EX-99.1

Published on August 8, 2024

LETTER TO SHAREHOLDERS Q2 2024 March 2023 Exhibit 99.1

Letter to Shareholders August 2024 - 1 - Amprius’ high-performance battery families, SiMaxxTM and SiCoreTM, have attracted significant market attention and customer demand. The company’s priority today is to build additional manufacturing capacity to meet this significant customer demand for our products. Disruptive Technology Advancements As we strive to expand the possibilities for the high-performance battery market, improving our industry-leading technology remains at the heart of our strategy. In the second quarter, we continued innovating to transform the electric mobility sector. The launch of our SiCore batteries in January has been received quite positively by our customer base and attracted new orders from existing as well as new strategic market segments. Company Overview Amprius develops, manufactures, and markets high- energy density and high-power density batteries with applications across all segments of electric mobility, including the aviation and EV industries. When it comes to battery performance, Amprius’ silicon anode batteries command a firm leading position in the industry. Amprius’ portfolio of batteries delivers: • 450 Wh/kg specific energy density and 1,150 Wh/L volumetric energy density, available commercially since early 2022 • 500 Wh/kg, 1,300 Wh/L battery platform, which will be available for commercial delivery later this year • Up to 10C continuous power capability and balanced high-energy and high-power designs; • An extreme fast charge rate of 0-80% state of charge in about six minutes • A wide operating temperature range of -30°C up to 55°C • Safety design features that enable us to pass the United States military’s benchmark nail penetration test Amprius has been in commercial battery production since 2018, and it is our belief that there are no other commercial batteries on the market that can perform at these levels today. Fellow Shareholders, The second quarter was a strong finish to the first half of the year for Amprius. We successfully delivered new high-performance batteries to the market, expanded our manufacturing capabilities, and engaged with new customers and market segments. With that, we are pleased to share our financial results and operational highlights with you below.

Letter to Shareholders August 2024 - 2 - Post-launch, we’ve seen continued demand for SiCore batteries in aviation, electric transportation, and other industrial applications. Amprius has recently further optimized our cell chemistry and designs, allowing us to deliver batteries with enhanced performance to the market. One of the high-performance batteries that we’ve introduced is the Amprius SA11. This energy and power-balanced battery is based on Amprius’ SiCore cell chemistry. The 30Ah battery cell offers 350 Wh/kg energy density with 700 cycles. We designed the performance and cell format specifically for demanding electric mobility applications, such as the eVTOL and drone markets. Another exciting battery product we delivered in the second quarter is the Amprius SA17, a 21700 cell. The SA17 is the highest energy density cylindrical battery of this format known in the industry. Following the success of our 18650 battery profile that was released in January, we created this larger capacity version cylindrical battery. The SA17 offers 6Ah energy, providing customers with a drop-in replacement for those that currently use 21700 5Ah batteries. With these new capabilities, we can further target applications in the micromobility sector, including two-wheel vehicles like scooters and e-bikes, as well as other use cases in aviation and industrial equipment. With these new additions, we now have 14 SKUs commercially available in our product portfolio. Amprius’ battery offerings cover the entire performance map of our customers’ commercial application needs: energy, power, cycle life, charging time and more. The combination of Amprius SiMaxx and SiCore platforms have enabled us to tailor our cell chemistries for expanding customer requirements. Both Amprius SiMaxx and SiCore batteries can be a high-energy and high-power solution for EVs. This quarter we made material progress towards delivering the 100Ah EV form factor battery cell to the United States Advanced Battery Consortium (USABC). The cell we have developed will meet or exceed all 2023 USABC LCFC EV cell characteristics, including exceptional fast charge performance and usable energy in a low-cost battery solution. This development was conducted as part of a $3 million cost sharing contract from the USABC in collaboration with the United States Department of Energy. Continued Commercial Success Amprius’ high-performance batteries have continued to garner strong feedback from customers in various market segments. In many cases, Amprius batteries are the only known commercially available batteries that meet customers’ requirements in technical performance

Letter to Shareholders August 2024 - 3 - and application economics, making us an essential component of their supply chain. In Q2, we shipped to 56 customers. Of these, 24 were new customers across the electric mobility sector, complementing strong, repeat, volume orders from our longtime partners such as AeroVironment, Teledyne FLIR, Kraus Hamdani, and BAE Systems. This combination of two dozen new customers and volume shipments to returning customers allowed us to double our quarterly revenue compared to Q2 last year. Geographically, we recorded a 41% year-over-year increase in shipments within the United States and a robust 271% increase in shipments to the rest of the world. With these improvements, we recorded 50% of total revenue in the second quarter from outside of the United States. Looking at forward demand, we logged $7.6 million in new sales orders during the quarter, which translated to a 32% increase in our net backlog at the end of Q2 2024 versus Q1 2024. During the quarter we also secured an additional order from longtime customer AALTO/Airbus. Based on order size and timing, Amprius will now be delivering SiMaxx 450 Wh/kg high-energy battery cells to AALTO/Airbus through 2025. These battery cells will continue to supply the necessary power and endurance for AALTO/Airbus’ Project Zephyr stratospheric flight operations. In Q2, we also entered into three different partnerships with leading pack designers and manufacturers. These partnerships are critical as they allow us to broaden our sales reach and offer our next-generation batteries to each manufacturer’s respective customer base. Manufacturing Capacity Expansion With the increase in customer orders, we have continued to focus on increasing our manufacturing throughput. In Q2, we took several steps forward to expand our production capacity for both SiMaxx and SiCore products. For SiCore, we currently have three well-equipped and experienced large-scale manufacturing partners in Asia providing over 500 MWh of production capacity across both pouch and cylindrical battery cells. This strategy provides Amprius with access to approximately 10 million pouch cells and 125 million cylindrical cells annually. These agreements provide us with mass global production capacity and ensure that we can deliver our products in a timely manner while maintaining the quality our customers expect. More importantly, the contract manufacturing partnership model allows us to eliminate upfront capital expenditures while ensuring immediate capacity to accelerate our sales. We have also made important progress on our large-scale manufacturing site in Brighton, Colorado. We have now completed roughly 60% of the Credit: AALTO/Airbus

Letter to Shareholders August 2024 - 4 - construction design drawings and specifications for the facility. We remain on track from a regulatory standpoint, having recently submitted our site plan and advanced all other regulatory plans and applications for the facility. As we previously discussed, the initial production line in Colorado will be focused on SiCore manufacturing given the more immediate opportunities we’ve identified for the SiCore platform and specifically from customers requesting a U.S.-based supply chain. We also continue to make important progress to ramp up our facility in Fremont, California. In the second quarter, we completed the qualification process for our centrotherm machine, which is used in the silicon anode fabrication process. Looking further ahead, we remain on pace to scale our Fremont production rate by the end of the year to up to 2 MWh. This plan includes implementing SiMaxx cathode production in-house to streamline our manufacturing process. We expect to have this process up and running in Fremont later this year as well. Industry Recognition The breakthrough performance of Amprius batteries has continued to gain recognition from the battery industry: • Fast Company named our 500 Wh/kg battery as a finalist in its 2024 ‘Innovation by Design Awards’ in the Impact category. The award takes into account traits such as functionality, originality, sustainability, cultural impact and more. We are thrilled to have repeatedly received recognition from Fast Company for our next-generation technology and to be listed among other leading companies in the industry. • Amprius was also recently recognized by the CleanTech Breakthrough Awards as the ‘Battery Technology Company of the Year’ in its inaugural event. These awards aim to recognize the world’s best companies, products, and services in the energy, climate and clean technology industries. • Invited by the Taiwan Battery Association, Amprius hosted its first Amprius Battery Forum in Taiwan in April, where over 100 attendees from industry-leading companies and institutions learned about Amprius’ breakthrough silicon anode battery technologies and partnership opportunities. The forum received significant interest from potential customers, industry partners, and the Taiwan investment community. • We are pleased to also share that Amprius batteries were responsible for powering the University of Michigan’s solar car to a first-place finish in the American Solar Challenge. We’ve greatly enjoyed our ongoing participation in the American Solar Challenge as well as our partnership with the University of Michigan’s solar car team and look forward to continuing our involvement in this great program. Expanded production facility in Fremont, CA

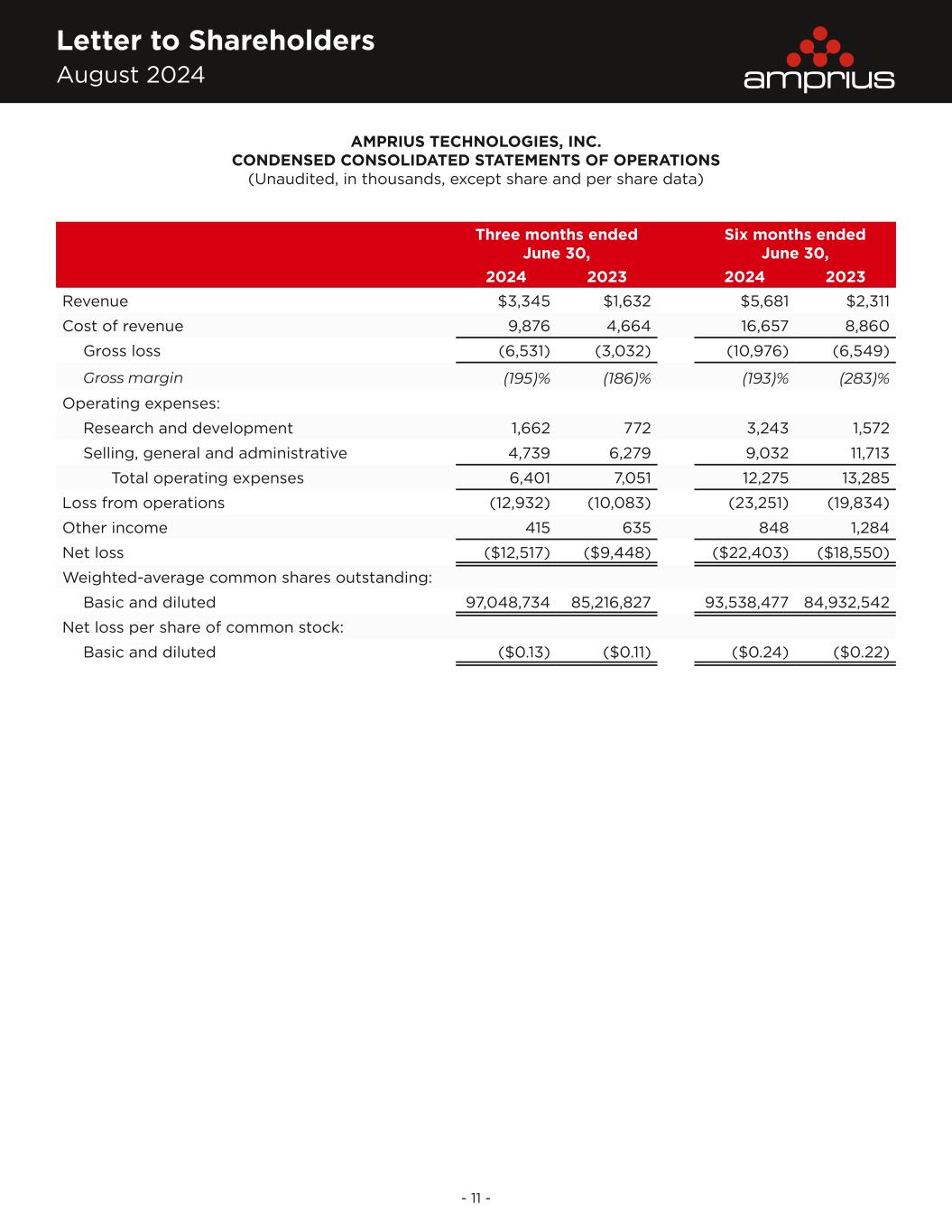

Letter to Shareholders August 2024 - 5 - Sustaining Momentum into Q3 The momentum we built to begin the year has propelled into the start of the second half of 2024. Recently, we were awarded a $1.9 million contract from the U.S. Army’s xTechPrime program to develop a large form factor 500 Wh/kg SiMaxx high-energy cell for electric mobility applications in the defense sector. The recognition of this breakthrough technology by the U.S. military opens much broader applications for our 500 Wh/Kg battery that is available only from Amprius today. We believe we are poised for a strong second half of the year thanks to our increasing sales outlook, growing customer engagements, expanded product portfolio, and the increase in high-volume manufacturing capacity. We are working hard to execute our goals and expect to continue our momentum through 2024 leading to a great 2025. Financial Performance We finished the second quarter with $3.3 million in total revenue, which is typically composed of our main revenue streams: product revenue and development services and grants revenue. All $3.3 million in Q2 came from product revenue. Our development services revenue comes from development programs that are non-recurring in nature. On a sequential, quarter-over-quarter basis, product revenue increased $1.0 million, or 43%, and compared to the prior year, revenue increased $1.7 million, or 105%. These increases were driven by shipments to 56 customers in the quarter. Although our product revenue remains largely driven by customer purchase orders that can arrive at uneven times throughout the year, we have shown consistent new customer growth and diversification in recent quarters. As noted earlier, 24 of the 56 customers this quarter were new customers. Also, just three customers this quarter represented greater than 10% of revenue, consistent with three in Q1 2024 and down from five in the same period last year. Going forward, we plan to continue adding to our customer mix to diversify our revenue streams and provide more reliable product output as we get to a position of scale. Moving to our profitability metrics, our gross margin was negative 195% for the quarter, compared to negative 190% in Q1 of 2024 and negative 186% in the prior year period. As a reminder, we see significant gross margin variation as our product and services revenue mix fluctuates. Also, our gross margin continues to be impacted by pre-construction costs related to the Colorado facility and facility lease costs which started June 1, 2024. Longer term, we are confident that our GAAP gross margin will begin to normalize as we approach our capacity expansion goals. Our operating expenses for the second quarter were $6.4 million, an increase of $0.5 million, or 9%, compared to Q1 2024, and a decrease of $0.7 million, or 9%, from the prior year period. The sequential quarter increase was driven by G&A and stock-based compensation increases. The year-over- year decrease is primarily attributable to reductions in G&A costs that were partially offset by investment in R&D and sales. Our GAAP net loss for the second quarter was $12.5 million, or a net loss of $0.13 cents per share, with 97.0 million weighted average number of shares outstanding. In Q1 2024, net loss was negative $0.11 cents per share with 90.0 million weighted average number of shares outstanding, and in Q2 2023 net loss was also negative $0.11 cents per share with

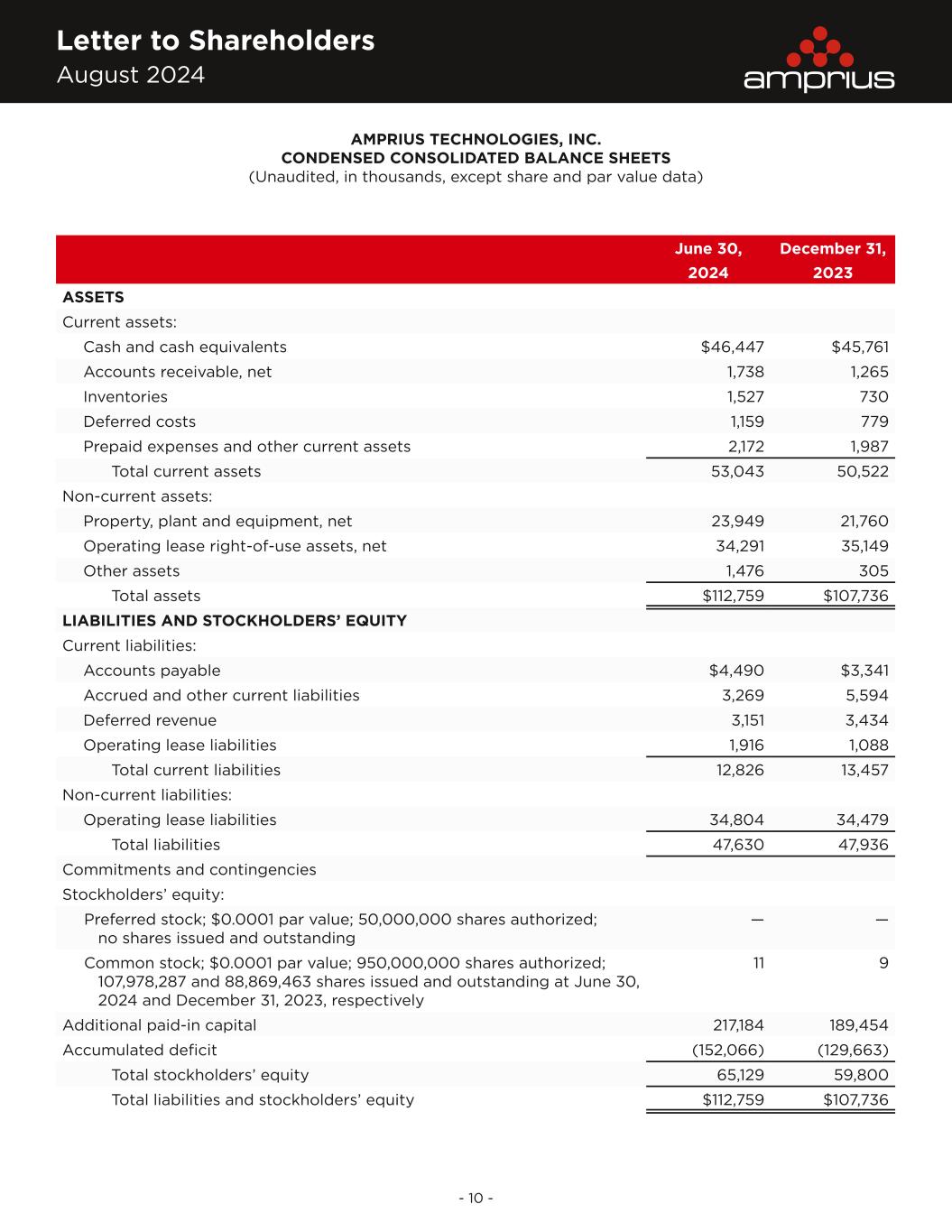

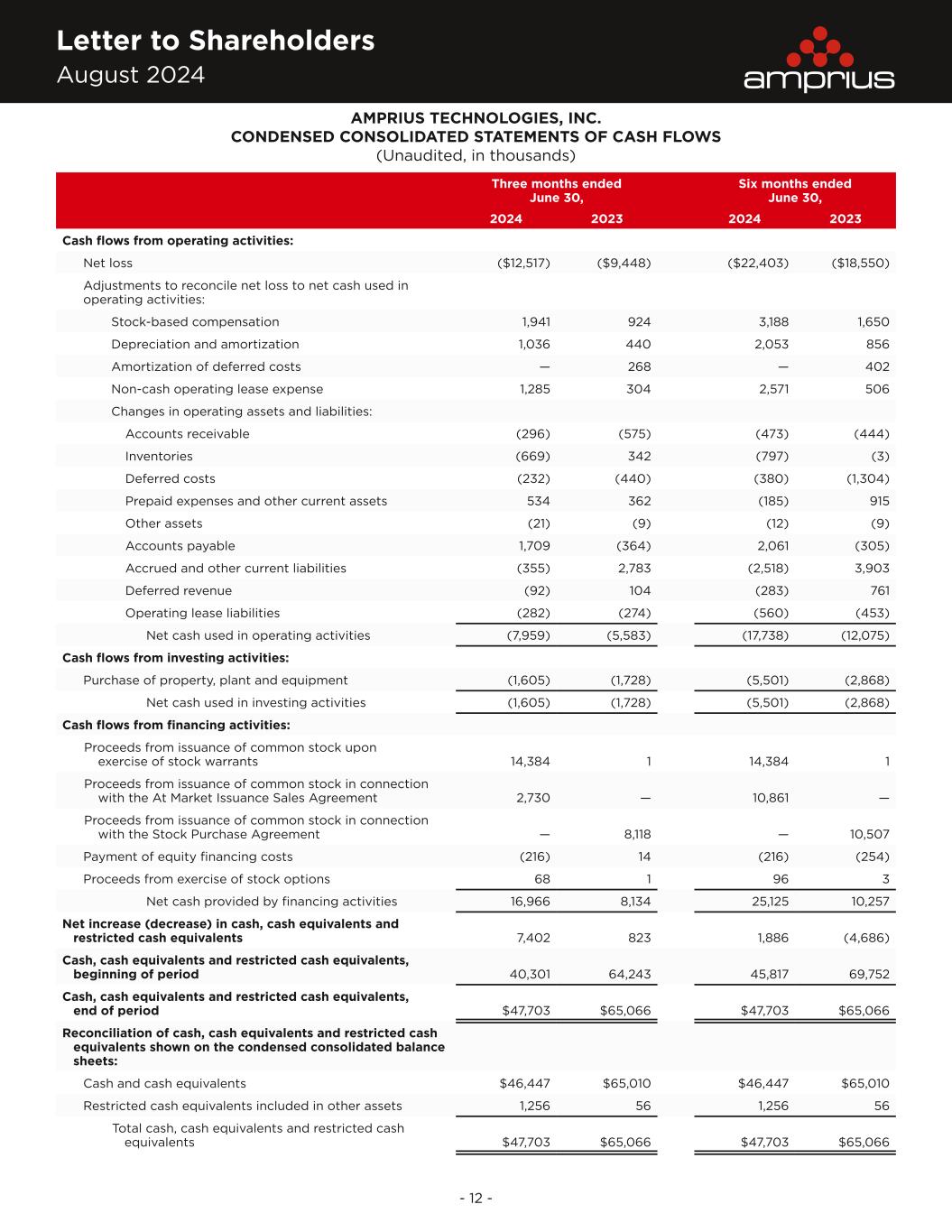

Letter to Shareholders August 2024 - 6 - 85.2 million weighted average number of shares outstanding. As of June 30, 2024, there were 88 full time employees, up from 81 in the first quarter and 72 in the prior year period, with those employees primarily based in our Fremont, California location. Our share-based compensation for the second quarter was $1.9 million compared to $1.2 million in Q1 and $0.9 million in the prior year period. As of June 30, 2024, we had 108.0 million shares outstanding, which was up 15.7 million from the prior quarter and primarily related to the recent work we’ve done to clean up our capitalization table. During the second quarter, we initiated a tender offer which provided a temporary repricing of our private and public warrants where we were able to reduce the number of warrants outstanding from approximately 47.7 million to approximately 34.6 million. As of August 8, 2024, we have closed a second tender offer to allow cashless exercise of the private warrants which resulted in the extinguishment of 15.6 million of the 15.9 million total outstanding in exchange for the issuance of 3.1 million shares of common stock. In total, more than 60% of the original warrants are no longer outstanding. Turning now to the balance sheet, we exited the second quarter with $46.4 million in net cash and no debt. Compared to Q1, we recorded a net increase of $7.4 million in cash. Key drivers of our cash activity for the quarter were: • $17.0 million of cash inflow added with $14.2 million netted from the exercise of cash-based warrants and $2.8 million of cash inflow added primarily through the usage of our ATM • $(8.0) million used in operating cash flow. We continue to remain lean with a $2.0 to $2.5 million run rate per month, excluding transaction related costs • $(1.6) million used to continue the build out of our expanded 2 MWh production line in Fremont and move our Brighton, Colorado facility forward Considering our business achievements and ongoing projects, we believe we are efficiently using capital to drive Amprius forward. Financial Outlook We expect to spend another $1 to $2 million on equipment to support the up to 2 MWh line in Fremont. This includes the necessary tools to have our cathode line up and running by the fourth quarter of this year. We’re also finalizing the pre-construction work for our Colorado facility. The first line will be for SiCore manufacturing, allowing us to use conventional, off- the-shelf processes which will help us provide a high confidence schedule and cost. The total facility will have room to accommodate 3-5GWh’s of capacity to support both SiMaxx and SiCore production. The construction scope and schedule for the facility will be determined by the final design and the availability and timing of funding. We are paying close attention to the larger industry dynamics. Changes in demand, supply, battery cost structure, government incentives, trade tariffs, and other considerations would also influence our decision. To support our strategic plan, we are regularly evaluating our capital resources including sources of funding that provide the optimal cost of capital for our current production needs. These sources include both equity issuances, such as sales under our ATM or warrant exercises, and non-dilutive sources, such as grants, loans and incentives.

Letter to Shareholders August 2024 - 7 - Summary As we look ahead, our strategy at Amprius remains unchanged. Our top priorities are innovating in next- generation batteries, growing our customer base, and scaling our manufacturing capabilities. Amprius continues to have: 1. Unmatched technical and product performance – With our cells’ combination of safety, energy, power, charging time, and temperature performance, we believe that Amprius batteries command a firm lead and are ideally positioned for the electric mobility market. 2. Years of product commercialization experience endorsed by industry leaders – Amprius batteries are commercially available today, and we have been shipping since 2018. This quarter alone we shipped to over 56 customers. As we continue to expand our portfolio of offerings to meet a greater range of use cases, we expect significantly more traction with customers. 3. Proven manufacturability and expanded production capacity – We have developed contract manufacturing capacities that support over 10 million pouch battery cells and 125 million cylindrical cells annually. We are also expanding our Fremont production capacity for SiMaxx battery production and finalizing our design process for our gigawatt factory in Colorado. We are looking forward to several exciting milestones over the rest of the year: • We expect to fully optimize our SiMaxx production process and ramp up production up to a 2 MWh run rate exiting the year at our Fremont facility. This will represent a ten-fold increase in our production levels that we had exiting 2023 and give us additional capacity coming online through 2025. We intend to use this expanded capacity to continue growing our new customer order book as well as move existing strategic customers down the technical-to-commercial validation process for the SiMaxx platform. • We look forward to bringing on additional new customer segments and expanding applications with our current customers as we leverage our unmatched performance and the hundreds of MWhs of SiCore production capacity through our contract manufacturing partnerships that are in place today. • We also expect to finalize the design plans and permitting for our Brighton, Colorado facility which will include SiCore as the first line. • We will deliver the 100Ah EV form factor cell to the USABC as part of our grant program in the coming weeks. This will mark a major milestone and a practical step for Amprius as we move into the EV market. • We continue to bring to market new and innovative products that push the boundaries of what is possible for our industry. As part of this, we look forward to commercializing our 500 Wh/kg SiMaxx cells later this year.

Letter to Shareholders August 2024 - 8 - Quarterly Conference Call and Webcast: Date: Thursday, August 8, 2024 Time: 5:00 PM ET (2:00 PM PT) Toll-Free Number: 888-428-7458 International Number: +1-862-298-0702 Webcast: Register and Join Dr. Kang Sun, CEO Sandra Wallach, CFO We believe that the opportunity in front of Amprius is tremendous. We have what we believe are the best performing commercial batteries in the industry. We have hundreds of MWhs of production capacity available to us, and we have a strong customer portfolio and pipeline. As we have demonstrated, we will execute according to plan and continue delivering results. We look forward to carrying our momentum from the first half of the year into the rest of 2024 and delivering on our objectives. Thank you for your continued support of Amprius Technologies. Best,

Letter to Shareholders August 2024 - 9 - Forward-Looking Statements This Letter to Shareholders includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Amprius’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding future product commercialization and delivery, the ability of Amprius to serve more customers, bring in additional revenue and expand applications, the timing and ability of Amprius to expand the manufacturing capacity of its Fremont facility and the manufacturing capacity of its Fremont facility exiting 2024, the timing and ability of Amprius to implement SiMaxx cathode production at its Fremont facility, the amount of additional equipment expenditures for its Fremont facility, the timing and ability of Amprius to finalize the design plans and permitting for its Brighton facility, the production lines and capacity at the Brighton facility, the capacity of Amprius’ toll manufacturing partners with respect to SiCore batteries, the benefits to partner with pack designers and manufacturers, the ability of Amprius to secure additional customer commitments, Amprius’ ability to meet customer demands with SiCore batteries, the addressable market for Amprius’ batteries, the potential application and performance of Amprius’ batteries, the ability of Amprius to move into the EV market, Amprius’ liquidity position, and Amprius’ financial and business performance. These statements are based on various assumptions, whether or not identified in this letter, and on the current expectations of Amprius’ management and are not predictions of actual performance. These forward-looking statements are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Amprius’ control. These forward-looking statements are subject to a number of risks and uncertainties, including market demands for SiCore batteries; the ability of Amprius to deliver high performance products to customers at acceptable prices and meet their demands via the toll manufacturing arrangements; Amprius’ ability to reduce costs as it scales production; delays in permitting, construction and operation of production facilities; Amprius’ ability to commercially produce its high performing batteries; third-party producers of Amprius batteries continuing to produce such batteries in the expected quantities and caliber and at the expected prices; Amprius’ customers continuing to purchase batteries directly from Amprius; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius’ products; the risk that Amprius’ high volume tools do not achieve sufficient quality or yield or that its manufacturing process does not meet cost targets; Amprius’ liquidity position and its ability to raise additional capital; and changes in domestic and foreign business, market, financial, political and legal conditions. For more information on these risks and uncertainties that may impact the operations and projections discussed herein can be found in the documents Amprius filed from time to time with the SEC, all of which are available on the SEC’s website at www.sec.gov. If any of these risks materialize or Amprius’ assumptions prove incorrect, actual results could differ materially from the results implied by these forward- looking statements. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this letter. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this letter. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.

Letter to Shareholders August 2024 - 10 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited, in thousands, except share and par value data) June 30, December 31, 2024 2023 ASSETS Current assets: Cash and cash equivalents $46,447 $45,761 Accounts receivable, net 1,738 1,265 Inventories 1,527 730 Deferred costs 1,159 779 Prepaid expenses and other current assets 2,172 1,987 Total current assets 53,043 50,522 Non-current assets: Property, plant and equipment, net 23,949 21,760 Operating lease right-of-use assets, net 34,291 35,149 Other assets 1,476 305 Total assets $112,759 $107,736 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $4,490 $3,341 Accrued and other current liabilities 3,269 5,594 Deferred revenue 3,151 3,434 Operating lease liabilities 1,916 1,088 Total current liabilities 12,826 13,457 Non-current liabilities: Operating lease liabilities 34,804 34,479 Total liabilities 47,630 47,936 Commitments and contingencies Stockholders’ equity: Preferred stock; $0.0001 par value; 50,000,000 shares authorized; no shares issued and outstanding — — Common stock; $0.0001 par value; 950,000,000 shares authorized; 107,978,287 and 88,869,463 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively 11 9 Additional paid-in capital 217,184 189,454 Accumulated deficit (152,066) (129,663) Total stockholders’ equity 65,129 59,800 Total liabilities and stockholders’ equity $112,759 $107,736

Letter to Shareholders August 2024 - 11 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in thousands, except share and per share data) Three months ended June 30, Six months ended June 30, 2024 2023 2024 2023 Revenue $3,345 $1,632 $5,681 $2,311 Cost of revenue 9,876 4,664 16,657 8,860 Gross loss (6,531) (3,032) (10,976) (6,549) Gross margin (195)% (186)% (193)% (283)% Operating expenses: Research and development 1,662 772 3,243 1,572 Selling, general and administrative 4,739 6,279 9,032 11,713 Total operating expenses 6,401 7,051 12,275 13,285 Loss from operations (12,932) (10,083) (23,251) (19,834) Other income 415 635 848 1,284 Net loss ($12,517) ($9,448) ($22,403) ($18,550) Weighted-average common shares outstanding: Basic and diluted 97,048,734 85,216,827 93,538,477 84,932,542 Net loss per share of common stock: Basic and diluted ($0.13) ($0.11) ($0.24) ($0.22)

Letter to Shareholders August 2024 - 12 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, in thousands) Three months ended June 30, Six months ended June 30, 2024 2023 2024 2023 Cash flows from operating activities: Net loss ($12,517) ($9,448) ($22,403) ($18,550) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 1,941 924 3,188 1,650 Depreciation and amortization 1,036 440 2,053 856 Amortization of deferred costs — 268 — 402 Non-cash operating lease expense 1,285 304 2,571 506 Changes in operating assets and liabilities: Accounts receivable (296) (575) (473) (444) Inventories (669) 342 (797) (3) Deferred costs (232) (440) (380) (1,304) Prepaid expenses and other current assets 534 362 (185) 915 Other assets (21) (9) (12) (9) Accounts payable 1,709 (364) 2,061 (305) Accrued and other current liabilities (355) 2,783 (2,518) 3,903 Deferred revenue (92) 104 (283) 761 Operating lease liabilities (282) (274) (560) (453) Net cash used in operating activities (7,959) (5,583) (17,738) (12,075) Cash flows from investing activities: Purchase of property, plant and equipment (1,605) (1,728) (5,501) (2,868) Net cash used in investing activities (1,605) (1,728) (5,501) (2,868) Cash flows from financing activities: Proceeds from issuance of common stock upon exercise of stock warrants 14,384 1 14,384 1 Proceeds from issuance of common stock in connection with the At Market Issuance Sales Agreement 2,730 — 10,861 — Proceeds from issuance of common stock in connection with the Stock Purchase Agreement — 8,118 — 10,507 Payment of equity financing costs (216) 14 (216) (254) Proceeds from exercise of stock options 68 1 96 3 Net cash provided by financing activities 16,966 8,134 25,125 10,257 Net increase (decrease) in cash, cash equivalents and restricted cash equivalents 7,402 823 1,886 (4,686) Cash, cash equivalents and restricted cash equivalents, beginning of period 40,301 64,243 45,817 69,752 Cash, cash equivalents and restricted cash equivalents, end of period $47,703 $65,066 $47,703 $65,066 Reconciliation of cash, cash equivalents and restricted cash equivalents shown on the condensed consolidated balance sheets: Cash and cash equivalents $46,447 $65,010 $46,447 $65,010 Restricted cash equivalents included in other assets 1,256 56 1,256 56 Total cash, cash equivalents and restricted cash equivalents $47,703 $65,066 $47,703 $65,066