EX-99.1

Published on August 10, 2023

LETTER TO SHAREHOLDERS Q2 Fiscal 2023 March 2023

Letter to Shareholders August 2023 - 1 - Company Overview Amprius develops and manufactures ultra-high energy density lithium-ion batteries based on our proprietary silicon anode technology. Our battery performance continues to command a firm leading position in the industry, highlighted by Amprius’ ability to provide: • 450 Wh/Kg specific energy density and 1150 Wh/L volumetric energy density • Up to 10C power capability • An extreme fast charge rate of 0-80% state of charge in around six minutes • A wide operating temperature range of -30°C up to 55°C • Safety design features that enable us to pass the United States military’s benchmark nail penetration test Our mandate is to scale our manufacturing capabilities to meet the ever-increasing demand for our solutions, with the long-term goal of becoming a mainstream battery solution with applications across all segments of electric mobility, including the aviation and EV industries. We are diligently working to execute the strategy we laid out earlier this year. Based on our accomplishments in the first half of 2023, we’ve already made significant progress in expanding our existing capabilities to maintain our industry-best performance at scale. Fellow Shareholders, Our second quarter was a testament to the growth potential across our business. Building on our momentum from the start of the year, we focused on executing our plans to develop our products, build out our book of customers, and advance on our path to large-scale commercialization. We made significant progress towards our goals this quarter, and are pleased to share our financial results and operational highlights with you below. We will also briefly summarize the main highlights on a conference call before hosting an interactive Q&A session.

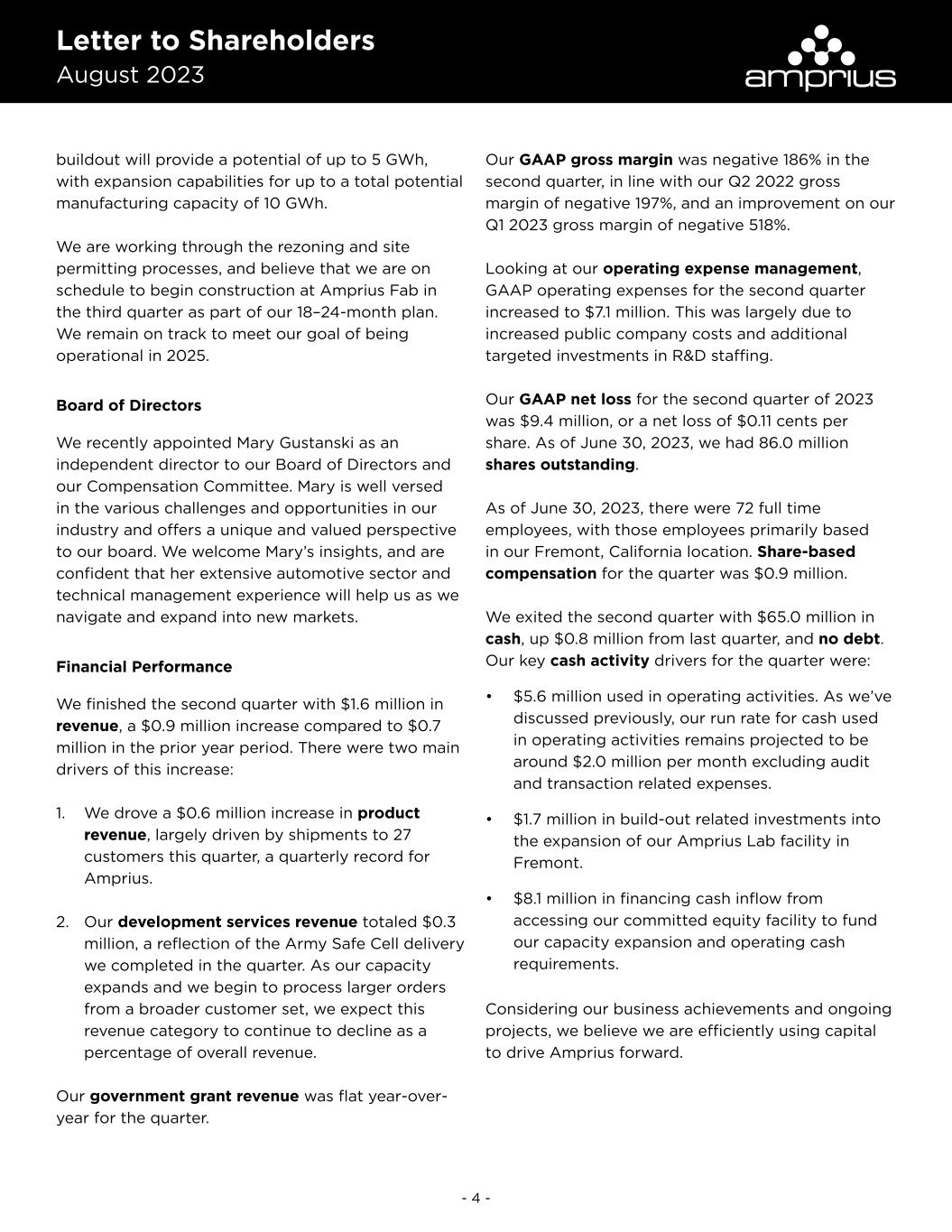

Letter to Shareholders August 2023 - 2 - Disruptive Technology Advancements Beginning with our technological developments, our second quarter included a few key examples of our ongoing efforts to push the boundaries of what is possible in the high-performance battery space. • Earlier this month, we announced our new product, the Amprius Ultra-High-Power-High- Energy Battery Cell. This cell is designed to power electric vertical takeoff and landing aircraft (eVTOL) and high-performance automotive vehicles. The cell achieves an impressive discharge rate of 10C while delivering 400 Wh/kg energy density, an extraordinary power output that brings unprecedented benefits to the eVTOL and unmanned aerial vehicle (UAV) industries. The new cell’s groundbreaking capabilities can extend to high-performance EVs as well. • Also, our silicon anode batteries recently powered BAE Systems’ first successful stratospheric flight. BAE Systems choosing Amprius as its partner for its High-Altitude Pseudo Satellite Uncrewed Aerial System demonstrates that they believe it important to use an ultralight battery that also offers the necessary power to fly the aircraft. • We also completed the U.S. Army Safe Cell Development Program, an important technical milestone for our business with the U.S. Army. We successfully delivered our 390 Wh/kg safe cells with a gel polymer electrolyte, passing the rigorous Military Performance Specification Nail Penetration Test. • Lastly, we’ve become an integral partner to several teams participating in the Bridgestone World Solar Challenge in October. Amprius batteries’ superior performance attracted significant attention from teams entering the development process, and four teams chose Amprius batteries to power their solar cars. These are just a few of the ways Amprius is changing the battery landscape. We are constantly evolving our products to push our industry’s boundaries and meet our customers’ performance goals. Continued Commercial Success Turning to our business development efforts, we continued to see significant demand for our products in the second quarter. We shipped to 27 total customers this quarter, up from 16 in last year’s second quarter and up from 19 in the first quarter of this year. Photo Credit: BAE Systems Photo Credit: University of Michigan Solar Car Team

Letter to Shareholders August 2023 - 3 - These customer relationships extend beyond technical engagements. This quarter’s customers include repeat customers like Airbus, AeroVironment, and Teledyne FLIR, who continue to show their support and demand for Amprius batteries through additional product orders and commercial shipments. We shipped to 10 new customers in the quarter as well, which indicates growing industry recognition and validation of our products. In addition, our pipeline of potential customers remains strong. Two key ways that we bolster our pipeline are through strategic technical engagements and prototype shipments. In the second quarter, we not only drove significant progress in our ongoing technical engagements, we also started a new technical engagement with a leading high performance automotive OEM. This new engagement is expected to be part of a joint development contract we’re finalizing with the manufacturer. Once finalized, we believe that this engagement will offer us another encouraging opportunity in the automotive space. As for prototype shipments, this quarter we made site visits to two battery pack manufacturers to whom we started shipping samples in the fourth quarter of last year. We believe that these visits serve as meaningful steps toward significant potential demand from the aviation industry through 2025 and beyond. Path to Commercial Scale In addition to driving demand for our batteries, it remains a priority for our business to expand our production capacity to meet this demand. We believe that this is a critical part of our strategy, both in the short term, as we work to expand Amprius Lab in Fremont, California, and over the medium- and long-term, as we strive to achieve gigawatt scale manufacturing with Amprius Fab in Brighton, Colorado. Amprius Lab In the second quarter, we ordered the necessary equipment to begin executing our Amprius Lab retrofit and expansion, a process that we are on track to complete by the end of the year in hopes of having the expanded facility up and running entering 2024. We expect this expansion at Amprius Lab to increase our production capacity to 10 times what it is today. Amprius Fab We are working diligently to meet our proposed plan for Amprius Fab. As a reminder, our planned 774,000 square foot large-scale production facility is part of a total site with over 1.3 million square feet available for expansion, expected to be the first mass production site for next-generation battery technology in the U.S. The initial phase of our

Letter to Shareholders August 2023 - 4 - buildout will provide a potential of up to 5 GWh, with expansion capabilities for up to a total potential manufacturing capacity of 10 GWh. We are working through the rezoning and site permitting processes, and believe that we are on schedule to begin construction at Amprius Fab in the third quarter as part of our 18–24-month plan. We remain on track to meet our goal of being operational in 2025. Board of Directors We recently appointed Mary Gustanski as an independent director to our Board of Directors and our Compensation Committee. Mary is well versed in the various challenges and opportunities in our industry and offers a unique and valued perspective to our board. We welcome Mary’s insights, and are confident that her extensive automotive sector and technical management experience will help us as we navigate and expand into new markets. Financial Performance We finished the second quarter with $1.6 million in revenue, a $0.9 million increase compared to $0.7 million in the prior year period. There were two main drivers of this increase: 1. We drove a $0.6 million increase in product revenue, largely driven by shipments to 27 customers this quarter, a quarterly record for Amprius. 2. Our development services revenue totaled $0.3 million, a reflection of the Army Safe Cell delivery we completed in the quarter. As our capacity expands and we begin to process larger orders from a broader customer set, we expect this revenue category to continue to decline as a percentage of overall revenue. Our government grant revenue was flat year-over- year for the quarter. Our GAAP gross margin was negative 186% in the second quarter, in line with our Q2 2022 gross margin of negative 197%, and an improvement on our Q1 2023 gross margin of negative 518%. Looking at our operating expense management, GAAP operating expenses for the second quarter increased to $7.1 million. This was largely due to increased public company costs and additional targeted investments in R&D staffing. Our GAAP net loss for the second quarter of 2023 was $9.4 million, or a net loss of $0.11 cents per share. As of June 30, 2023, we had 86.0 million shares outstanding. As of June 30, 2023, there were 72 full time employees, with those employees primarily based in our Fremont, California location. Share-based compensation for the quarter was $0.9 million. We exited the second quarter with $65.0 million in cash, up $0.8 million from last quarter, and no debt. Our key cash activity drivers for the quarter were: • $5.6 million used in operating activities. As we’ve discussed previously, our run rate for cash used in operating activities remains projected to be around $2.0 million per month excluding audit and transaction related expenses. • $1.7 million in build-out related investments into the expansion of our Amprius Lab facility in Fremont. • $8.1 million in financing cash inflow from accessing our committed equity facility to fund our capacity expansion and operating cash requirements. Considering our business achievements and ongoing projects, we believe we are efficiently using capital to drive Amprius forward.

Letter to Shareholders August 2023 - 5 - Financial Outlook As we mentioned last quarter, we have several ongoing development services programs with performance obligations that we expect to complete within 2023. This means that we should see increased revenue recognition weighted more heavily towards the latter part of the year. Also, we continue to expect to be capacity constrained until we exit 2023, when our new 2 MWh capacity is projected to come online. That project and our build out of Amprius Fab in Brighton, Colorado remain our top capital allocation priorities. We believe that we are on track with our prior CapEx projections, expecting to spend approximately $10 to $12 million completing the build out of the Amprius Lab facility in Fremont by the end of the year, as well as $50 to $80 million in the second half of the year as we start construction at Amprius Fab and begin to order long-lead-time equipment. We expect to confirm the facility design and scale, as well as provide a project budget, during the second half of this year. Overall, with the strength of our balance sheet and multiple vehicles to generate additional funding through both equity issuances, such as warrants and sales under our Committed Equity Facility, and non- dilutive sources, such as grants, loans, and incentives, we believe we will have enough cash to execute on our strategic plan. Summary As we look to the rest of the year, our strategy and focus at Amprius remains unchanged. Our four distinct advantages relative to other battery manufacturers remain intact. Amprius batteries continue to bring: 1. Unmatched technical and product performance – Amprius batteries command a firm lead in safety, energy, power, charging time, and temperature performance, and are uniquely positioned for the electric mobility market. 2. Years of product commercialization experience endorsed by industry leaders – Amprius batteries are commercially available today, and have been shipping since 2018. 3. Proven manufacturability, with a pathway to higher volume manufacturing capacity – Exiting 2023, we will further prove out our large-scale manufacturing process and parameters with our 2 MWh production line at Amprius Lab. Also, our build out of Amprius Fab remains on track, and we expect to have the facility operational entering 2025. 4. A team of seasoned business operators with a solid track record – We believe we have the right team in place to execute our mission. We’re looking forward to several exciting milestones over the rest of 2023. Before the end of the year, we expect to secure additional customer commitments, deliver 500 Wh/kg battery prototypes, complete our MWh scale silicon anode battery manufacturing facility at Amprius Lab, and start Amprius Fab’s construction and complete our production line design and facility equipment specifications.

Letter to Shareholders August 2023 - 6 - Quarterly Conference Call and Webcast: Date: Thursday, August 10, 2023 Time: 5:00 PM ET (2:00 PM PT) Toll-Free Number: 866-424-3442 International Number: +1-201-689-8548 Webcast: Register and Join Dr. Kang Sun, CEO Sandra Wallach, CFO As we look to the rest of the year, our strategy and focus at Amprius remains unchanged. We have a tremendous opportunity ahead, with a product portfolio that positions us to both grow in the aviation market and expand to other industries seeking batteries with leading performance. Our demand pipeline is robust, with opportunities on our growth path in the coming years that include the $1.25 billion conformal wearable battery market by 2030, the $49 billion aviation battery market by 2025, and the $67 billion EV battery market by 2025. 2023 has been a very productive year for the company thus far. Our solid performance in this quarter has demonstrated our team’s ability to deliver what we have planned and promised. Thank you for your continued support of Amprius Technologies. Best,

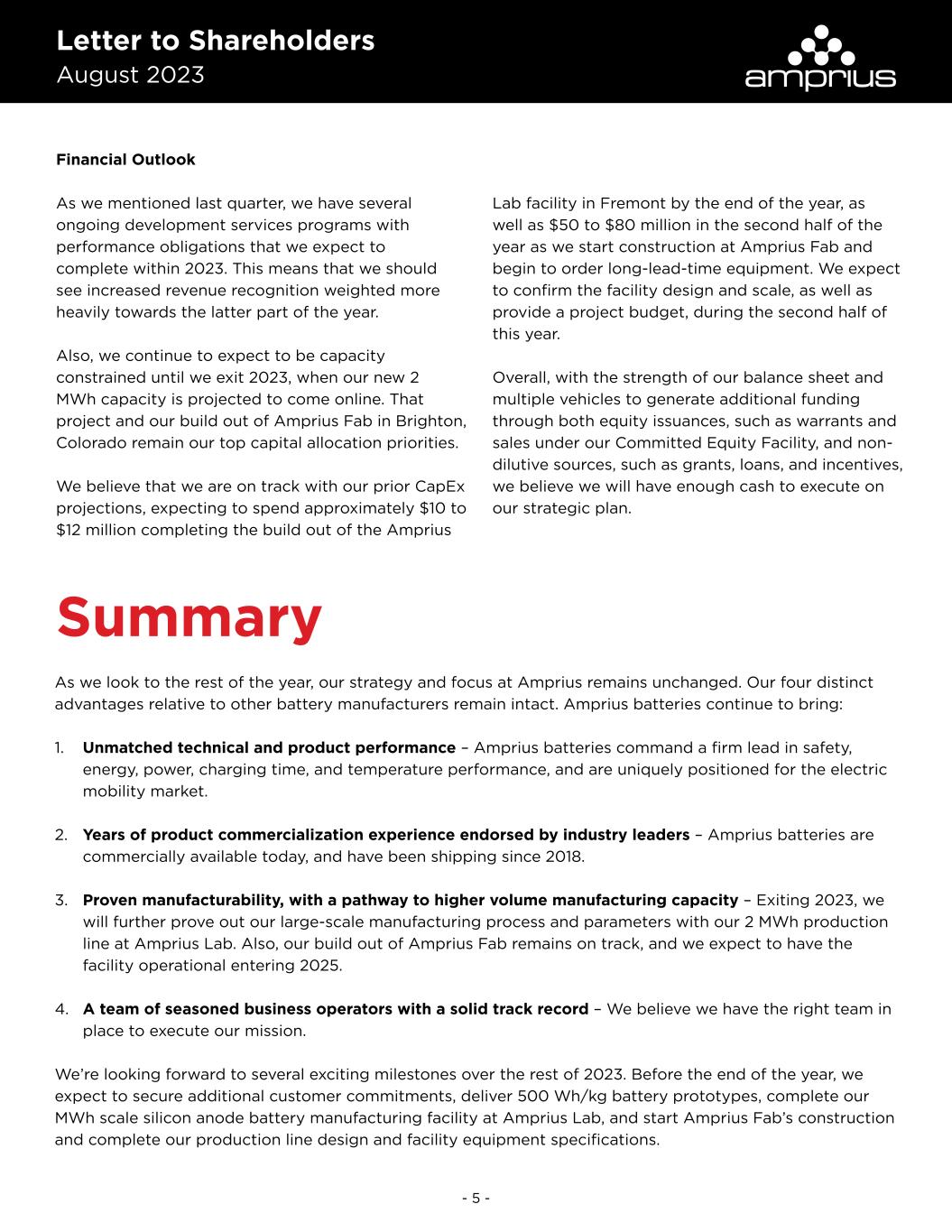

Letter to Shareholders August 2023 - 7 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited, in thousands, except share and par value data) June 30, 2023 December 31, 2022 ASSETS Current assets: Cash and cash equivalents $65,010 $69,696 Accounts receivable 1,130 686 Inventories 503 500 Deferred costs 2,578 1,897 Prepaid expenses and other current assets 1,479 2,394 Total current assets 70,700 75,173 Non-current assets: Property, plant and equipment, net 6,903 4,236 Operating lease right-of-use assets, net 7,744 2,751 Deferred costs 588 367 Other assets 702 644 Total assets $86,637 $83,171 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $597 $1,028 Accrued and other current liabilities 7,141 2,708 Deferred revenue 3,198 2,660 Operating lease liabilities 1,070 521 Total current liabilities 12,006 6,917 Non-current liabilities: Deferred revenue 943 720 Operating lease liabilities 6,998 2,501 Total liabilities 19,947 10,138 Commitments and contingencies Stockholders’ equity: Preferred stock; $0.0001 par value; 50,000,000 shares authorized; no shares issued and outstanding. — — Common stock; $0.0001 par value; 950,000,000 shares authorized; 85,993,560 and 84,610,114 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively 9 8 Additional paid-in capital 178,118 165,912 Accumulated deficit (111,437) (92,887) Total stockholders’ equity 66,690 73,033 Total liabilities and stockholders’ equity $86,637 $83,171

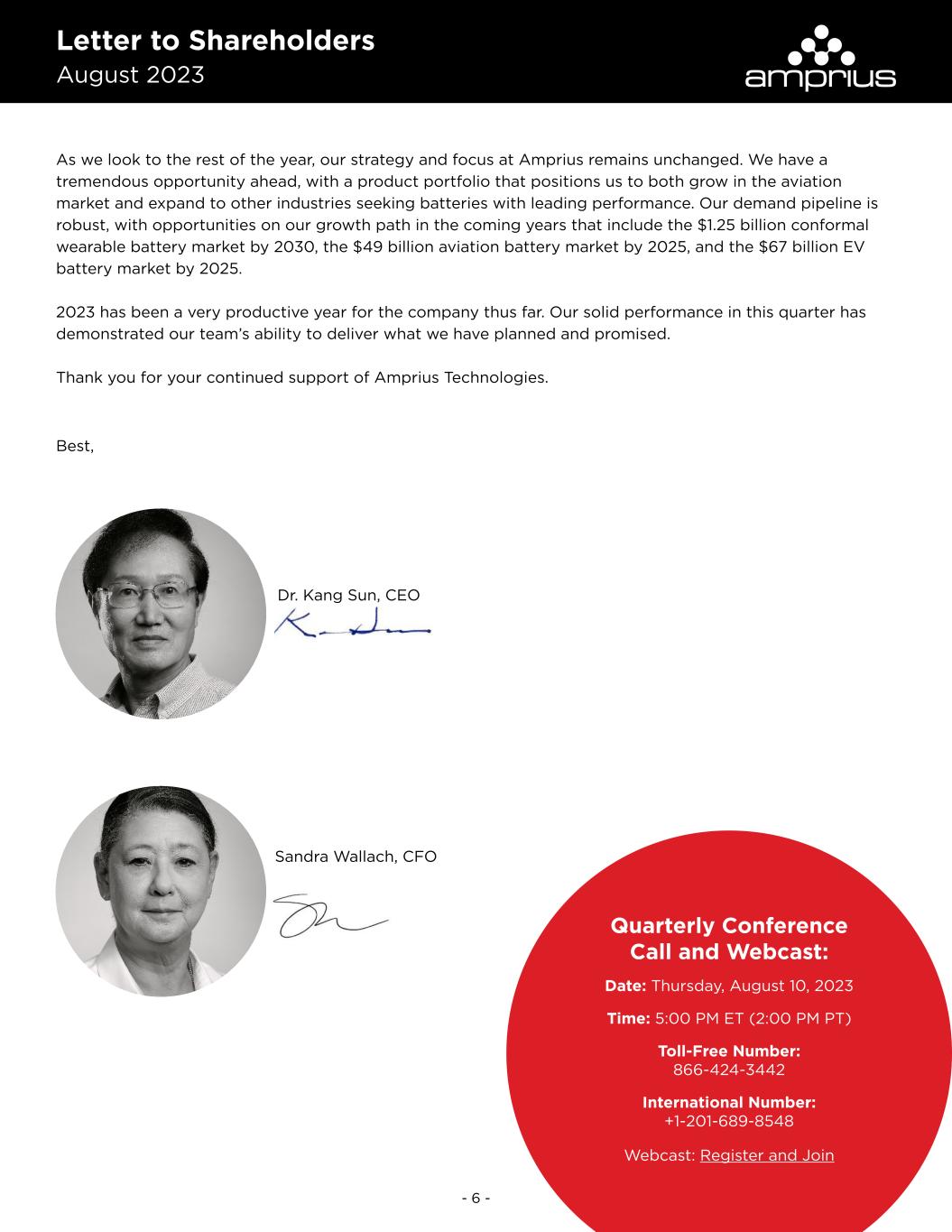

Letter to Shareholders August 2023 - 8 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in thousands, except share and per share data) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Revenue $1,632 $691 $2,311 $2,801 Cost of revenue 4,664 2,055 8,860 5,266 Gross loss (3,032) (1,364) (6,549) (2,465) Gross Margin (186)% (197)% (283)% (88)% Operating expenses: Research and development 772 478 1,572 849 Selling, general and administrative 6,279 2,319 11,713 3,757 Total operating expenses 7,051 2,797 13,285 4,606 Loss from operations (10,083) (4,161) (19,834) (7,071) Other income, net 635 7 1,284 39 Net loss $(9,448) $(4,154) $(18,550) $(7,032) Weighted-average common shares outstanding: Basic and diluted 85,216,827 65,776,550 84,932,542 65,775,545 Net loss per share of common stock: Basic and diluted $(0.11) $(0.06) $(0.22) $(0.11)

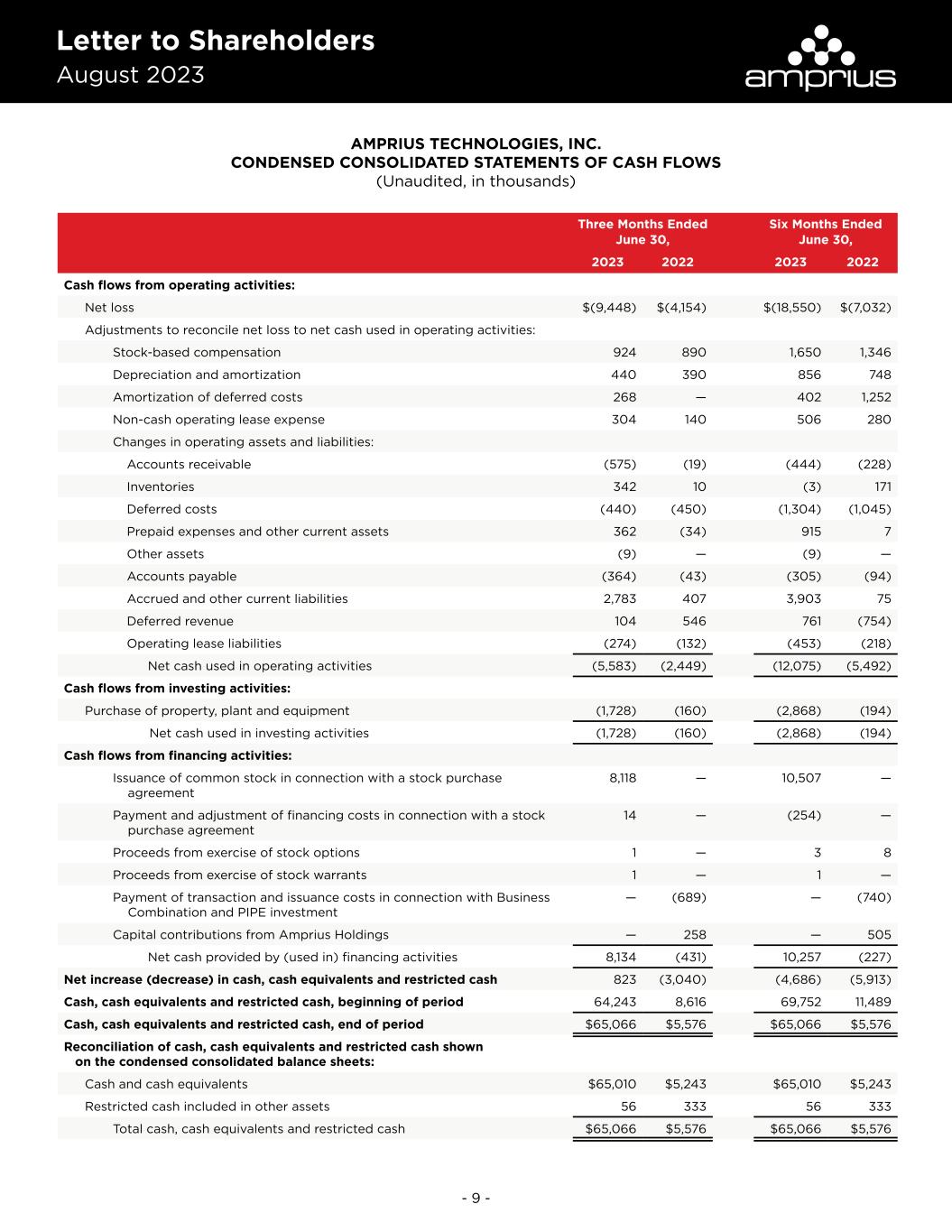

Letter to Shareholders August 2023 - 9 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, in thousands) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Cash flows from operating activities: Net loss $(9,448) $(4,154) $(18,550) $(7,032) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 924 890 1,650 1,346 Depreciation and amortization 440 390 856 748 Amortization of deferred costs 268 — 402 1,252 Non-cash operating lease expense 304 140 506 280 Changes in operating assets and liabilities: Accounts receivable (575) (19) (444) (228) Inventories 342 10 (3) 171 Deferred costs (440) (450) (1,304) (1,045) Prepaid expenses and other current assets 362 (34) 915 7 Other assets (9) — (9) — Accounts payable (364) (43) (305) (94) Accrued and other current liabilities 2,783 407 3,903 75 Deferred revenue 104 546 761 (754) Operating lease liabilities (274) (132) (453) (218) Net cash used in operating activities (5,583) (2,449) (12,075) (5,492) Cash flows from investing activities: Purchase of property, plant and equipment (1,728) (160) (2,868) (194) Net cash used in investing activities (1,728) (160) (2,868) (194) Cash flows from financing activities: Issuance of common stock in connection with a stock purchase agreement 8,118 — 10,507 — Payment and adjustment of financing costs in connection with a stock purchase agreement 14 — (254) — Proceeds from exercise of stock options 1 — 3 8 Proceeds from exercise of stock warrants 1 — 1 — Payment of transaction and issuance costs in connection with Business Combination and PIPE investment — (689) — (740) Capital contributions from Amprius Holdings — 258 — 505 Net cash provided by (used in) financing activities 8,134 (431) 10,257 (227) Net increase (decrease) in cash, cash equivalents and restricted cash 823 (3,040) (4,686) (5,913) Cash, cash equivalents and restricted cash, beginning of period 64,243 8,616 69,752 11,489 Cash, cash equivalents and restricted cash, end of period $65,066 $5,576 $65,066 $5,576 Reconciliation of cash, cash equivalents and restricted cash shown on the condensed consolidated balance sheets: Cash and cash equivalents $65,010 $5,243 $65,010 $5,243 Restricted cash included in other assets 56 333 56 333 Total cash, cash equivalents and restricted cash $65,066 $5,576 $65,066 $5,576

Letter to Shareholders August 2023 - 10 - Forward-Looking Statements This Letter to Shareholders includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Amprius’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding Amprius’ sales pipeline and customer commitment, future product commercialization, the timing and ability to expand Amprius’ Fremont facility and build a large- scale manufacturing facility and expand its manufacturing capacity, the addressable market for Amprius’ batteries, the potential application and performance of Amprius’ batteries, the expected benefits of Brighton manufacturing facility, Amprius’ liquidity position, and Amprius’ financial and business performance. These statements are based on various assumptions, whether or not identified in this letter, and on the current expectations of Amprius’ management and are not predictions of actual performance. These forward-looking statements are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Amprius’ control. These forward-looking statements are subject to a number of risks and uncertainties, including risks related to delays in permitting, construction and operation of production facilities; Amprius’ ability to commercially produce its high performing batteries; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius’ products; the termination of government clean energy and electric vehicle incentives or the reduction in government spending on vehicles powered by battery technology; the risk that Amprius’ high volume tools do not achieve sufficient quality or yield or that its manufacturing process does not meet cost targets; delays or failure in rezoning the land for the Bright manufacturing facility; Amprius’ liquidity position and its ability to raise additional capital; and changes in domestic and foreign business, market, financial, political and legal conditions. For more information on these risks and uncertainties that may impact the operations and projections discussed herein can be found in the documents Amprius filed from time to time with the SEC, all of which are available on the SEC’s website at www.sec.gov. If any of these risks materialize or Amprius’ assumptions prove incorrect, actual results could differ materially from the results implied by these forward- looking statements. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this letter. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this letter. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.