EX-99.1

Published on November 7, 2024

LETTER TO SHAREHOLDERS Q3 2024 March 2023 Exhibit 99.1

Letter to Shareholders November 2024 - 1 - Amprius has been in commercial battery production since 2018, and it is our belief that there are no other commercial batteries on the market that can perform at these levels today. Market Opportunity While Amprius high-energy and high-power batteries are for all electric mobility applications, the company is presently serving two large and high-growth segments: aviation and light electric vehicles. Both benefit from our battery performance and present us with an enormous business opportunity. Independent sources, such as Fortune Business Insights and Providence Research Report, project these markets to grow rapidly and exceed $200 billion each by 2032. Company Overview Amprius is a pioneer and a leader in the silicon anode battery space. Amprius develops, manufactures, and markets high-energy density and high-power density batteries with applications across all segments of electric mobility. When it comes to battery performance, Amprius’ silicon anode batteries command a firm leading position in the industry amongst commercially available batteries. Amprius’ portfolio of batteries delivers: • 450 Wh/kg specific energy density and 1,150 Wh/L volumetric energy density, available commercially since early 2022 • 500 Wh/kg, 1,300 Wh/L battery platform, which are expected to be available for delivery later this year • Up to 10C continuous power capability and balanced high-energy and high-power designs • An extreme fast charge rate of 0-80% state of charge in about six minutes • A wide operating temperature range of -30°C up to 55°C • Safety design features that enable us to pass the United States military’s benchmark nail penetration test Fellow Shareholders, The third quarter was record-breaking for Amprius. We more than doubled revenue from the second quarter and engaged with 53 new customers. We expanded our market participation to the light electric vehicle segment, signed two engagements with Fortune 500 industrial leaders, delivered high energy density 360 Wh/kg EV battery cells to industry consortium USABC, and contracted for GWh scale contract manufacturing capacities. With that, we are pleased to share our financial results and operational highlights with you below.

Letter to Shareholders November 2024 - 2 - Our aviation customers include manufacturing OEMs in high altitude pseudo satellites, eVTOLs, electric aircrafts, and various drones from commercial to industrial to military. The light electric vehicle market is quite impressive as well and we discuss our commercial penetration below. We believe we are just at the beginning of the significant expansion of our addressable markets. A significant constraint to growth in these markets is the critical role of battery innovation. At Amprius, we offer solutions to this constraint, and our third quarter results reflect our traction in both the aviation and light electric vehicle industries as customers see the value of our technology. Disruptive Technology Advancements The introduction of Amprius’ SiCore batteries in January has given us a large advantage in the battery space by expanding our offerings. Amprius offers a versatile platform that enables industry leading silicon anode batteries for a variety of customer applications. Today, we offer customers 14 different SKUs that are available in a variety of battery formats and form factors. These cells, which range from 300 Wh/kg to 450 Wh/kg, ensure that we cover a significant portion of our customers’ commercial applications. Amprius batteries offer the best-in-class for energy, power, cycle life, charge time, temperature performance, and safety for electric mobility. Our technology leadership and battery performance are validated by increasing customer purchasing volume. After being awarded a $3 million cost sharing contract from the United States Advanced Battery Consortium (USABC) in collaboration with the United States Department of Energy approximately a year and a half ago, this quarter we successfully delivered the EV cells to them. This is a remarkable technical breakthrough in an important market segment for Amprius. USABC selected Amprius to address some of the most challenging issues experienced by EV users, such as range anxiety and the need for faster charging times. Amprius not only addressed these issues but surpassed many of the initial goals set by the USABC. Amprius EV cells achieved 360 Wh/kg energy density, 1,200 W/kg power density, and a charge to 90% of their rated energy in 15 minutes. Based on initial results, Amprius believes it is making significant strides towards achieving a cycle life of 1,000. We believe our successes pave the way for future engagements with electric vehicle manufacturers. Continued Commercial Success Amprius batteries have become a great attraction in the electric mobility market. In many cases, Amprius batteries are the only known commercially available batteries that meet certain of our customers’ requirements in technical performance and application economics. In the third quarter, we shipped to 94 customers. Of these, 53 were new customers, covering several

Letter to Shareholders November 2024 - 3 - segments of the electric mobility sector. Our year- to-date customer count now stands at over 175. Many of these customers are also longtime partners with repeat, volume purchase orders, including AALTO/Airbus, AeroVironment, Teledyne FLIR, Kraus Hamdani, and BAE Systems. The combination of new customers and volume shipments to returning customers generated $7.9 million in revenue for the third quarter. Our performance in Q3 represents more than double the amount of revenue we generated just last quarter, almost triples what we generated in Q3 last year, and compares to the $9.1 million we generated in all of 2023. The primary driver behind our growth this quarter has been our SiCore product. Since its launch in January, we’ve expanded our contract manufacturing capabilities, enabling us to quickly scale production and deliver large, volume shipments where we have strong demand. The three customer engagements we announced in Q3 are the results of the SiCore platform introduction and contract manufacturing strategy. We believe the high performance of our batteries and the immediate availability of manufacturing capacities will enable us to quickly move customers through the commercial validation process, secure volume purchase commitments, and deliver large quantities of cells to customers. In September, we announced that we received two contracts totaling over $20 million to supply 40 Ah high performance cells for light electric vehicle applications, which we are already shipping. For context, our 40 Ah high performance SiCore batteries are produced at a contract manufacturing facility as soon as the battery and the production lines are qualified by the customers, enabling us to rapidly scale and meet customer demand. We expect to recognize this revenue by mid-2025. In the last few months, we have also signed two separate agreements with Fortune 500 leaders. While we are in the early stage of these projects, both engagements have the potential to greatly expand and become high volume orders from tier- one customers. The first of these contracts is a non-binding letter of intent with a Fortune Global 500 technology OEM to develop a high-energy SiCore cylindrical cell for the light electric vehicle market. This LOI is expected to translate into a commercial supply agreement that will cover the next five years and could provide Amprius with battery production orders exceeding 2 GWh over the proposed contract’s duration. We will begin shipping the first group of SiCore cylindrical cells designed for this application later this year. The second Fortune 500 agreement is a development contract for a small format, custom, high-energy SiMaxx pouch cell. Amprius’ high- energy batteries provide the critical solution to the customer’s application. We expect to produce a battery with approximately 50% less weight and size compared to their current battery, without compromising performance. A smaller and lighter battery enables better product design, enhances the overall customer experience, and offers a significant competitive advantage in the market. This customer

Letter to Shareholders November 2024 - 4 - application is projected to require over one million cells per year if the project objectives are met and economic terms are agreed upon. Manufacturing Capacity Expansion In order to support current as well as future customer commitments, we took additional steps this quarter to increase our manufacturing capabilities. In June, we announced the initial rollout of our contract manufacturing strategy that secured over 500 MWh of additional capacity through several partnerships. To further diversify and expand our manufacturing capabilities, we recently launched two lines designed for the requirements of Amprius products with one of our existing partners. These production lines are already operational and shipping cells and will be supporting the light electric vehicle battery orders discussed above. Beyond creating additional capacity, having lines dedicated to our products enables us to provide more stringent designs for our cell chemistries, which is a key consideration for many of our highly technical customer applications. As of today, we have access to annual production of up to 800 MWh of pouch cells and up to over 1 GWh of cylindrical cells. As for our manufacturing facility we are planning in Brighton, Colorado, we have now completed the production line specification and selection, and finished the construction design drawings and specifications for the facility. We remain on track from a regulatory standpoint, having recently submitted our site plan and advanced all other regulatory plans and applications for the facility. Since we have GWh scale contract manufacturing capacities available today, we may not need Colorado production capacities to support market demand for some time. We also are continuing to make progress ramping up our facility in Fremont, California. We remain on pace to scale our Fremont SiMaxx production rate entering 2025 with up to 2 MWh scale. Outlook Looking ahead, we are increasingly optimistic about the road ahead of us as well as our ability to meet the challenges. With technical leadership, great battery performance, a growing book of customers, and the capacity to now support large volume shipments, we believe that we are set up for sustainable growth for the foreseeable future. We are working hard to execute our goals, and we expect to carry our momentum through the end of 2024 and into 2025. Newly installed production lines at one of Amprius’ contract manufacturing partners Expanded production facility in Fremont, CA

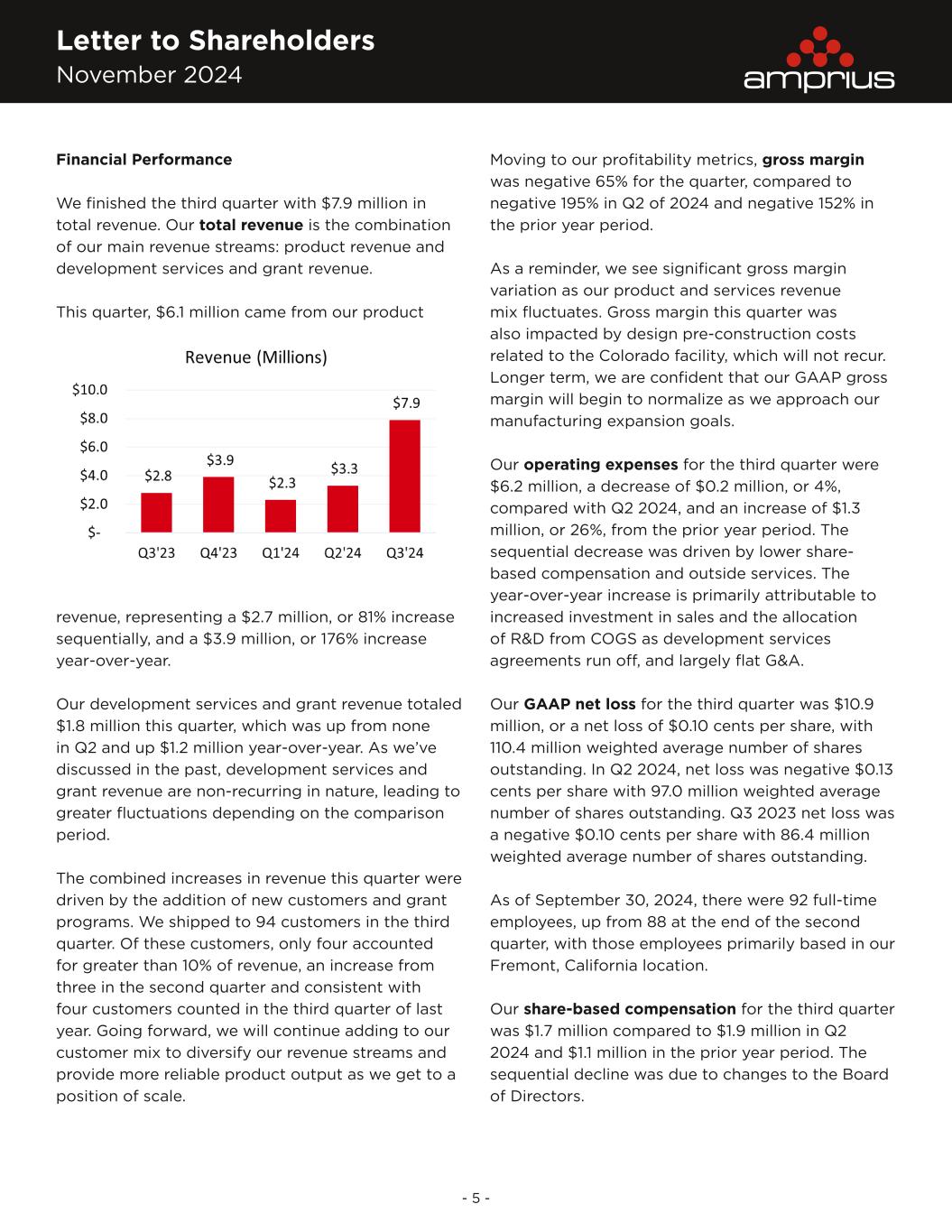

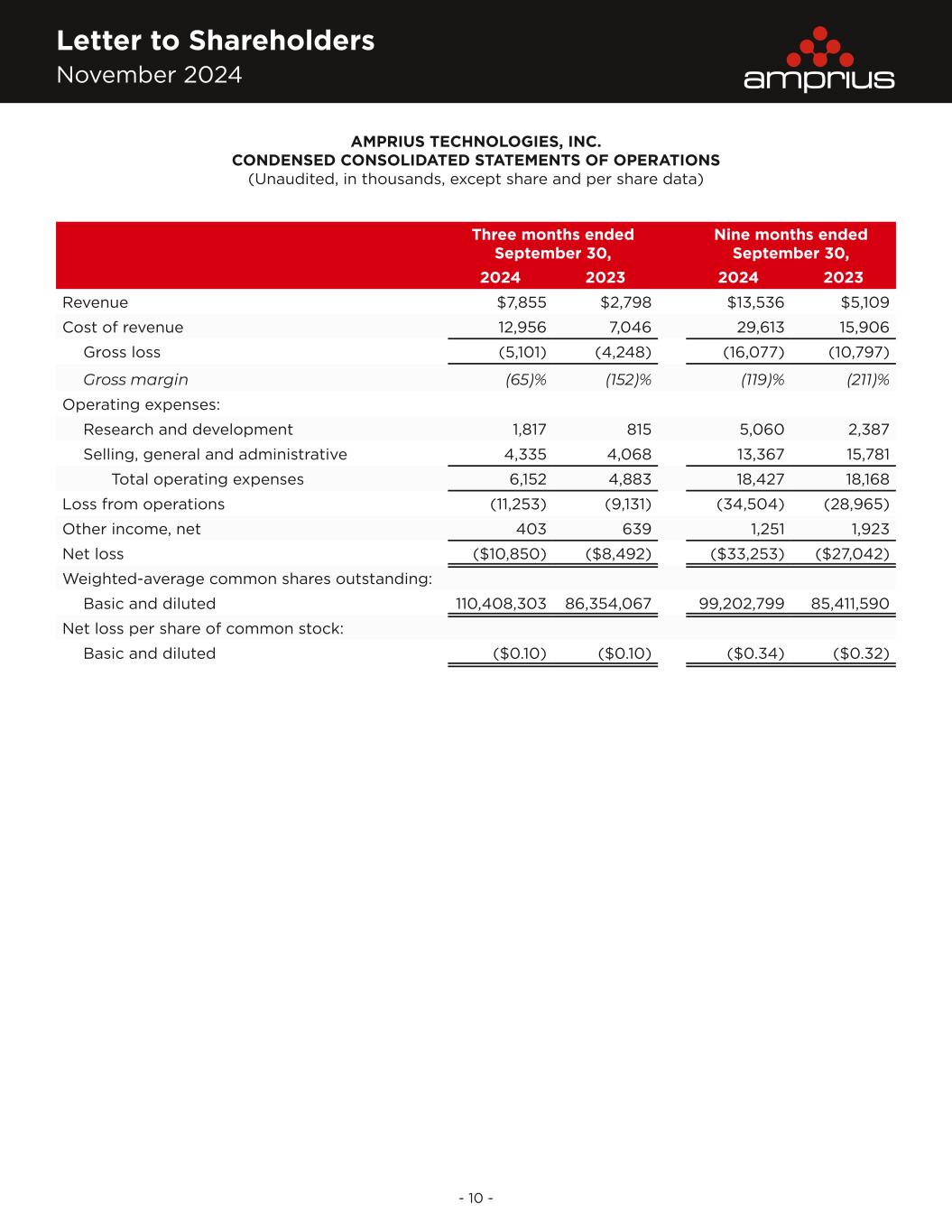

Letter to Shareholders November 2024 - 5 - Financial Performance We finished the third quarter with $7.9 million in total revenue. Our total revenue is the combination of our main revenue streams: product revenue and development services and grant revenue. This quarter, $6.1 million came from our product revenue, representing a $2.7 million, or 81% increase sequentially, and a $3.9 million, or 176% increase year-over-year. Our development services and grant revenue totaled $1.8 million this quarter, which was up from none in Q2 and up $1.2 million year-over-year. As we’ve discussed in the past, development services and grant revenue are non-recurring in nature, leading to greater fluctuations depending on the comparison period. The combined increases in revenue this quarter were driven by the addition of new customers and grant programs. We shipped to 94 customers in the third quarter. Of these customers, only four accounted for greater than 10% of revenue, an increase from three in the second quarter and consistent with four customers counted in the third quarter of last year. Going forward, we will continue adding to our customer mix to diversify our revenue streams and provide more reliable product output as we get to a position of scale. Moving to our profitability metrics, gross margin was negative 65% for the quarter, compared to negative 195% in Q2 of 2024 and negative 152% in the prior year period. As a reminder, we see significant gross margin variation as our product and services revenue mix fluctuates. Gross margin this quarter was also impacted by design pre-construction costs related to the Colorado facility, which will not recur. Longer term, we are confident that our GAAP gross margin will begin to normalize as we approach our manufacturing expansion goals. Our operating expenses for the third quarter were $6.2 million, a decrease of $0.2 million, or 4%, compared with Q2 2024, and an increase of $1.3 million, or 26%, from the prior year period. The sequential decrease was driven by lower share- based compensation and outside services. The year-over-year increase is primarily attributable to increased investment in sales and the allocation of R&D from COGS as development services agreements run off, and largely flat G&A. Our GAAP net loss for the third quarter was $10.9 million, or a net loss of $0.10 cents per share, with 110.4 million weighted average number of shares outstanding. In Q2 2024, net loss was negative $0.13 cents per share with 97.0 million weighted average number of shares outstanding. Q3 2023 net loss was a negative $0.10 cents per share with 86.4 million weighted average number of shares outstanding. As of September 30, 2024, there were 92 full-time employees, up from 88 at the end of the second quarter, with those employees primarily based in our Fremont, California location. Our share-based compensation for the third quarter was $1.7 million compared to $1.9 million in Q2 2024 and $1.1 million in the prior year period. The sequential decline was due to changes to the Board of Directors.

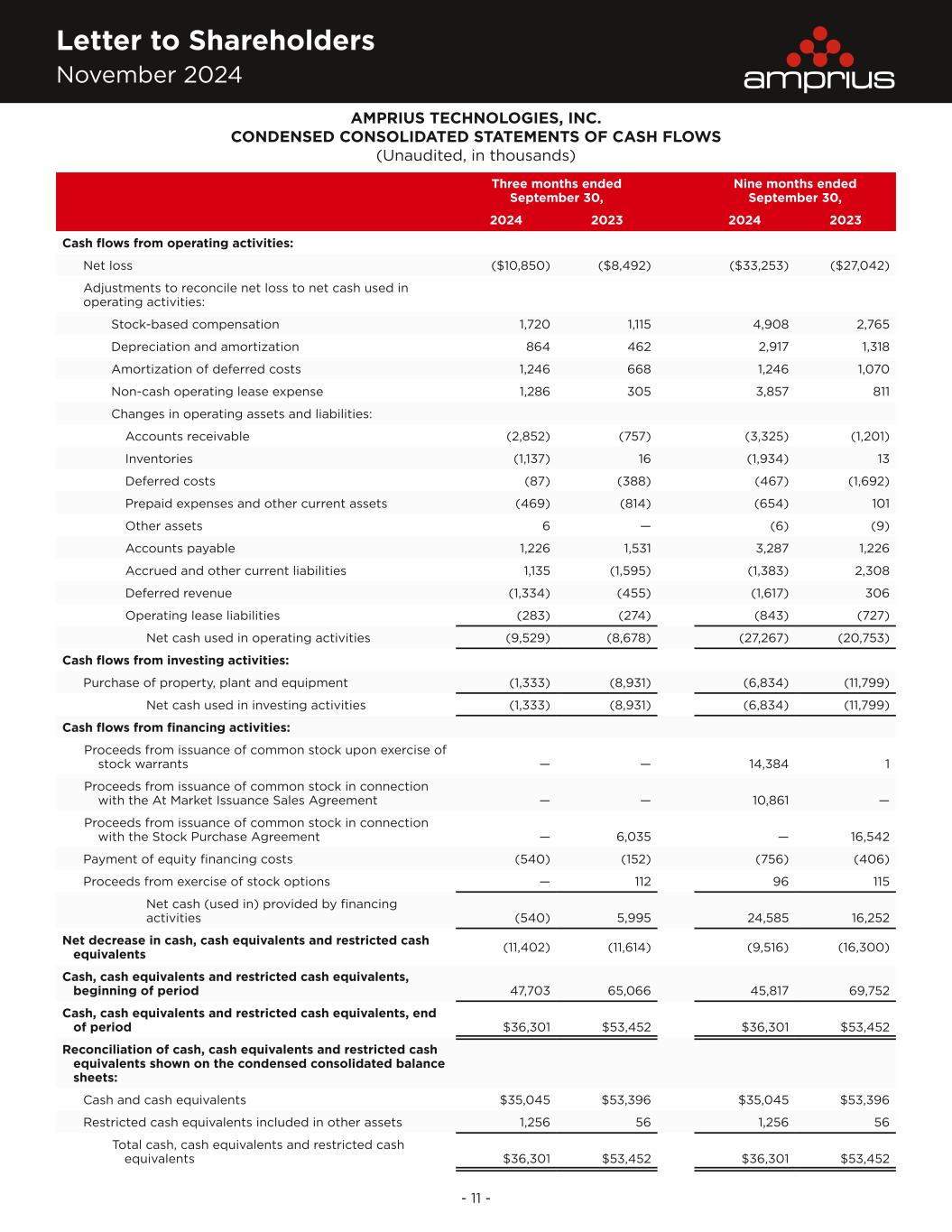

Letter to Shareholders November 2024 - 6 - As of September 30, 2024, we had 111.3 million shares outstanding, which was up 3.4 million from the prior quarter. The increase includes 3.1 million shares issued as part of the warrant exchange that reduced the total number of outstanding private warrants from 15.9 million to 0.3 million. Turning now to the balance sheet, we exited the third quarter with $35.0 million in net cash and no debt. The key drivers for the $11.4 million of cash we used in the quarter were: • $(9.5) million used in operating cash flow. We continue to remain lean with a $2.5 million to $3.0 million run rate per month, excluding transaction related costs. Operating cash flow included $2.4 million in non-recurring expenses used for the design of the Colorado facility. These expenses are projected to tail off with the completion of the construction drawings, which are substantially complete; • $(1.3) million used to continue the build out of our expanded 2 MWh production line in Fremont; • $(0.5) million related to the payment of stock issuance costs associated with the warrant repricing offer. Considering our business achievements and ongoing projects, we believe we are efficiently using capital to drive Amprius forward. Financial Outlook We expect to spend another $1.0 million in Q4 2024 on supporting equipment to complete the 2 MWh line in Fremont in addition to normal operating capital requirements. Now that the designs are effectively complete for Colorado, we will continue to monitor the larger industry dynamics driving our ability to proceed further. Timing and availability of funding, along with monitoring the overall sector for changes in demand, supply, battery cost structure, government incentives, trade tariffs, and other considerations will influence our decision on next steps and timing. Capitalization Table Updates On October 23, 2024, we announced that Amprius, Inc., our former controlling shareholder, had voluntarily liquidated and dissolved. As a result, the shares that Amprius, Inc. held were distributed pro rata per a dissolution plan approved by their Board of Directors. This distribution removes a controlling shareholder consideration and dispenses the shares more broadly into the hands of the original investors in Amprius, Inc. Amprius, Inc. contributed to us 5.5 million common shares of Amprius Technologies and will reimburse related expenses, in exchange for our assumption of the outstanding stock options of Amprius, Inc. - an aggregate of 7.0 million options with a weighted average exercise price of $2.10 per share. There was no operating impact to Amprius Technologies as a result of this distribution or option assumption and we extinguished the contributed shares. The option assumption was approved by a committee of the Amprius Technologies Board of Directors comprised of solely independent and disinterested directors.

Letter to Shareholders November 2024 - 7 - Summary As we look ahead, our strategy at Amprius remains unchanged. Our top priorities are innovating next- generation batteries, growing our customer base, and scaling our manufacturing capabilities. Today, Amprius has the best performing, commercially available batteries for the electric mobility market, strong revenue growth, an impressive customer pipeline, and GWh scale of available manufacturing capacity. Our technical leadership and unmatched battery performance in the industry has been validated by industry leaders and repeat customer orders. Our contract manufacturing strategy has also shown great results, with the ability to support our customers with over 10 million pouch battery cells and 125 million cylindrical cells annually. We also recently celebrated the launch of dedicated Amprius lines at one of our manufacturing partners with the capacity for 800 MWh of pouch cells. At the same time, we are exploring additional manufacturing partners in Asia and Europe, expanding our Fremont production capacity for SiMaxx battery production, and have finalized our design for the factory in Colorado. We believe that the opportunity in front of Amprius is tremendous. We look forward to closing out the year strong and heading into 2025 with increasing momentum. Thank you for your continued support of Amprius Technologies. Best, Quarterly Conference Call and Webcast: Date: Thursday, November 7, 2024 Time: 5:00 PM ET (2:00 PM PT) Toll-Free Number: 888-437-3179 International Number: +1-862-298-0702 Webcast: Register and Join Dr. Kang Sun, CEO Sandra Wallach, CFO

Letter to Shareholders November 2024 - 8 - Forward-Looking Statements This Letter to Shareholders includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Amprius’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding future product commercialization and delivery, the ability of Amprius to serve more customers, bring in additional revenue and expand applications, the ability of Amprius to scale production and deliver large, volume shipments, the timing and ability of Amprius to recognize revenue from existing customer engagements, the ability of Amprius to meet the initial requirements of the existing tie-one customers and expand such relationship to large volume orders, the benefits of having product lines engineered specially for Amprius’ products, the timing and ability of Amprius to expand the manufacturing capacity of its Fremont facility and the manufacturing capacity of its Fremont facility entering 2025, the amount of additional equipment expenditures for its Fremont facility, the ability of Amprius to complete the regulatory approval process for its Brighton facility, the capacity of Amprius’ contract manufacturing partners with respect to SiCore batteries and the number of cells they can manufacture annually, the ability of Amprius to secure additional customer commitments, Amprius’ ability to meet customer demands with SiCore batteries, Amprius’ ability to meet customers demand with contract manufacturing capacities, the addressable market for Amprius’ batteries and the benefits of the expansion of such addressable markets, the potential application and performance of Amprius’ batteries, the ability of Amprius to move into the EV market, Amprius’ liquidity position, and Amprius’ financial and business performance. These statements are based on various assumptions, whether or not identified in this letter, and on the current expectations of Amprius’ management and are not predictions of actual performance. These forward-looking statements are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Amprius’ control. These forward-looking statements are subject to a number of risks and uncertainties, including market demands for SiCore batteries; the ability of Amprius to deliver high performance products to customers at acceptable prices and meet their demands via the contract manufacturing arrangements; Amprius’ ability to reduce costs as it scales production; delays in permitting, construction and operation of production facilities; Amprius’ ability to commercially produce its high performing batteries; third-party producers of Amprius batteries continuing to produce such batteries in the expected quantities and caliber and at the expected prices; Amprius’ customers continuing to purchase batteries directly from Amprius; risks related to Amprius’ ability to enter into definitive supply agreements with potential customers, including potential customers with whom we have non-binding letters of intent; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius’ products; the risk that Amprius’ high volume tools do not achieve sufficient quality or yield or that its manufacturing process does not meet cost targets; Amprius’ liquidity position and its ability to raise additional capital; and changes in domestic and foreign business, market, financial, political and legal conditions. For more information on these risks and uncertainties that may impact the operations and projections discussed herein can be found in the documents Amprius filed from time to time with the SEC, all of which are available on the SEC’s website at www.sec.gov. If any of these risks materialize or Amprius’ assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this letter. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this letter. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.

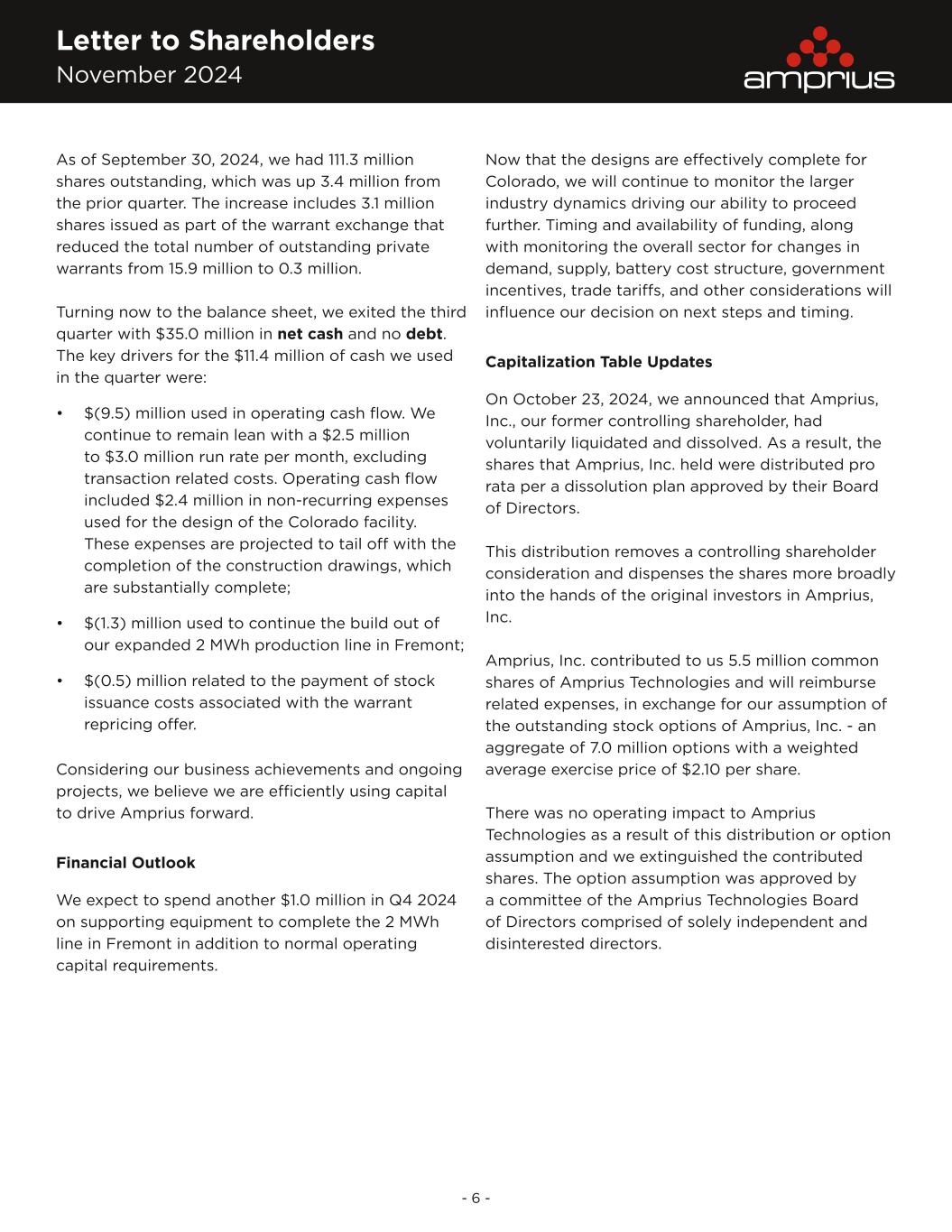

Letter to Shareholders November 2024 - 9 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited, in thousands, except share and par value data) September 30, December 31, 2024 2023 ASSETS Current assets: Cash and cash equivalents $35,045 $45,761 Accounts receivable, net 4,590 1,265 Inventories 2,664 730 Deferred costs — 779 Prepaid expenses and other current assets 2,641 1,987 Total current assets 44,940 50,522 Non-current assets: Property, plant and equipment, net 23,968 21,760 Operating lease right-of-use assets, net 33,829 35,149 Other assets 1,470 305 Total assets $104,207 $107,736 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $4,934 $3,341 Accrued and other current liabilities 4,196 5,594 Deferred revenue 1,817 3,434 Operating lease liabilities 2,053 1,088 Total current liabilities 13,000 13,457 Non-current liabilities: Operating lease liabilities 35,208 34,479 Total liabilities 48,208 47,936 Commitments and contingencies Stockholders’ equity: Preferred stock; $0.0001 par value; 50,000,000 shares authorized; no shares issued and outstanding — — Common stock; $0.0001 par value; 950,000,000 shares authorized; 111,338,789 and 88,869,463 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively 11 9 Additional paid-in capital 218,904 189,454 Accumulated deficit (162,916) (129,663) Total stockholders’ equity 55,999 59,800 Total liabilities and stockholders’ equity $104,207 $107,736

Letter to Shareholders November 2024 - 10 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in thousands, except share and per share data) Three months ended September 30, Nine months ended September 30, 2024 2023 2024 2023 Revenue $7,855 $2,798 $13,536 $5,109 Cost of revenue 12,956 7,046 29,613 15,906 Gross loss (5,101) (4,248) (16,077) (10,797) Gross margin (65)% (152)% (119)% (211)% Operating expenses: Research and development 1,817 815 5,060 2,387 Selling, general and administrative 4,335 4,068 13,367 15,781 Total operating expenses 6,152 4,883 18,427 18,168 Loss from operations (11,253) (9,131) (34,504) (28,965) Other income, net 403 639 1,251 1,923 Net loss ($10,850) ($8,492) ($33,253) ($27,042) Weighted-average common shares outstanding: Basic and diluted 110,408,303 86,354,067 99,202,799 85,411,590 Net loss per share of common stock: Basic and diluted ($0.10) ($0.10) ($0.34) ($0.32)

Letter to Shareholders November 2024 - 11 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, in thousands) Three months ended September 30, Nine months ended September 30, 2024 2023 2024 2023 Cash flows from operating activities: Net loss ($10,850) ($8,492) ($33,253) ($27,042) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 1,720 1,115 4,908 2,765 Depreciation and amortization 864 462 2,917 1,318 Amortization of deferred costs 1,246 668 1,246 1,070 Non-cash operating lease expense 1,286 305 3,857 811 Changes in operating assets and liabilities: Accounts receivable (2,852) (757) (3,325) (1,201) Inventories (1,137) 16 (1,934) 13 Deferred costs (87) (388) (467) (1,692) Prepaid expenses and other current assets (469) (814) (654) 101 Other assets 6 — (6) (9) Accounts payable 1,226 1,531 3,287 1,226 Accrued and other current liabilities 1,135 (1,595) (1,383) 2,308 Deferred revenue (1,334) (455) (1,617) 306 Operating lease liabilities (283) (274) (843) (727) Net cash used in operating activities (9,529) (8,678) (27,267) (20,753) Cash flows from investing activities: Purchase of property, plant and equipment (1,333) (8,931) (6,834) (11,799) Net cash used in investing activities (1,333) (8,931) (6,834) (11,799) Cash flows from financing activities: Proceeds from issuance of common stock upon exercise of stock warrants — — 14,384 1 Proceeds from issuance of common stock in connection with the At Market Issuance Sales Agreement — — 10,861 — Proceeds from issuance of common stock in connection with the Stock Purchase Agreement — 6,035 — 16,542 Payment of equity financing costs (540) (152) (756) (406) Proceeds from exercise of stock options — 112 96 115 Net cash (used in) provided by financing activities (540) 5,995 24,585 16,252 Net decrease in cash, cash equivalents and restricted cash equivalents (11,402) (11,614) (9,516) (16,300) Cash, cash equivalents and restricted cash equivalents, beginning of period 47,703 65,066 45,817 69,752 Cash, cash equivalents and restricted cash equivalents, end of period $36,301 $53,452 $36,301 $53,452 Reconciliation of cash, cash equivalents and restricted cash equivalents shown on the condensed consolidated balance sheets: Cash and cash equivalents $35,045 $53,396 $35,045 $53,396 Restricted cash equivalents included in other assets 1,256 56 1,256 56 Total cash, cash equivalents and restricted cash equivalents $36,301 $53,452 $36,301 $53,452