EX-99.1

Published on May 9, 2024

LETTER TO SHAREHOLDERS Q1 2024 March 2023 Exhibit 99.1

Letter to Shareholders May 2024 - 1 - Amprius has been in commercial battery production since 2018, and it is our belief that there are no other commercial batteries on the market that can perform at these levels today. Amprius’ high-performance battery families, SiMaxxTM and SiCoreTM, have attracted significant market attention and customer demand. The company’s priority today is to build additional manufacturing capacity as quickly as we can to meet this significant customer demand for our products. Company Overview Amprius develops, manufactures, and markets high energy density and high power density batteries with applications across all segments of electric mobility, including the aviation and EV industries. When it comes to battery performance, Amprius’ silicon anode batteries command a firm leading position in the industry. Amprius’ portfolio of batteries delivers: • 450 Wh/kg specific energy density and 1,150 Wh/L volumetric energy density, available commercially since early 2022 • 500 Wh/kg, 1,300 Wh/L battery platform, which will be available for commercial delivery later this year • Up to 10C continuous power capability and balanced high energy and high power designs • An extreme fast charge rate of 0-80% state of charge in about six minutes • A wide operating temperature range of -30°C up to 55°C • Safety design features that enable us to pass the United States military’s benchmark nail penetration test Fellow Shareholders, We hit the ground running in the first quarter at Amprius. We doubled the number of customers who received shipments in Q1 compared to Q4 of last year, a significant accomplishment and a testament to the marketability of our batteries. We are delivering industry-leading performance with our battery technology while also taking critical steps to scale production to meet the growing demand for our solutions. With that, we are pleased to share our financial results and operational highlights with you below.

Letter to Shareholders May 2024 - 2 - Disruptive Technology Advancements As we strive to expand the possibilities for the high-performance battery space, improving our industry-leading technology remains at the heart of our strategy. In the first quarter, we continued to innovate to transform the electric mobility sector. In January we launched our all-new SiCore product family to go along with our existing SiMaxx silicon nanowire platform. A few key features of our SiCore platform include: • SiCore was developed to serve the applications that demand high energy density and longer cycle life, offering up to 400 Wh/kg and as many as 1,200 cycles at full depth of discharge • SiCore products have additional form factor flexibility, capable of both pouch and cylindrical cell form factors, allowing them to be used in more applications, such as e-bikes and other micromobility market segments In addition to having another product platform available for Amprius customers, the introduction of SiCore batteries accelerates our revenue growth without additional capital investment and serves our customers without delay. To produce SiCore batteries, we are taking advantage of existing lithium-ion battery production capacity in the industry and have toll manufacturers as a bridge between now and the operation of our own large scale manufacturing facility. These toll manufacturing agreements provide us with hundreds of MWhs of SiCore capacity today. Continued Commercial Success So far, 2024 has been a resounding commercial success for Amprius. In Q1, we shipped to 82 customers, doubling our customer count over Q4 2023. 52 of these shipments were to new customers from across the electric mobility sector, complementing our strong repeat customer base that includes AALTO Airbus, Teledyne Flir, the U.S. Army, Kraus Hamdani, and BAE Systems. The SiCore platform with high-volume manufacturing capacity is a primary driver of our ability to meet this market demand. In the first quarter, we shipped SiCore products to 76 customers. As we further build out our SiCore customer base, we are confident that we will be able to continue to meet the strong demand for our batteries while our SiMaxx production approaches large-scale capacity. While SiMaxx product demand continues to outstrip our supply, we recently had several high-volume shipments to existing customers including Kraus Hamdani Aerospace. Customers like Kraus Hamdani continue to validate our technology, expanding our lead as the go-to cells for best-in-class performance. Manufacturing Capacity Expansion As customer demand for Amprius batteries is accelerating, expanding production capacity is our priority. In Q1, we continued to make significant progress in ramping up our production in Fremont, California. Most recently, we completed the qualification process for our centrotherm machine, which is used in the silicon anode fabrication process. We remain on track to achieve 2 MWh production in Fremont by the end of the year. We are also implementing SiMaxx cathode production in-house to streamline our manufacturing process. We plan to have this capacity up and running in Fremont later this year.

Letter to Shareholders May 2024 - 3 - We have continued to make important progress on our large-scale manufacturing site in Brighton, Colorado. We currently have completed 30% of the construction design drawings and specifications for the facility, and have taken several regulatory steps forward, including submitting our site plan and advancing all other regulatory plans and applications for the facility. As an additional step and in response to the market’s strong reaction to our SiCore platform, we’ve updated our plans for the Brighton facility to redesign our initial production line to be SiCore- focused. We will continue to produce SiMaxx out of Fremont until a second line begins production in Brighton. Carrying Momentum into Q2 We are driving our growing momentum from the beginning of the year into the second quarter across several of our initiatives: • We recently signed our first long-term manufacturing agreement with one of our toll manufacturing partners to confirm our cooperation and strategic alignment. This new agreement establishes the overall engagement and moves us from operating transactionally to a partnership framework. • We have extended our partnerships with several customers, including multiple purchase orders from AALTO Airbus for our SiMaxx 450 Wh/ kg high energy cells. They are continuing to use these cells in their HAPS Project Zephyr, with SiMaxx supplying the necessary power and endurance for their stratospheric flight operations. • We have also received the first production order for the U.S. Army Safe Cells, and we expect to deliver them later this year. This is the first order we’ve received after the successful completion of the development contract that we previously shared with you. • We signed a new strategic partnership in the second quarter with AIBOT. Amprius will soon provide SiCore cells to the company, ensuring maximum power and reliability for AIBOT’s mission-critical operations. • Amprius will also provide SiCore cells to STAFL Systems as its preferred battery cell supplier for custom high-performance battery packs

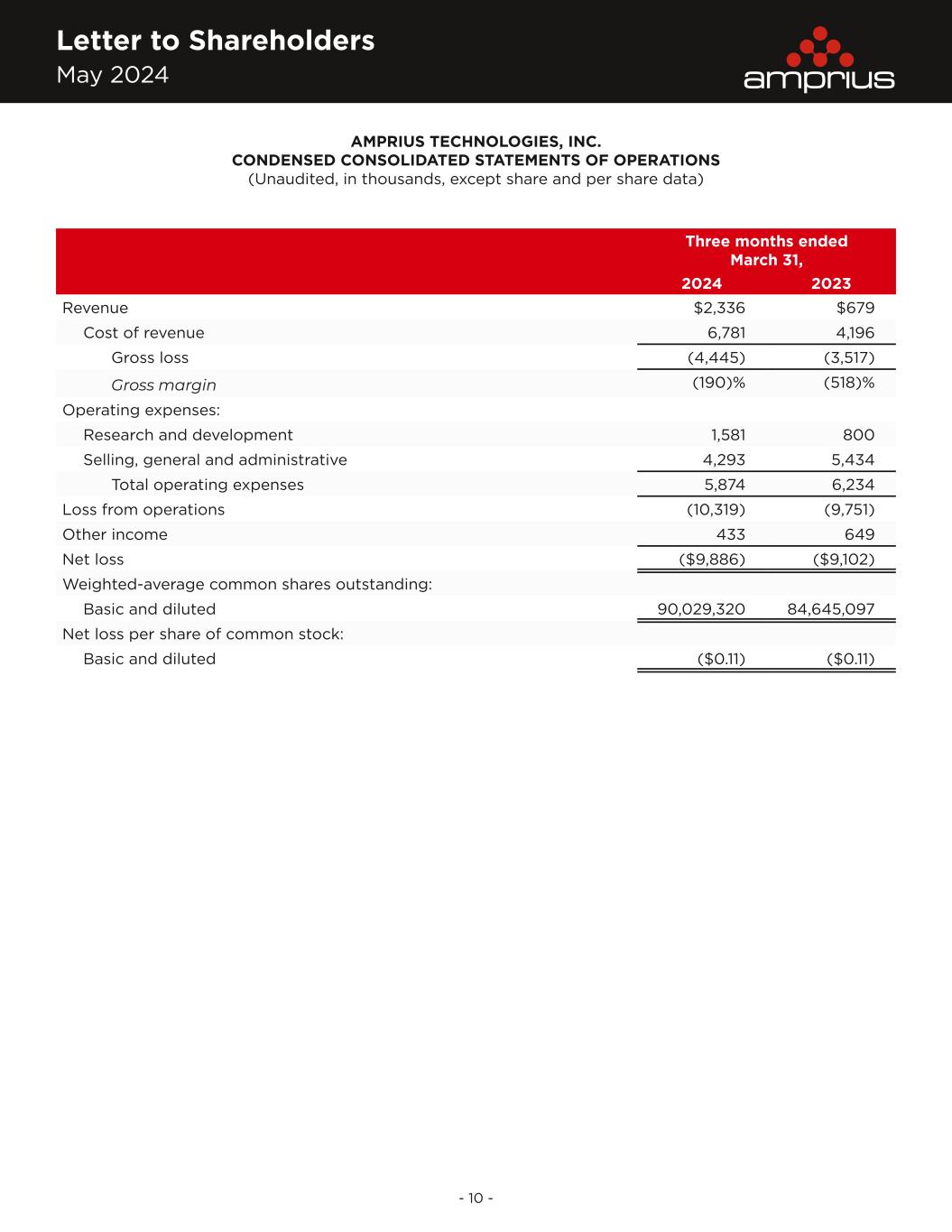

Letter to Shareholders May 2024 - 4 - We believe that these collaborations provide Amprius with opportunities to increase sales and expand market reach and market share in the high-performance battery market segment. Together, these high-profile customers and strategic partnerships have strengthened Amprius’ traction in our industry. Industry Validation Just a few weeks ago, in response to growing global awareness of our batteries, Amprius hosted its first Taiwan Battery Forum, where over 100 attendees from industry-leading companies and institutions learned about Amprius’ breakthrough battery technologies and partnership opportunities. Also, in April, Amprius was honored with the Inaugural CleanTech Battery Company of the Year award by the market intelligence and research group Tech Breakthrough. This comes on the heels of Amprius’ nomination to Fast Company’s annual list of the world’s most innovative companies, another point of recognition for our business. While we have long believed that our products are yet to be matched at the commercial level, we are proud that the industry is taking notice as well. It is clear that our recent customer expansion and new industry recognition signal a strong start to 2024 for Amprius. We are working hard to expand our production capacity to meet our sizeable demand, and we are confident in the path forward. Financial Performance We finished the first quarter with $2.3 million in total revenue. As we have previously discussed, our total revenue is the combination of two main revenue streams: product revenue and development services and grants revenue. This quarter, all $2.3 million of our revenue came from our product revenue, representing a 397% increase from the prior year period and a 147% sequential increase. These increases were largely driven by shipments to 82 customers in Q1, doubling our customer count over last quarter. Although our product revenue remains largely driven by customer purchase orders that can arrive at uneven times throughout the year, we have shown consistent new customer growth and diversification in recent quarters. Also, of these customers, only three customers represented greater than 10% of revenue, a testament to our diverse customer base. As we’ve discussed in prior quarters, our development services revenue comes largely from large development programs that are non-recurring in nature. Moving to our profitability metrics, our gross margin was negative 190% for the quarter, compared to negative 518% in the prior year period and negative 98% in Q4 of 2023. As a reminder, we see significant gross margin variation as our product and services revenue mix fluctuates. Also, we anticipated that factory start-up costs would ramp up for Colorado design and pre-construction, and still expect this to be the case through at least 2024. Longer term, we are confident that our GAAP gross margin will begin to normalize as we approach our capacity expansion goals. Our operating expenses for the first quarter were $5.9 million, a 6% decrease from the prior year period and flat quarter-over-quarter. This decrease is primarily attributable to a decrease in G&A costs that were offset by investments in R&D and sales.

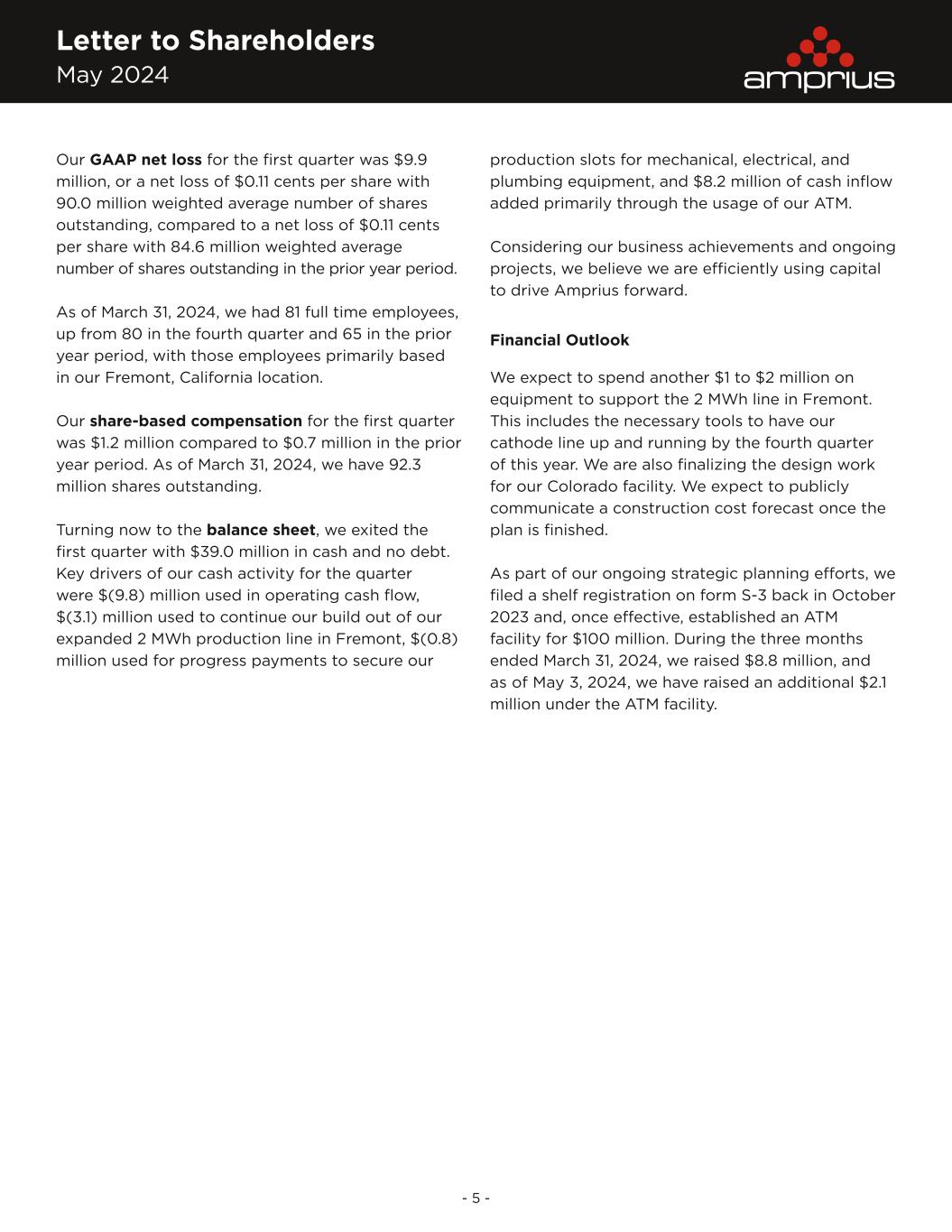

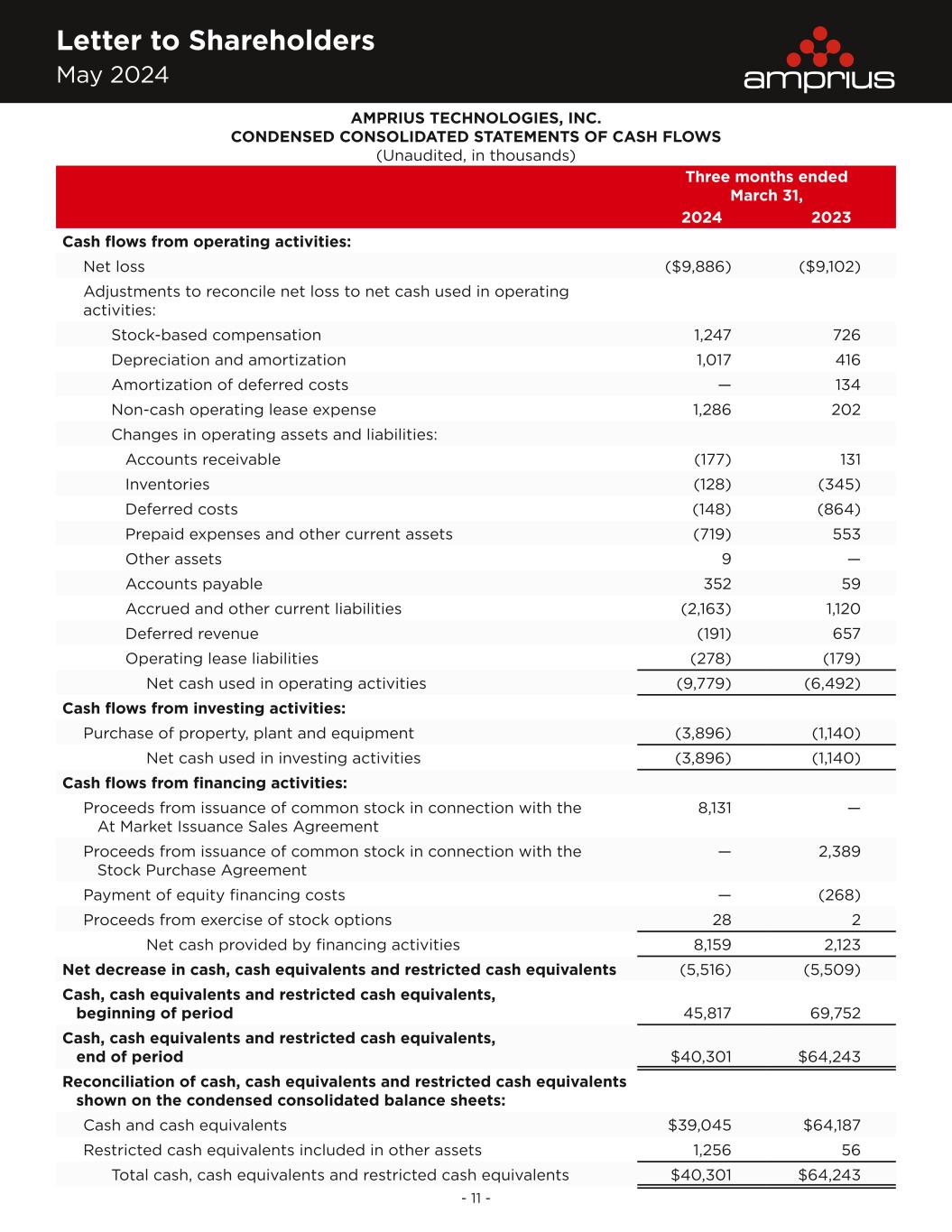

Letter to Shareholders May 2024 - 5 - Our GAAP net loss for the first quarter was $9.9 million, or a net loss of $0.11 cents per share with 90.0 million weighted average number of shares outstanding, compared to a net loss of $0.11 cents per share with 84.6 million weighted average number of shares outstanding in the prior year period. As of March 31, 2024, we had 81 full time employees, up from 80 in the fourth quarter and 65 in the prior year period, with those employees primarily based in our Fremont, California location. Our share-based compensation for the first quarter was $1.2 million compared to $0.7 million in the prior year period. As of March 31, 2024, we have 92.3 million shares outstanding. Turning now to the balance sheet, we exited the first quarter with $39.0 million in cash and no debt. Key drivers of our cash activity for the quarter were $(9.8) million used in operating cash flow, $(3.1) million used to continue our build out of our expanded 2 MWh production line in Fremont, $(0.8) million used for progress payments to secure our production slots for mechanical, electrical, and plumbing equipment, and $8.2 million of cash inflow added primarily through the usage of our ATM. Considering our business achievements and ongoing projects, we believe we are efficiently using capital to drive Amprius forward. Financial Outlook We expect to spend another $1 to $2 million on equipment to support the 2 MWh line in Fremont. This includes the necessary tools to have our cathode line up and running by the fourth quarter of this year. We are also finalizing the design work for our Colorado facility. We expect to publicly communicate a construction cost forecast once the plan is finished. As part of our ongoing strategic planning efforts, we filed a shelf registration on form S-3 back in October 2023 and, once effective, established an ATM facility for $100 million. During the three months ended March 31, 2024, we raised $8.8 million, and as of May 3, 2024, we have raised an additional $2.1 million under the ATM facility.

Letter to Shareholders May 2024 - 6 - Summary As we look to the rest of the year, our strategy and focus here at Amprius remains unchanged and our distinct advantages relative to other battery manufacturers are still intact. Amprius continues to have: 1. Unmatched technical and product performance — With the combination of safety, energy, power, charging time, and temperature performance, we believe that Amprius batteries are ideally positioned for the electric mobility market. 2. Years of product commercialization experience endorsed by industry leaders — Amprius batteries are commercially available today, and we have been shipping since 2018. This quarter, we doubled the number of customers who received shipments, including our normal repeat customers as well as over 50 new customers, a testament to our robust demand pipeline. 3. Proven manufacturability, with a pathway to higher volume manufacturing capacity — We are actively scaling our manufacturing capacity through building our own production capacities and partnering with toll manufacturers. With our ramp underway in Fremont, our design process moving forward in Brighton, and signed partnerships with additional toll manufacturing partners in place, we remain on track to deliver expanded production capacities to fulfill market demand. We are looking forward to several exciting milestones over the rest of the year: • We expect to fully optimize our SiMaxx mass production process and ramp up production to a 2 MWh run rate exiting the year at our Fremont facility. This will represent a 10x increase in our production levels that we had exiting 2023 to support our customer demand. • We intend to take advantage of the hundreds of MWhs of new SiCore product availability from our toll manufacturing agreements to reach more new customers and expand our current customer engagements. • During the summer, we plan to deliver the 100 Ah EV form factor cell to the US Advanced Battery Consortium (USABC) as part of our grant program. • We are in the process of finalizing the design plans and are excited to begin the planning of our gigawatt-scale facility in Brighton, Colorado. • We continue to bring to market new and innovative products that push the boundaries of what is possible for our industry. As part of this, we look forward to commercializing our 500 Wh/kg SiMaxx cells later this year.

Letter to Shareholders May 2024 - 7 - Quarterly Conference Call and Webcast: Date: Thursday, May 9, 2024 Time: 5:00 PM ET (2:00 PM PT) Toll-Free Number: 866-424-3442 International Number: +1-201-689-8548 Webcast: Register and Join Dr. Kang Sun, CEO Sandra Wallach, CFO We have a tremendous opportunity ahead, with a product portfolio that positions us to both grow in the aviation market and expand to other industries seeking batteries with leading performance. Our demand pipeline is robust, with opportunities in the coming years that include the $1.25 billion conformal wearable battery market by 2030, the $33 billion aviation battery market by 2030, and the $509 billion EV battery market by 2033, all of which are part of Amprius’ growth initiatives in the coming years. We truly believe that we are on the path to making our technology mainstream for these markets. 2024 has been very productive for the company thus far. We look forward to continuing to deliver what we have planned in the year ahead. Thank you for your continued support of Amprius Technologies. Best,

Letter to Shareholders May 2024 - 8 - Forward-Looking Statements This Letter to Shareholders includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Amprius’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding future product commercialization and delivery, the ability of Amprius to serve more customers and bring in additional revenue, the timing and ability of Amprius to expand the manufacturing capacity of its Fremont facility and the manufacturing capacity of its Fremont facility exiting 2024, the timing and ability of Amprius to implement SiMaxx cathode production at its Fremont facility, the amount of additional equipment expenditures for its Fremont facility, the timing and ability of Amprius to start the construction of and build a large-scale manufacturing facility and expand its manufacturing capacity, the production lines at the Brighton facility, the ability of Amprius to publicly communicate a construction cost forecast for its Brighton facility, factory start-up costs for the Brighton facility, the capacity of Amprius’ toll manufacturing partners with respect to SiCore batteries, the ability of Amprius to secure additional customer commitments, Amprius’ ability to meet customer demands with SiCore batteries, the addressable market for Amprius’ batteries, the potential application and performance of Amprius’ batteries, Amprius’ liquidity position, and Amprius’ financial and business performance. These statements are based on various assumptions, whether or not identified in this letter, and on the current expectations of Amprius’ management and are not predictions of actual performance. These forward-looking statements are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Amprius’ control. These forward-looking statements are subject to a number of risks and uncertainties, including market demands for SiCore batteries; the ability of Amprius to deliver high performance products to customers at acceptable prices and meet their demands via the toll manufacturing arrangements; Amprius’ ability to reduce costs as it scales production; delays in permitting, construction and operation of production facilities; Amprius’ ability to commercially produce its high performing batteries; third-party producers of Amprius batteries continuing to produce such batteries in the expected quantities and caliber and at the expected prices; Amprius’ customers continuing to purchase batteries directly from Amprius; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius’ products; the risk that Amprius’ high volume tools do not achieve sufficient quality or yield or that its manufacturing process does not meet cost targets; Amprius’ liquidity position and its ability to raise additional capital; and changes in domestic and foreign business, market, financial, political and legal conditions. For more information on these risks and uncertainties that may impact the operations and projections discussed herein can be found in the documents Amprius filed from time to time with the SEC, all of which are available on the SEC’s website at www.sec.gov. If any of these risks materialize or Amprius’ assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this letter. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this letter. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.

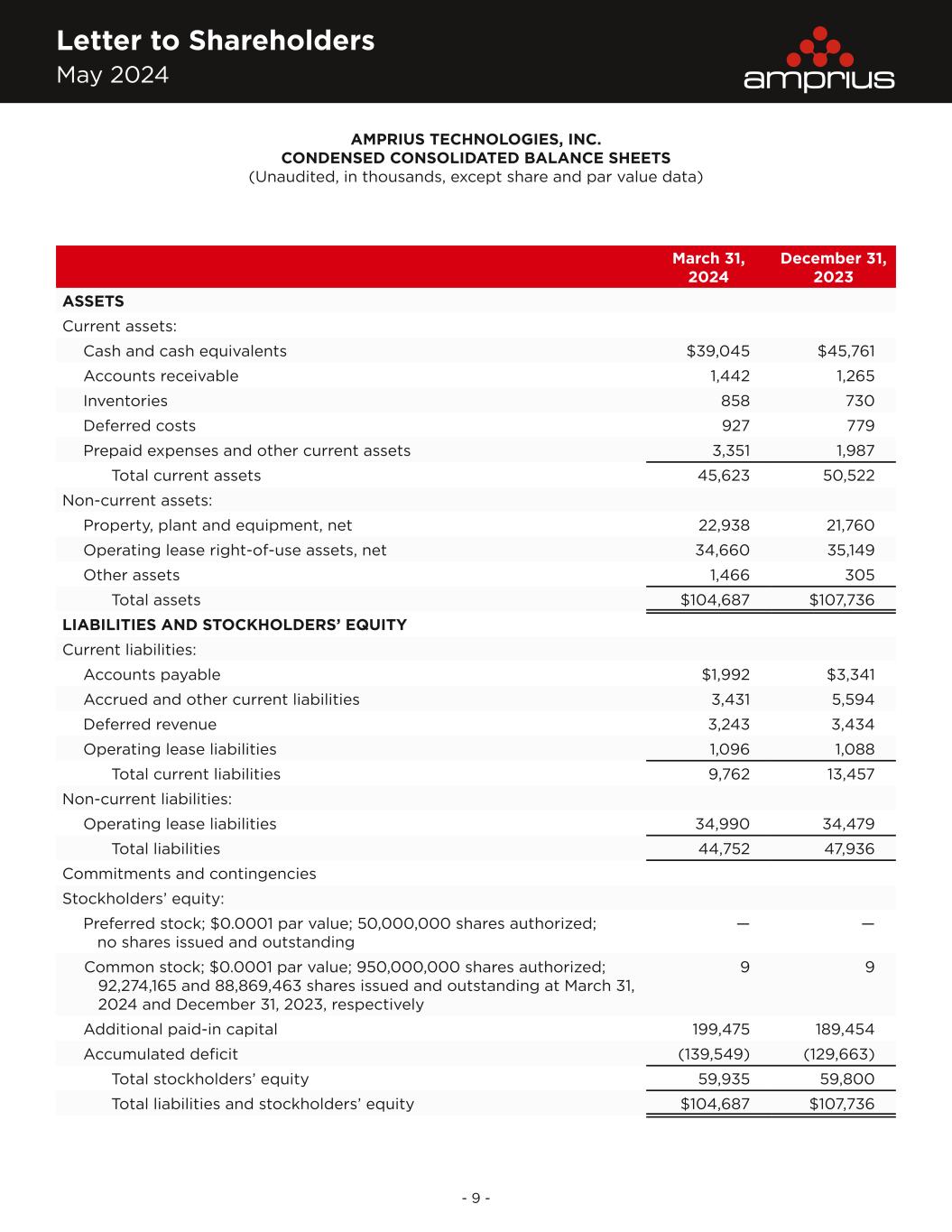

Letter to Shareholders May 2024 - 9 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited, in thousands, except share and par value data) March 31, 2024 December 31, 2023 ASSETS Current assets: Cash and cash equivalents $39,045 $45,761 Accounts receivable 1,442 1,265 Inventories 858 730 Deferred costs 927 779 Prepaid expenses and other current assets 3,351 1,987 Total current assets 45,623 50,522 Non-current assets: Property, plant and equipment, net 22,938 21,760 Operating lease right-of-use assets, net 34,660 35,149 Other assets 1,466 305 Total assets $104,687 $107,736 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $1,992 $3,341 Accrued and other current liabilities 3,431 5,594 Deferred revenue 3,243 3,434 Operating lease liabilities 1,096 1,088 Total current liabilities 9,762 13,457 Non-current liabilities: Operating lease liabilities 34,990 34,479 Total liabilities 44,752 47,936 Commitments and contingencies Stockholders’ equity: Preferred stock; $0.0001 par value; 50,000,000 shares authorized; no shares issued and outstanding — — Common stock; $0.0001 par value; 950,000,000 shares authorized; 92,274,165 and 88,869,463 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively 9 9 Additional paid-in capital 199,475 189,454 Accumulated deficit (139,549) (129,663) Total stockholders’ equity 59,935 59,800 Total liabilities and stockholders’ equity $104,687 $107,736

Letter to Shareholders May 2024 - 10 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in thousands, except share and per share data) Three months ended March 31, 2024 2023 Revenue $2,336 $679 Cost of revenue 6,781 4,196 Gross loss (4,445) (3,517) Gross margin (190)% (518)% Operating expenses: Research and development 1,581 800 Selling, general and administrative 4,293 5,434 Total operating expenses 5,874 6,234 Loss from operations (10,319) (9,751) Other income 433 649 Net loss ($9,886) ($9,102) Weighted-average common shares outstanding: Basic and diluted 90,029,320 84,645,097 Net loss per share of common stock: Basic and diluted ($0.11) ($0.11)

Letter to Shareholders May 2024 - 11 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, in thousands) Three months ended March 31, 2024 2023 Cash flows from operating activities: Net loss ($9,886) ($9,102) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 1,247 726 Depreciation and amortization 1,017 416 Amortization of deferred costs — 134 Non-cash operating lease expense 1,286 202 Changes in operating assets and liabilities: Accounts receivable (177) 131 Inventories (128) (345) Deferred costs (148) (864) Prepaid expenses and other current assets (719) 553 Other assets 9 — Accounts payable 352 59 Accrued and other current liabilities (2,163) 1,120 Deferred revenue (191) 657 Operating lease liabilities (278) (179) Net cash used in operating activities (9,779) (6,492) Cash flows from investing activities: Purchase of property, plant and equipment (3,896) (1,140) Net cash used in investing activities (3,896) (1,140) Cash flows from financing activities: Proceeds from issuance of common stock in connection with the At Market Issuance Sales Agreement 8,131 — Proceeds from issuance of common stock in connection with the Stock Purchase Agreement — 2,389 Payment of equity financing costs — (268) Proceeds from exercise of stock options 28 2 Net cash provided by financing activities 8,159 2,123 Net decrease in cash, cash equivalents and restricted cash equivalents (5,516) (5,509) Cash, cash equivalents and restricted cash equivalents, beginning of period 45,817 69,752 Cash, cash equivalents and restricted cash equivalents, end of period $40,301 $64,243 Reconciliation of cash, cash equivalents and restricted cash equivalents shown on the condensed consolidated balance sheets: Cash and cash equivalents $39,045 $64,187 Restricted cash equivalents included in other assets 1,256 56 Total cash, cash equivalents and restricted cash equivalents $40,301 $64,243