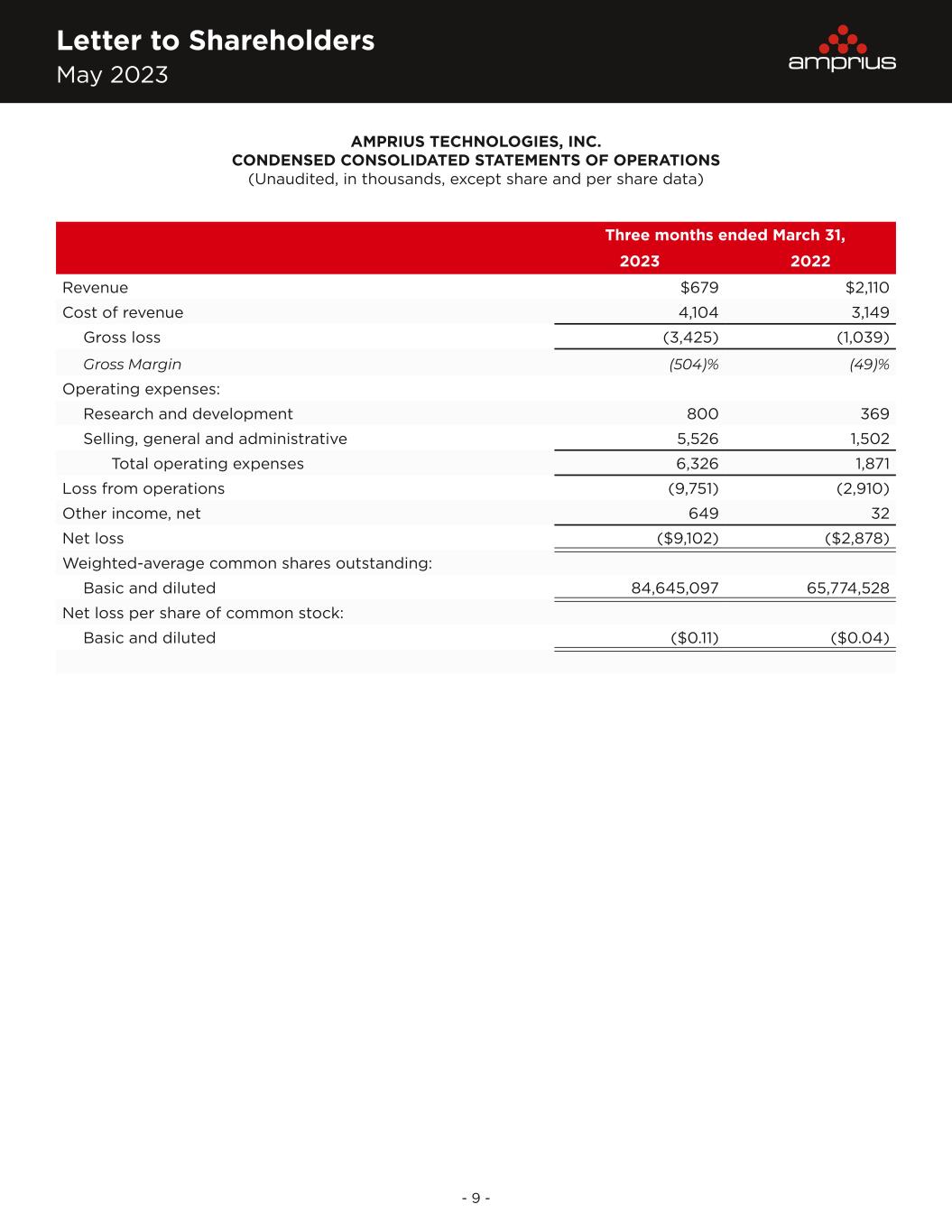

Letter to Shareholders May 2023 - 10 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, in thousands) Three months ended March 31, 2023 2022 Cash flows from operating activities: Net loss $(9,102) $(2,878) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 726 456 Depreciation and amortization 416 358 Amortization of deferred costs 134 1,252 Non-cash operating lease expense 202 140 Changes in operating assets and liabilities: Accounts receivable 131 (209) Inventories (345) 161 Deferred costs (864) (595) Prepaid expenses and other current assets 553 41 Accounts payable 59 (51) Accrued and other current liabilities 1,120 (332) Deferred revenue 657 (1,300) Operating lease liabilities (179) (86) Net cash used in operating activities (6,492) (3,043) Cash flows from investing activities: Purchase of property, plant and equipment (1,140) (34) Net cash used in investing activities (1,140) (34) Cash flows from financing activities: Issuance of common stock in connection with a stock purchase agreement 2,389 — Payment of financing costs in connection with a stock purchase agreement (268) — Proceeds from exercise of stock options 2 8 Capital contributions from Amprius Holdings — 247 Payment of transaction and issuance costs in connection with Business — (51) Net cash provided by financing activities 2,123 204 Net decrease in cash, cash equivalents and restricted cash (5,509) (2,873) Cash, cash equivalents and restricted cash, beginning of period 69,752 11,489 Cash, cash equivalents and restricted cash, end of period $64,243 $8,616 Reconciliation of cash, cash equivalents and restricted cash shown on the condensed consolidated balance sheets: Cash and cash equivalents $64,187 $8,616 Restricted cash included in other assets 56 — Total cash, cash equivalents and restricted cash $64,243 $8,616

Letter to Shareholders May 2023 - 11 - Forward-Looking Statements This Letter to Shareholders includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Amprius’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding future product commercialization, Amprius’ ability to build a large- scale manufacturing facility and expand its manufacturing capacity, the addressable market for Amprius’ batteries, the potential application and performance of Amprius’ batteries, Amprius’ sales pipeline, the expected benefits of Brighton manufacturing facility, and Amprius’ financial and business performance. These statements are based on various assumptions, whether or not identified in this letter, and on the current expectations of Amprius’ management and are not predictions of actual performance. These forward-looking statements are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Amprius’ control. These forward-looking statements are subject to a number of risks and uncertainties, including risks related to delays in permitting, construction and operation of production facilities; Amprius’ ability to commercially produce its high performing batteries; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius’ products; the termination of government clean energy and electric vehicle incentives or the reduction in government spending on vehicles powered by battery technology; the risk that our high volume tools do not achieve sufficient quality or yield or that our manufacturing process does not meet cost targets; delays or failure in rezoning the land for the Bright manufacturing facility; delays in construction and operation of production facilities; Amprius’ liquidity position; and changes in domestic and foreign business, market, financial, political and legal conditions. For more information on these risks and uncertainties that may impact the operations and projections discussed herein can be found in the “Risk Factors” section of our Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 30, 2023, and other documents we filed from time to time with the SEC, all of which are available on the SEC’s website at www.sec.gov. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this letter. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this letter. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.