EX-99.1

Published on March 20, 2025

LETTER TO SHAREHOLDERS Q4 2024 March 2023 Exhibit 99.1

Letter to Shareholders March 2025 - 1 - Amprius has been in commercial battery production since 2018, and it is our belief that there are no other commercial batteries on the market that can perform at these levels today Disruptive Technology Advancements Innovative technologies and breakthrough product performance are the foundation of Amprius’ business. The large-scale manufacturability and commercialization of these technologies and products have enabled Amprius to achieve incredible milestones and business results this year. In January 2025, Amprius introduced the first battery cell in the industry with combined high energy and high power: 370 Wh/Kg energy density and offering up to 3,500 W/Kg power. Furthermore, the cell supports high discharge rates of up to 10C without cooling and up to 15C with active cooling, ensuring quick power delivery without compromising runtime. Company Overview Amprius is a pioneer and a leader in the silicon anode battery space. At Amprius, we develop, manufacture, and market high-energy density and high-power density silicon anode batteries with applications across all segments of electric mobility, including the aviation, electric vehicle and light electric vehicle industries. Today, Amprius commands performance leadership with its combination of battery energy density, power density, charging time, operating temperature range, and safety. Amprius’ portfolio of batteries delivers: • 450 Wh/kg specific energy density and 1,150 Wh/L volumetric energy density, available commercially since early 2022 • 500 Wh/kg, 1,300 Wh/L battery platform, which is expected to be available for delivery by the end of 2025 • Up to 10C continuous power capability and balanced high-energy and high-power designs • An extreme fast charge rate of 0-80% state of charge in about six minutes • A wide operating temperature range of -30°C up to 55°C • Safety design features that enable us to pass the United States military’s benchmark nail penetration test Fellow Shareholders, 2024 was an important and productive year for Amprius. Our accomplishments include the introduction of SiCore – our new silicon anode battery platform; the commercialization of a new group of batteries with breakthrough performance; we obtained access to over 1.8 GWh of contract manufacturing capacity; as well as achieving record sales revenue, engaging with 235 customers, and developing a strong growth path. With that, we are pleased to share our financial results and operational highlights with you below.

Letter to Shareholders March 2025 - 2 - This cell provides an ideal solution for aviation, electric vehicles, and any electric mobility applications that require both endurance and rapid energy delivery. In Q4, pre-production 10Ah samples were delivered to six of our customers, enabling real-world testing in challenging environments. We are seeing strong customer interest for this battery with industry leaders like Teledyne FLIR already actively evaluating its capabilities. “Amprius’ new SiCore cell is positioned to deliver a transformative boost in power and energy for our unmanned aerial systems, extending mission durations while maintaining critical performance under demanding conditions.” — Tung Ng, Vice President, Unmanned Systems North America at Teledyne FLIR Amprius also developed and shipped a high- performance EV battery cell sample to the United States Advanced Battery Consortium (USABC) in 2024. The USABC awarded Amprius a $3.0 million grant to develop low cost and fast charging battery cells back in 2022. Since then, Amprius not only met the USABC’s development targets but exceeded them by delivering a cell with a specific energy of 360 Wh/ kg at the beginning of life and a power density of 1,200 W/kg. The A-Sample EV cells can also charge to 90% of their rated energy in just 15 minutes, exceeding the USABC target of 80% within the same timeframe. In 2024, Amprius also received the xTech Prime Award from the U.S. Army to develop a large format 500 Wh/kg battery cell. We believe that this product, which is in development with our partner AeroVironment, will allow unmatched battery performance. This project is expected to be completed this year. “Amprius’ 500 Wh/kg SiMaxx cell provides the energy density required to enable broad application objectives on our solar HAPS performance roadmap.” — Dex Halpin, Vice President and General Manager of AeroVironment’s HAPS division. Today, Amprius has a high-performance commercial battery portfolio that provides critical solutions to customers with diverse applications across the electric mobility market. The 14 different SKUs provide a range of performance options for different applications that are all commercially available today. Continued Commercial Success The technical achievements at Amprius have enabled our commercial success. In fact, in the fourth quarter alone, we shipped to 98 total customers with 53 of those being new to the Amprius platform. Our expanding customer base, complemented by increased volume shipments to strategic customers, resulted in fourth quarter revenue of $10.6 million, a 35% increase from the third quarter of 2024 and a 170% increase from the fourth quarter of 2023.

Letter to Shareholders March 2025 - 3 - Additionally, 77% of the revenue from Q4 came from outside of the United States compared to just 22% in the same period last year on a “shipped-to” basis and demonstrates the expansion of our global customer base. Over the course of 2024, we shipped to a total of 235 customers. This includes new customers as well as repeat volume orders from our long- term partners like AALTO/Airbus, AeroVironment, Teledyne FLIR, Kraus Hamdani, and BAE Systems. The rapid customer expansion we are driving is a testament to our products’ competitiveness, manufacturing capabilities, and sales strategy. We generated $24.2 million in revenue for the full year, a 167% increase over 2023. In 2024, we developed several sizable business opportunities to support our growth for years to come. In Q3 and Q4, we shared that we signed two separate agreements with Fortune 500 companies. The first agreement, announced in September 2024, was a non-binding letter of intent with a Fortune Global 500 technology OEM to develop a high- energy SiCore cylindrical cell for the light electric vehicle (LEV) market. The battery solution that Amprius will provide represents a breakthrough in cell chemistry, cell design, and cell manufacturing. We believe this will be a very attractive product for the light electric vehicle market, which contributed about 25% of our Q4 revenue. The LEV market is expected to grow significantly. Based on a January 2025 report from The Business Research Company, the LEV market size is expected to reach approximately $136.0 billion by 2029. In addition, the LEV market has a shorter design-in cycle because it is already operating at scale. The other agreement, announced in October 2024, was a development contract for a small format, custom, high-energy SiMaxx pouch cell. Amprius’ high-energy batteries offer a critical solution for the customer’s application. We anticipate delivering a battery that is approximately 50% lighter and smaller compared to their current battery, without compromising performance. At the end of Q3, we also announced two contracts totaling over $20 million to supply 40Ah high performance cells for light electric vehicle applications. We initiated shipments in 2024 and we expect to recognize 100% of the revenue before the end of 2025. In total, we added over $16.0 million in new customer purchase orders to our backlog in the fourth quarter, giving us additional visibility into our growth for 2025.

Letter to Shareholders March 2025 - 4 - Manufacturing Capacity Expansion In addition to the performance of Amprius batteries, our manufacturing capability and capacity have attracted customer attention as well. Today, Amprius has access to annual production of over 1.8 GWh of cell manufacturing capacity and is well-positioned to deliver all types of battery cells to customers: pouch cells, cylindrical cells, and prismatic cells. We are also actively working on developing a global contract manufacturing network to expand cell availability. Strong Momentum to Start 2025 Entering 2025, we are increasingly optimistic about our future and have begun the year with a running start. Last month, we announced that we secured a $15 million purchase order from a leading unmanned aircraft system, or UAS, manufacturer for our SiCore cells. This volume purchase order follows successful field trials and qualifications over the course of nine months, leading to Amprius’ battery being designed into the manufacturer’s fixed-wing UAS platform. This order secures a critical supply for the customer’s production ramp, and we expect to ship the cells in the second half of 2025. As more commercial and defense aviation customers complete their battery qualification processes, we are seeing a strong pipeline of follow-on commitments. We believe that orders like these indicate that the drone market is continuing to grow and reinforce Amprius’ role in powering future applications. Fortune Business Insights projects that the global drone market will surge from $18 billion in 2023 to $213 billion by 2032. So, we believe we’re just at the beginning of a significant expansion of one of our addressable markets. This quarter we’ve also designed and shipped a new high-performance 6.3Ah cylindrical cell for use in the LEV sector. This cell delivers over 25% more capacity than existing 21700 cells, setting a new standard for energy density in the industry for this widely used cell format. Because of its seamless integration into existing battery systems, manufacturers can implement higher-capacity, longer-lasting power without costly redesigns. Macroeconomic Outlook We have been closely monitoring the policy changes and potential industry headwinds resulting from the recent change in federal administration. With much of the global battery supply in Asia, we are not immune to economic policy impacting the region, but we are taking swift action to mitigate any risks to the extent we’re able, including diversifying our manufacturing partnerships and supply chains to avoid geopolitical concerns and tariff related issues. We plan to share additional updates with you as they become available. We remain confident in our expectations for growth throughout 2025.

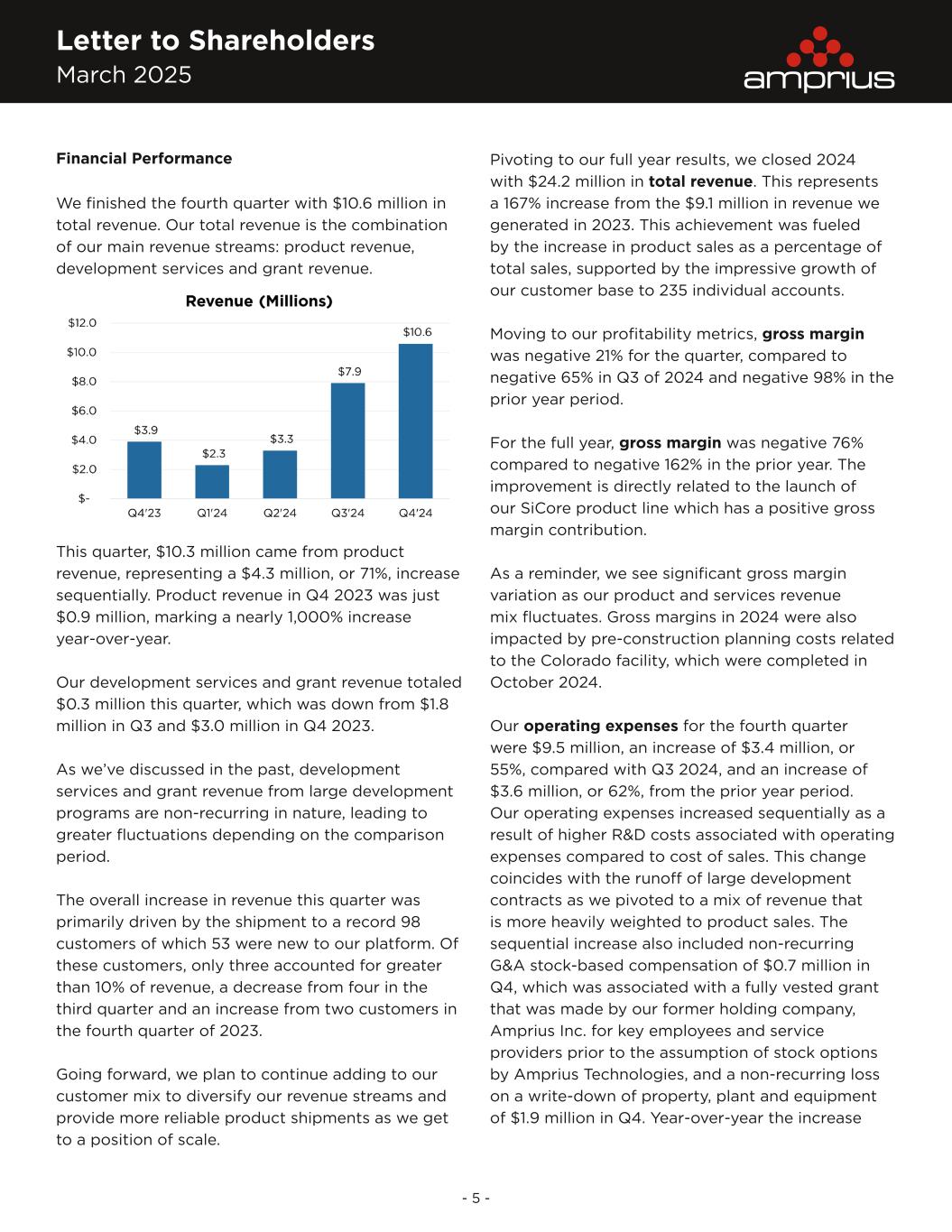

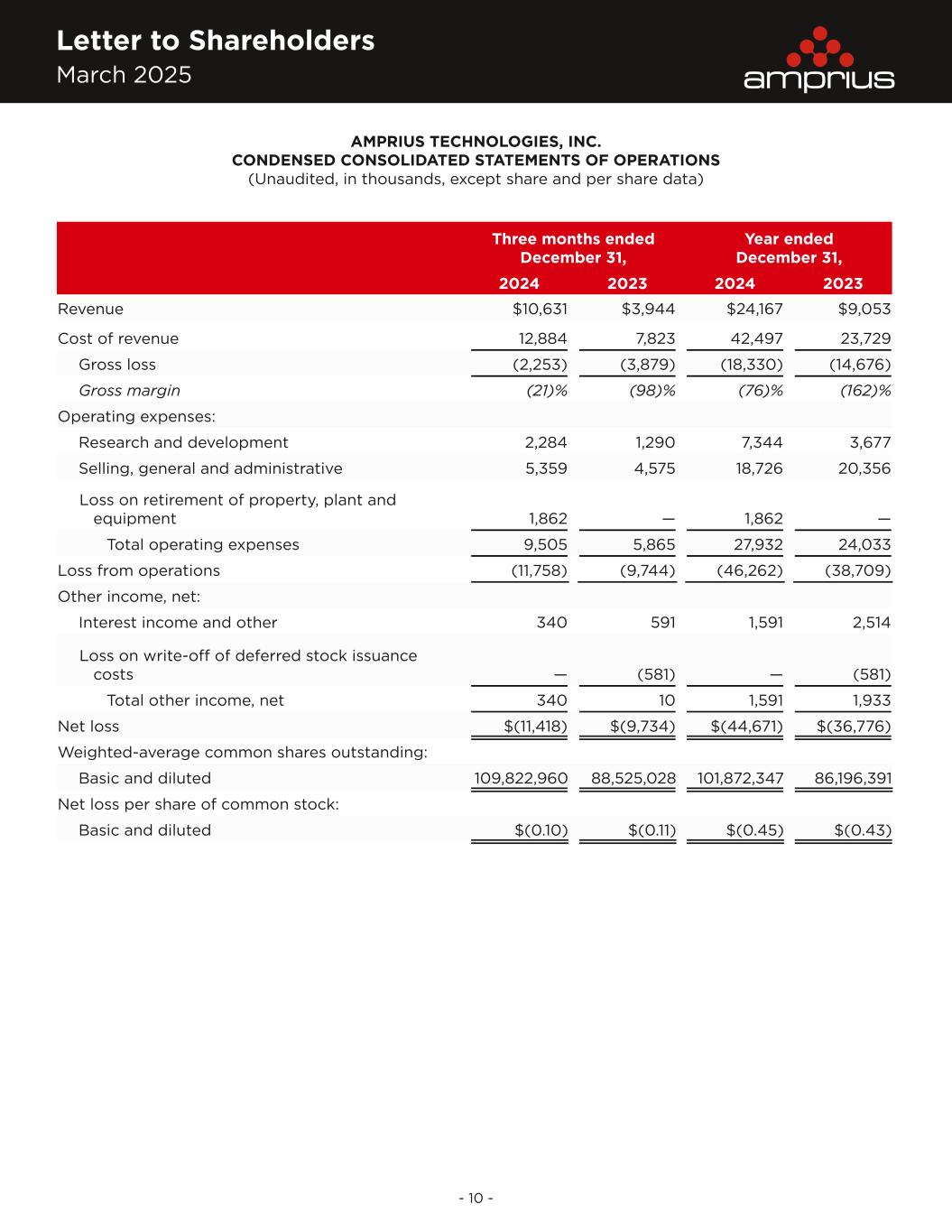

Letter to Shareholders March 2025 - 5 - Financial Performance We finished the fourth quarter with $10.6 million in total revenue. Our total revenue is the combination of our main revenue streams: product revenue, development services and grant revenue. This quarter, $10.3 million came from product revenue, representing a $4.3 million, or 71%, increase sequentially. Product revenue in Q4 2023 was just $0.9 million, marking a nearly 1,000% increase year-over-year. Our development services and grant revenue totaled $0.3 million this quarter, which was down from $1.8 million in Q3 and $3.0 million in Q4 2023. As we’ve discussed in the past, development services and grant revenue from large development programs are non-recurring in nature, leading to greater fluctuations depending on the comparison period. The overall increase in revenue this quarter was primarily driven by the shipment to a record 98 customers of which 53 were new to our platform. Of these customers, only three accounted for greater than 10% of revenue, a decrease from four in the third quarter and an increase from two customers in the fourth quarter of 2023. Going forward, we plan to continue adding to our customer mix to diversify our revenue streams and provide more reliable product shipments as we get to a position of scale. Pivoting to our full year results, we closed 2024 with $24.2 million in total revenue. This represents a 167% increase from the $9.1 million in revenue we generated in 2023. This achievement was fueled by the increase in product sales as a percentage of total sales, supported by the impressive growth of our customer base to 235 individual accounts. Moving to our profitability metrics, gross margin was negative 21% for the quarter, compared to negative 65% in Q3 of 2024 and negative 98% in the prior year period. For the full year, gross margin was negative 76% compared to negative 162% in the prior year. The improvement is directly related to the launch of our SiCore product line which has a positive gross margin contribution. As a reminder, we see significant gross margin variation as our product and services revenue mix fluctuates. Gross margins in 2024 were also impacted by pre-construction planning costs related to the Colorado facility, which were completed in October 2024. Our operating expenses for the fourth quarter were $9.5 million, an increase of $3.4 million, or 55%, compared with Q3 2024, and an increase of $3.6 million, or 62%, from the prior year period. Our operating expenses increased sequentially as a result of higher R&D costs associated with operating expenses compared to cost of sales. This change coincides with the runoff of large development contracts as we pivoted to a mix of revenue that is more heavily weighted to product sales. The sequential increase also included non-recurring G&A stock-based compensation of $0.7 million in Q4, which was associated with a fully vested grant that was made by our former holding company, Amprius Inc. for key employees and service providers prior to the assumption of stock options by Amprius Technologies, and a non-recurring loss on a write-down of property, plant and equipment of $1.9 million in Q4. Year-over-year the increase

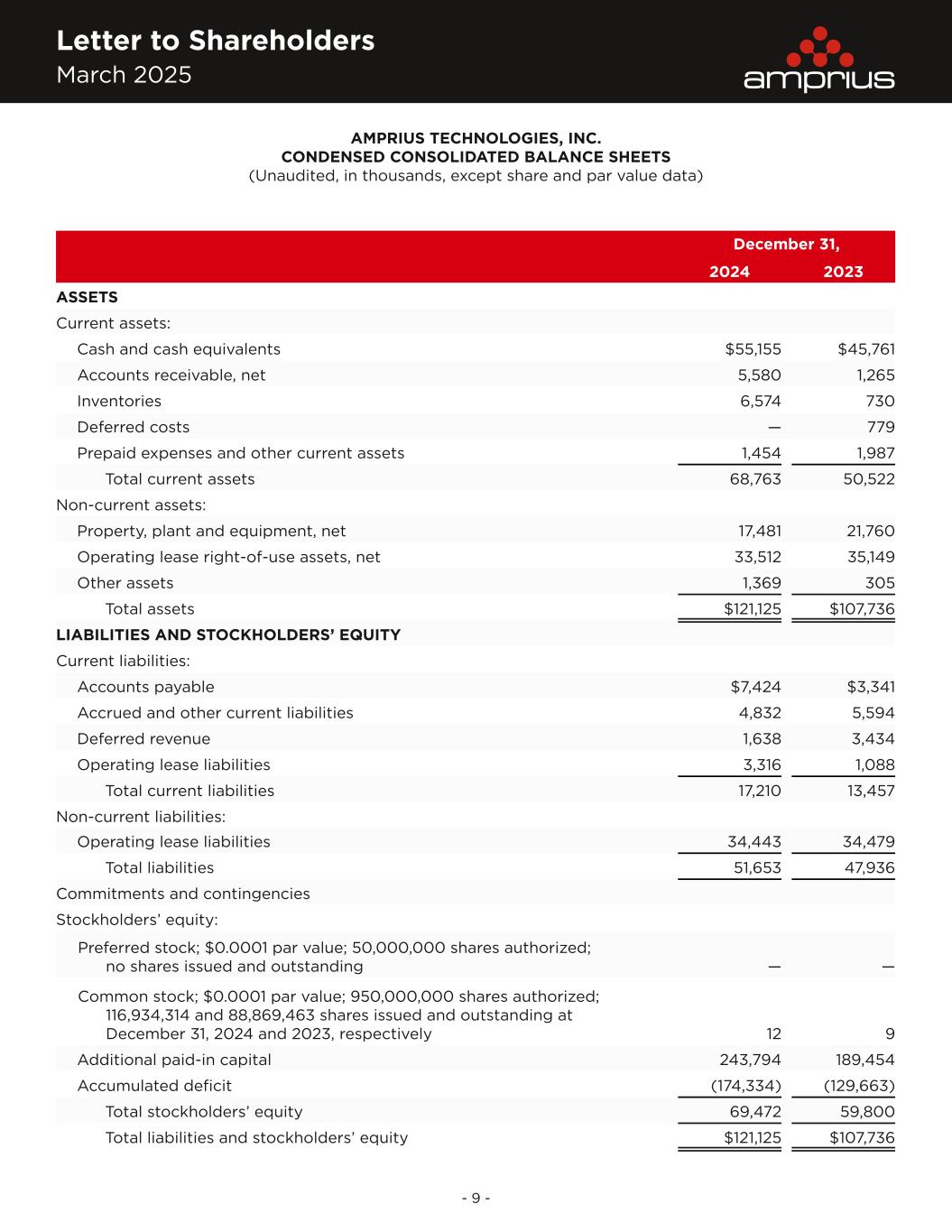

Letter to Shareholders March 2025 - 6 - in operating expenses was driven by increased investment in sales, the re-allocation of R&D from cost of goods sold as development services agreements run off, and the same non-recurring stock-based compensation charge and loss on a write-down of property, plant and equipment. For the full year, our operating expenses were $27.9 million compared to $24.0 million in 2023. Our GAAP net loss for the fourth quarter was $11.4 million, or a net loss of $0.10 cents per share, with 109.8 million weighted average number of shares outstanding. In Q3 2024, our net loss was $10.9 million, or negative $0.10 cents per share, with 110.4 million weighted average number of shares outstanding. Q4 2023 net loss was $9.7 million, or negative $0.11 cents per share, with 88.5 million weighted average number of shares outstanding. Our fourth quarter GAAP basic and diluted EPS of negative $0.10 cents included two non-recurring items, below, that total $0.02 cents per share: • Loss on a write-down of property, plant and equipment of $1.9 million • Stock-based compensation charges from Amprius Inc. of $0.7 million For the full year, GAAP net loss was $44.7 million, or a net loss of $0.45 cents per share, with 101.9 million weighted average number of shares outstanding, compared to a net loss of $36.8 million, or negative $0.43 cents per share, with 86.2 million weighted average number of shares outstanding in 2023. As of December 31, 2024, there were 99 full-time employees, up from 92 at the end of the third quarter, with those employees primarily based in our Fremont, California location. Our share-based compensation for the fourth quarter was $2.4 million compared to $1.7 million in Q3 and $1.1 million in the prior year period. The sequential increase is primarily based on the non-recurring grant of fully vested shares by Amprius Inc. for key employees and service providers. For the full year, share-based compensation was $7.3 million compared to $3.9 million in 2023. The change is primarily due to changes in the Board of Directors and the previously mentioned non- recurring grant of fully vested shares by Amprius Inc. As of December 31, 2024, we had 116.9 million shares outstanding, which was up 5.6 million from the prior quarter. The change includes 5.5 million shares forfeited and cancelled as part of the option assumption agreement with Amprius Inc. prior to its dissolution. This decrease was more than offset by 0.3 million shares related to option exercises and RSU vesting and 10.8 million shares issued from our ATM reserve. Turning now to the balance sheet, we exited the year with $55.2 million in net cash and no debt. The $20.1 million net increase in cash is primarily related to the $22.6 million we generated through the issuance of common stock under our at-the-market issuance sales agreement. As of December 31, 2024, we had over $66.0 million left on the facility. Other key drivers for cash in the quarter included: • $6.1 million used in operating cash flow. We continue to remain lean with a $2.5 to $3.0 million monthly run rate, excluding transaction related costs. Our Q4 operating cash results included minimal non-recurring expenses for the design and preconstruction work of the Colorado facility which was completed in October 2024. At this time, we do not expect future expenses related to the facility buildout. • $4.2 million in cash inflow associated with the return of our deposits for long lead time items related to the Colorado facility. This was partially offset by $0.6 million in property, plant, and equipment purchases for the Fremont facility. Considering our business achievements and ongoing projects, we believe we are efficiently using capital to drive Amprius forward.

Letter to Shareholders March 2025 - 7 - Financial Outlook We expect to spend another $1.0 million on supporting equipment to complete the 2 MWh line in Fremont in addition to normal operating capital requirements. Now that the designs are effectively complete for Colorado, we will continue to monitor the larger industry dynamics driving our ability to proceed further. The scope and schedule of the construction will be determined based on, among other factors, the timing and availability of funding. We are also monitoring the overall sector for changes in demand, supply, battery cost structure, government incentives, trade tariffs, and other considerations that may also influence our decision, including whether to proceed with construction at all. We have secured adequate capacity for the foreseeable future through our contract manufacturing network and plan to further expand that in 2025 without deploying our capital. As we look ahead, our strategy at Amprius remains unchanged. Our top priorities are leading in technology innovation and product performance, ensuring world class manufacturing capability and sufficient production capacity, growing our customer pipeline and driving revenue growth, and maintaining a healthy balance sheet. We are excited about the year ahead and looking forward to growing our business on the momentum we built in 2024. In 2025, Amprius expects to deliver new high-performance batteries, participate in new market segments, engage with more customers, build additional manufacturing partnerships, and bring our business to another level. We believe that the opportunity ahead of Amprius is tremendous. Our team is confident in delivering what we have planned and promised. We’ve begun the year strong and will look to build increasing momentum throughout 2025. Thank you for your continued support of Amprius Technologies. Best, Summary Dr. Kang Sun, CEO Sandra Wallach, CFO Quarterly Conference Call and Webcast: Date: Thursday, March 20, 2025 Time: 5:00 PM ET (2:00 PM PT) Toll-Free Number: 866-424-3442 International Number: +1-201-689-8548 Webcast: Register and Join

Letter to Shareholders March 2025 - 8 - Forward-Looking Statements This Letter to Shareholders includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Amprius’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding future product commercialization and delivery, the ability of Amprius to serve more customers, bring in additional revenue and expand applications, the ability of Amprius to scale production and deliver large, volume shipments, the timing and ability of Amprius to recognize revenue from existing or new customer engagements, the ability of Amprius to meet the initial requirements of the existing tie- one customers and expand such relationship to large volume orders, the benefits of having product lines engineered specially for Amprius’ products, the timing and ability of Amprius to expand the manufacturing capacity of its Fremont facility and the manufacturing capacity of its Fremont facility, the amount of additional equipment expenditures for its Fremont facility, the capacity of Amprius’ contract manufacturing partners with respect to SiCore batteries and the number of cells they can manufacture annually, the ability of Amprius to secure additional customer commitments, Amprius’ ability to meet customer demands with SiCore batteries, Amprius’ ability to meet customers demand with contract manufacturing capacities, the addressable market for Amprius’ batteries and the benefits of the expansion of such addressable markets, the potential application and performance of Amprius’ batteries, the ability of Amprius to move into new markets, Amprius’ growth and the growth in the markets in which it operates; Amprius’ liquidity position, and Amprius’ financial and business performance. These statements are based on various assumptions, whether or not identified in this letter, and on the current expectations of Amprius’ management and are not predictions of actual performance. These forward-looking statements are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Amprius’ control. These forward-looking statements are subject to a number of risks and uncertainties, including market demands for SiCore batteries; the ability of Amprius to deliver high performance products to customers at acceptable prices and meet their demands via the contract manufacturing arrangements; Amprius’ ability to reduce costs as it scales production; delays in permitting, construction and operation of production facilities; Amprius’ ability to commercially produce its high performing batteries; third-party producers of Amprius batteries continuing to produce such batteries in the expected quantities and caliber and at the expected prices; Amprius’ customers continuing to purchase batteries directly from Amprius; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius’ products; the risk that Amprius’ high volume tools do not achieve sufficient quality or yield or that its manufacturing process does not meet cost targets; Amprius’ liquidity position and its ability to raise additional capital; the ability of Amprius to maintain the listing of its securities on the New York Stock Exchange; the possibility that Amprius may be adversely affected by economic, business or competitive factors, including supply chain interruptions and developments in alternative technologies, and may not be able to manage other risks and uncertainties; the effect of macroeconomic factors, such as tariffs, trade barriers, abrupt political changes, geopolitics, currency fluctuations, embargoes, shortages, terrorist activity, armed conflict and public health emergencies on Amprius’ business; and changes in domestic and foreign business, market, financial, political and legal conditions. For more information on these risks and uncertainties that may impact the operations and projections discussed herein can be found in the documents Amprius filed from time to time with the SEC, all of which are available on the SEC’s website at www.sec.gov. If any of these risks materialize or Amprius’ assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this letter. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this letter. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.

Letter to Shareholders March 2025 - 9 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited, in thousands, except share and par value data) December 31, 2024 2023 ASSETS Current assets: Cash and cash equivalents $55,155 $45,761 Accounts receivable, net 5,580 1,265 Inventories 6,574 730 Deferred costs — 779 Prepaid expenses and other current assets 1,454 1,987 Total current assets 68,763 50,522 Non-current assets: Property, plant and equipment, net 17,481 21,760 Operating lease right-of-use assets, net 33,512 35,149 Other assets 1,369 305 Total assets $121,125 $107,736 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $7,424 $3,341 Accrued and other current liabilities 4,832 5,594 Deferred revenue 1,638 3,434 Operating lease liabilities 3,316 1,088 Total current liabilities 17,210 13,457 Non-current liabilities: Operating lease liabilities 34,443 34,479 Total liabilities 51,653 47,936 Commitments and contingencies Stockholders’ equity: Preferred stock; $0.0001 par value; 50,000,000 shares authorized; no shares issued and outstanding — — Common stock; $0.0001 par value; 950,000,000 shares authorized; 116,934,314 and 88,869,463 shares issued and outstanding at December 31, 2024 and 2023, respectively 12 9 Additional paid-in capital 243,794 189,454 Accumulated deficit (174,334) (129,663) Total stockholders’ equity 69,472 59,800 Total liabilities and stockholders’ equity $121,125 $107,736

Letter to Shareholders March 2025 - 10 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in thousands, except share and per share data) Three months ended December 31, Year ended December 31, 2024 2023 2024 2023 Revenue $10,631 $3,944 $24,167 $9,053 Cost of revenue 12,884 7,823 42,497 23,729 Gross loss (2,253) (3,879) (18,330) (14,676) Gross margin (21)% (98)% (76)% (162)% Operating expenses: Research and development 2,284 1,290 7,344 3,677 Selling, general and administrative 5,359 4,575 18,726 20,356 Loss on retirement of property, plant and equipment 1,862 — 1,862 — Total operating expenses 9,505 5,865 27,932 24,033 Loss from operations (11,758) (9,744) (46,262) (38,709) Other income, net: Interest income and other 340 591 1,591 2,514 Loss on write-off of deferred stock issuance costs — (581) — (581) Total other income, net 340 10 1,591 1,933 Net loss $(11,418) $(9,734) $(44,671) $(36,776) Weighted-average common shares outstanding: Basic and diluted 109,822,960 88,525,028 101,872,347 86,196,391 Net loss per share of common stock: Basic and diluted $(0.10) $(0.11) $(0.45) $(0.43)

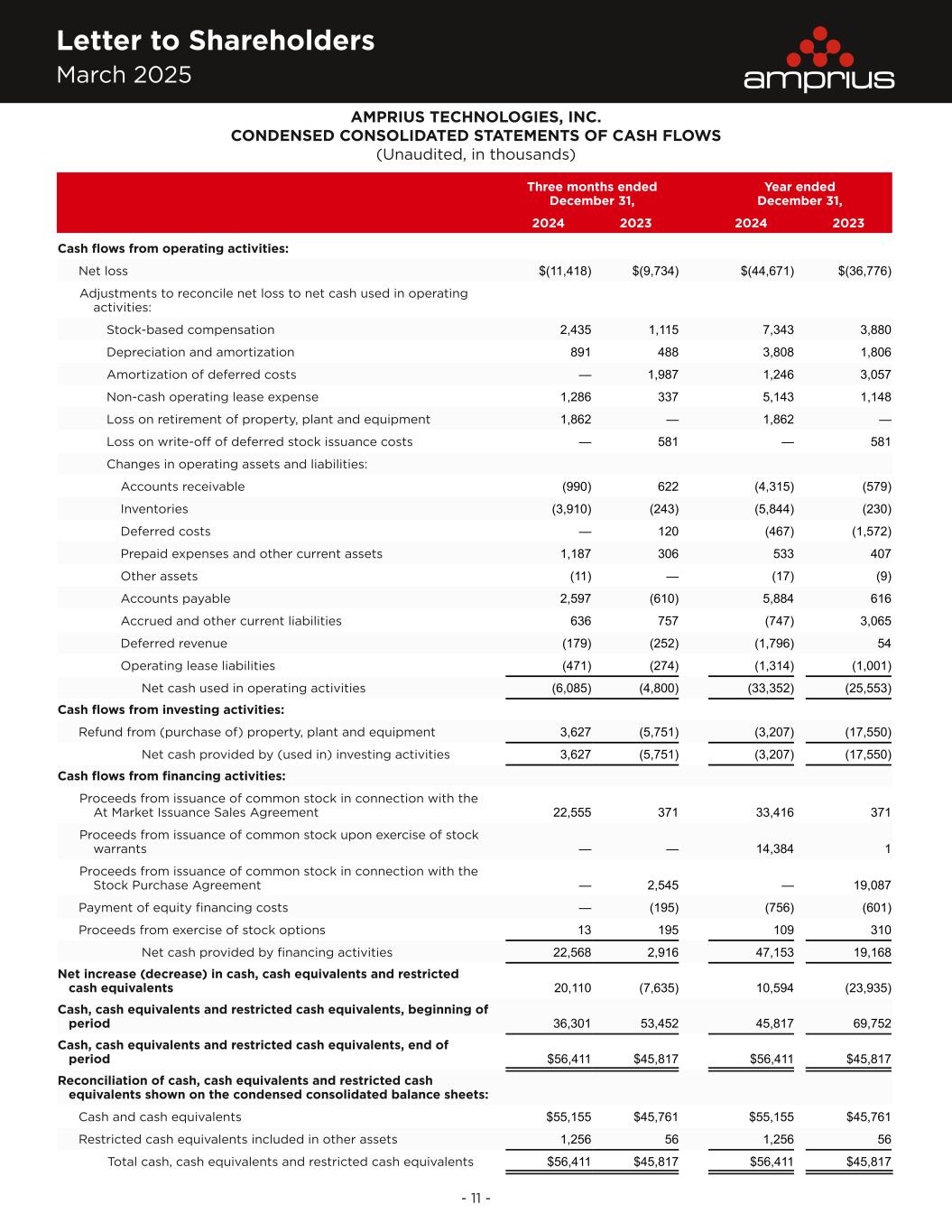

Letter to Shareholders March 2025 - 11 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, in thousands) Three months ended December 31, Year ended December 31, 2024 2023 2024 2023 Cash flows from operating activities: Net loss $(11,418) $(9,734) $(44,671) $(36,776) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 2,435 1,115 7,343 3,880 Depreciation and amortization 891 488 3,808 1,806 Amortization of deferred costs — 1,987 1,246 3,057 Non-cash operating lease expense 1,286 337 5,143 1,148 Loss on retirement of property, plant and equipment 1,862 — 1,862 — Loss on write-off of deferred stock issuance costs — 581 — 581 Changes in operating assets and liabilities: Accounts receivable (990) 622 (4,315) (579) Inventories (3,910) (243) (5,844) (230) Deferred costs — 120 (467) (1,572) Prepaid expenses and other current assets 1,187 306 533 407 Other assets (11) — (17) (9) Accounts payable 2,597 (610) 5,884 616 Accrued and other current liabilities 636 757 (747) 3,065 Deferred revenue (179) (252) (1,796) 54 Operating lease liabilities (471) (274) (1,314) (1,001) Net cash used in operating activities (6,085) (4,800) (33,352) (25,553) Cash flows from investing activities: Refund from (purchase of) property, plant and equipment 3,627 (5,751) (3,207) (17,550) Net cash provided by (used in) investing activities 3,627 (5,751) (3,207) (17,550) Cash flows from financing activities: Proceeds from issuance of common stock in connection with the At Market Issuance Sales Agreement 22,555 371 33,416 371 Proceeds from issuance of common stock upon exercise of stock warrants — — 14,384 1 Proceeds from issuance of common stock in connection with the Stock Purchase Agreement — 2,545 — 19,087 Payment of equity financing costs — (195) (756) (601) Proceeds from exercise of stock options 13 195 109 310 Net cash provided by financing activities 22,568 2,916 47,153 19,168 Net increase (decrease) in cash, cash equivalents and restricted cash equivalents 20,110 (7,635) 10,594 (23,935) Cash, cash equivalents and restricted cash equivalents, beginning of period 36,301 53,452 45,817 69,752 Cash, cash equivalents and restricted cash equivalents, end of period $56,411 $45,817 $56,411 $45,817 Reconciliation of cash, cash equivalents and restricted cash equivalents shown on the condensed consolidated balance sheets: Cash and cash equivalents $55,155 $45,761 $55,155 $45,761 Restricted cash equivalents included in other assets 1,256 56 1,256 56 Total cash, cash equivalents and restricted cash equivalents $56,411 $45,817 $56,411 $45,817