EX-99.1

Published on May 8, 2025

March 2023 LETTER TO SHAREHOLDERS Q1 2025

Letter to Shareholders May 2025 - 1 - Amprius has been producing commercial batteries since 2018, and we believe no other commercially available lithium-ion batteries on the market today can match the performance of our silicon anode cells. Breakthrough Technology Advancements Innovative technologies and breakthrough product performance are the foundation of Amprius’ business. Following the launch of our SiCore product platform in January 2024, we expanded our portfolio with several new battery designs, strengthening our position as a leader in next- generation lithium-ion technology. Amprius offers over a dozen SKUs tailored to a broad range of customer applications. Among the most impactful additions are two first-quarter product releases that generated strong market interest: Company Overview Amprius is a pioneer and a leader in the silicon anode battery space. At Amprius, we develop, manufacture, and market high-energy density and high-power density silicon anode batteries with applications across all segments of electric mobility, including the aviation, electric vehicle, and light electric vehicle industries. Today, Amprius commands performance leadership with its combination of energy density, power density, charging time, operating temperature range, and safety. Amprius’ portfolio of batteries delivers: • 450 Wh/kg specific energy density and 1,150 Wh/L volumetric energy density, available commercially since early 2022 • 500 Wh/kg, 1,300 Wh/L battery platform, with third-party validation • Up to 10C continuous power capability and balanced high-energy and high-power designs • An extreme fast charge rate of 0-80% state of charge in about six minutes • A wide operating temperature range of -30°C up to 55°C • Safety design features that enable us to pass the United States military’s benchmark nail penetration test Fellow Shareholders, In the first quarter, Amprius demonstrated its commitment to innovation and business growth. We shipped batteries to over 100 customers and successfully introduced several new cell chemistries highlighted by our development of a 370 Wh/kg high-power pouch cell and a 6300 mAh high-energy cylindrical cell. With that, we are pleased to share our financial results and operational highlights with you below.

Letter to Shareholders May 2025 - 2 - High-Power 370 Wh/kg Cell: Delivering a maximum discharge rate of 15C, this cell sets a new benchmark for power-to-energy performance in the lithium- ion battery industry. It addresses critical needs in electric mobility markets—where both rapid energy delivery and extended endurance are essential. Since January, we have been shipping this cell to customers including Teledyne FLIR for evaluation. High-Energy 21700 Cylindrical Cell: In March, we introduced a 6300 mAh 21700-format cell, with a 25% improvement in energy density over conventional designs. Its drop-in compatibility allows customers to enhance performance without expensive system redesigns. We have already delivered samples to a Fortune 500 company in the light electric vehicle market. This new 6300 mAh cell was named “Best in Show” at the 2025 International Battery Seminar, marking the third consecutive year an Amprius innovation has received a major industry award at the International Battery Seminar, further validating our leadership in high-performance battery technology. Commercially, what really separates Amprius from the competition in the emerging lithium-ion battery technology space is that we are not just producing battery samples in the lab. Instead, Amprius is manufacturing high performance silicon anode batteries at scale. Our newly designed company website, provides more information about Amprius’ product portfolio, technologies, and applications. It serves as a valuable resource for our customers, partners, investors and shareholders. We are actively leveraging this platform to expand our reach and drive engagement with new customers across the aviation, defense, and electric mobility markets. Continued Commercial Success Our start in the first quarter of 2025 had multiple commercial wins for our products with both new and returning customers placing orders. We shipped batteries to 102 customers, including 46 customers that are new to the Amprius platform. The breakthrough performance and large production capacity of Amprius SiCore batteries enable us to attract customers and drive revenue growth. We generated revenue of $11.3 million in Q1, a 6% increase from the fourth quarter of last year and up 383% from the same period last year. This strong growth was primarily driven by a greater than 600% increase in SiCore shipments since we began selling the product commercially at the beginning of last year.

Letter to Shareholders May 2025 - 3 - Our ability to mass produce SiCore batteries has allowed us to become cost-competitive with traditional battery manufacturers while maintaining our firm technological advantages, opening the door to new customers while enabling larger volumes for existing customers. In Q1, 83% of our revenue came from outside of the United States on a shipped-to basis. This is an increase from 65% in the prior year period, demonstrating the expansion of our customer base worldwide. This customer diversification has also allowed us to grow despite the general headwinds and uncertainty created by current policies domestically and internationally. During the quarter, we also announced a $15.0 million purchase order from an unmanned aerial system (UAS) OEM. This order was the result of a nine-month long testing cycle that resulted in Amprius’ battery being designed into the manufacturer’s fixed-wing UAS platform. We remain on track to ship these cells in the second half of the year to fulfill the customers’ demand. Orders like these demonstrate our ability to work with customers throughout the design and qualification process and convert them into volume orders over time. As we have previously discussed, this process generally takes anywhere between 9 to 18 months for aviation customers. However, that time can be cut down significantly for customers in the light electric vehicle sector, which is already running at scale. We have made strong progress in penetrating the LEV market, and approximately 25% of our revenue in the first quarter came from that market. We believe that the LEV market, with its shorter design-in cycles and scalability, is positioned to be a compelling growth engine for Amprius. Our drop-in replacement battery solutions make it easier for customers to adopt our technology quickly, without costly redesigns, helping us gain market share more efficiently. In total, we added $34.5 million in new customer purchase orders to our backlog in the first quarter, giving us additional visibility into our growth for the remainder of 2025.

Letter to Shareholders May 2025 - 4 - Manufacturing Capacity Expansion In 2024, Amprius developed gigawatt-scale contract manufacturing capacity for our SiCore platform, enabling us to fulfill both existing backlog and growing customer demand. This expansion positions us to serve high-volume programs efficiently while maintaining competitive cost structures. In addition to our SiCore capacity through contract manufacturing partners, we completed a hardware retrofit at our Fremont facility for the SiMaxx platform. We are now focused on optimizing production to support customers requiring the ultra-high-energy 500 Wh/kg SiMaxx product. This includes our long time customer AALTO/Airbus and our partner AeroVironment for the xTech Prime U.S. Army grant program. Strong Momentum to Start Q2 We entered the second quarter with significant operating momentum. Following the launch of our SiCore platform, we have continued to expand and enhance our product portfolio. Most recently, we introduced a breakthrough 450 Wh/kg SiCore cell— delivering 950 Wh/L volumetric energy and up to 80% more energy than conventional lithium-ion cells with graphite anodes. This new product builds on our leadership in silicon anode technology and is already proving to be a strong market driver. With best-in-class energy density and availability at scale, the 450 Wh/kg cell is ideally suited for aviation and electric mobility platforms—key segments of our customer base. We believe that this new product, combined with the products that are already in volume production, will be the growth engine of our revenue in 2025. Macroeconomic Outlook We believe that Amprius has several layers of defense for trade conflicts and tariffs. First, we believe that we deliver the highest performing cells on the market today at a competitive cost. For many of our customers, it’s not a question of choosing us over a competitor; we’re the only solution on the market that can meet their technical and economic needs. Second, over 80% of our revenue last quarter was “out of the scope” for current U.S. import tariffs because our customers were located outside of the country. For the products sold to U.S. customers, we are working along the supply chain to achieve economic solutions for all parties. Third, we are diversifying our manufacturing globally to insulate us from the potential impact of tariffs. Like every business in today’s marketplace, we are monitoring the latest policy decisions from the U.S. government and others around the globe. Despite the lingering uncertainty, we remain confident in our expectations for growth for the full year based on the information we have today as well as the proactive steps we have taken to mitigate potential impacts. Management Welcome We are excited to share that Tom Stepien has joined us as the new President of Amprius Technologies. Tom brings more than 35 years of leadership experience across energy storage, advanced manufacturing, and technology innovation. He has a proven track record of scaling high-growth companies and translating technical advancements into commercial success. As we expand our global

Letter to Shareholders May 2025 - 5 - operations and expand our customer base, Tom’s expertise in building customer-centric, growth- oriented organizations will be instrumental in leading Amprius through its next phase of growth. “With a powerful technology platform, an exceptional team, and growing market traction, Amprius is well- positioned to lead the next wave of electrification.” — Tom Stepien, President of Amprius Technologies Financial Performance We ended the first quarter with $11.3 million in total revenue. Our total revenue is the combination of our main revenue streams: product revenue, development services and grant revenue. This quarter, $11.0 million came from our product revenue, representing a $0.7 million, or 6%, increase sequentially. Product revenue in Q1 2024 was $2.3 million, marking a 370%, or $8.6 million, year-over- year increase. Our development services and grant revenue totaled $0.3 million this quarter, which was consistent with $0.3 million in Q4 2024 and up from zero year-over- year. As we have discussed in the past, development services and grant revenue from large development programs are non-recurring in nature, leading to greater fluctuations depending on the comparison period. The overall increase in revenue was primarily driven by the addition of 46 new customers within the 102 customers we shipped to in the first quarter. Of these customers, only three accounted for greater than 10% of revenue, consistent with three customers in both the first and fourth quarters of 2024. Going forward, we plan to continue adding to our customer mix to diversify our revenue streams and provide more predictable product shipments as we get to a position of scale. Moving to our profitability metrics, gross margin was negative 21% for the quarter, compared to negative 21% in Q4 of 2024 and negative 190% in the prior year period. As a reminder, we see significant gross margin variation as our product and services revenue mix fluctuates. Gross margins in 2024 were also impacted by pre-construction planning costs related to the Colorado facility, which were completed in October 2024. Our operating expenses for the first quarter were $7.3 million, a decrease of $2.2 million, or 23%, compared to Q4 2024, and an increase of $1.4 million, or 24%, from the prior year period. The decrease from Q4 to Q1 was driven by the non- recurring loss on retirement of property, plant and equipment discussed in our Q4 and full year earnings of $1.9 million. Year-over-year the increase in OPEX was driven by increased investment in sales and the re-allocation of R&D from cost of goods sold as development services agreements run off. Our GAAP net loss for the first quarter was $9.4 million, or a net loss of $0.08 cents per share, with 117.9 million weighted average number of shares outstanding. In Q4 2024, our net loss was $11.4 million or a net loss of $0.10 cents per share with

Letter to Shareholders May 2025 - 6 - 109.8 million weighted average number of shares outstanding. Q1 2024 net loss was $9.9 million or a net loss of $0.11 cents per share with 90.0 million weighted average number of shares outstanding. As of March 31, 2025, there were 95 full-time employees, down from 99 at the end of the fourth quarter, with those employees primarily based in our Fremont, California location. Our share-based compensation for the first quarter was $1.8 million compared to $2.4 million in Q4 and $1.2 million in the prior year period. The sequential decrease is primarily attributable to $0.7 million for the non-recurring grant of fully vested shares by Amprius Inc. for key employees and service providers that occurred in the fourth quarter. As of March 31, 2025, we had 120.5 million shares outstanding, which was up 3.6 million from the prior quarter. The change includes approximately 1.0 million shares issued from option exercises and RSU vesting and 2.6 million shares issued from our ATM reserve. We exited the first quarter with $48.4 million in net cash and no debt. Key drivers for cash in the quarter included: • $14.1 million used in operating cash flow, which was slightly higher than our projected monthly run rate of approximately $2.5 to $3.0 million, excluding transaction-related costs. The main cause of the variance this quarter is related to the change in working capital accounts, specifically that late quarter billings were caught up in accounts receivable at the end of the quarter. • $0.9 million in investment related to the Fremont, California facility. • $8.5 million of cash inflow from the issuance of common stock under our at-market sales agreement. We still have $57.8 million left on the facility. Considering our business achievements and ongoing projects, we believe we are efficiently using capital to drive Amprius forward. Financial Outlook We expect to move to a steady state of quarterly investment in normal operating items with the hardware upgrade behind us for Fremont. At this time, there are no plans to move forward with the Colorado facility. The designs for this project are effectively complete, and we are continuing to monitor the larger industry dynamics associated with building a factory in the United States. Changes in demand, supply, battery cost structure, government incentives, trade tariffs, and other considerations, including the timing and availability of funding will influence our decision on the next steps and timing. We have secured adequate capacity for the foreseeable future through our contract manufacturing network and plan to further expand that in 2025 without deploying our capital.

Letter to Shareholders May 2025 - 7 - As we look ahead, our strategy at Amprius remains unchanged. The company is focusing on technology innovation, new product introduction, quality manufacturing, customer engagement and revenue growth. We realize that our success depends on our ability to execute our vision. In the coming months, we expect to release new batteries on our product roadmap that will further our lead in the battery space. This includes new products from our SiCore platform and the commercial availability of our SiMaxx 500 Wh/kg product. With 235 customers served in 2024 and another 46 new customers in the first quarter, we are excited about our commercial traction and the opportunities ahead of us. Our priority now is to convert these engagements into customer purchase orders as quickly as we can. We are also strengthening and expanding our manufacturing capabilities and capacities to better align geographically with our customers worldwide. We believe the opportunity ahead of Amprius is tremendous and that we are well-positioned for continued success with our industry-leading silicon anode batteries, backed by gigawatt-scale manufacturing capabilities through our capital-light contract manufacturing network. Our breadth of customer engagement is evident in the hundreds of customers we shipped to through March 2025, including both new business and repeat orders from marquee customers. From a financial perspective, we believe we are in excellent shape with adequate cash reserves, a low burn rate, no debt, and our existing at-the-market sales agreement providing additional flexibility. We believe that these core pillars will help us continue to support a strong and growing business throughout the rest of the year and beyond. Over the next few months, we’ll be attending several industry and financial conferences, which we plan to announce at future dates. We hope to see you there. Thank you for your continued support of Amprius Technologies. Best, Summary Dr. Kang Sun, CEO Sandra Wallach, CFO Quarterly Conference Call and Webcast: Date: Thursday, May 8, 2025 Time: 5:00 PM ET (2:00 PM PT) Toll-Free Number: 866-424-3442 International Number: +1-201-689-8548 Webcast: Register and Join

Letter to Shareholders May 2025 - 8 - Forward-Looking Statements This Letter to Shareholders includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Amprius’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “will” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding future product commercialization and delivery, the ability of Amprius to serve more customers, bring in additional revenue and expand applications, the ability of Amprius to scale production and deliver large, volume shipments, the timing and ability of Amprius to recognize revenue from existing or new customer engagements, the ability of Amprius to meet the initial requirements of the existing customers and expand such relationship to large volume orders, the benefits of having product lines engineered specially for Amprius’ products, the timing and ability of Amprius to expand the manufacturing capacity of its Fremont facility, the amount of additional equipment expenditures for its Fremont facility, the capacity of Amprius’ contract manufacturing partners with respect to SiCore batteries and the number of cells they can manufacture annually, the ability of Amprius to secure additional customer commitments, Amprius’ ability to meet customer demands with its batteries, Amprius’ ability to meet customers demand with contract manufacturing capacities, the addressable market for Amprius’ batteries and the benefits of the expansion of such addressable markets, the potential application and performance of Amprius’ batteries, the ability of Amprius to move into new markets, Amprius’ growth and the growth in the markets in which it operates, Amprius’ liquidity position, Amprius’ ability to mitigate the impact of macroeconomic factors, such as increased tariffs and retaliatory actions, and Amprius’ financial and business performance. These statements are based on various assumptions, whether or not identified in this letter, and on the current expectations of Amprius’ management and are not predictions of actual performance. These forward-looking statements are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Amprius’ control. These forward-looking statements are subject to a number of risks and uncertainties, including market demands for SiCore batteries; the ability of Amprius to deliver high performance products to customers at acceptable prices and meet their demands via the contract manufacturing arrangements; Amprius’ ability to reduce costs as it scales production; delays in permitting, construction and operation of production facilities; Amprius’ ability to commercially produce its high performing batteries; third-party producers of Amprius batteries continuing to produce such batteries in the expected quantities and caliber and at the expected prices; Amprius’ customers continuing to purchase batteries directly from Amprius; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius’ products; the risk that Amprius’ high volume tools do not achieve sufficient quality or yield or that its manufacturing process does not meet cost targets; Amprius’ liquidity position and its ability to raise additional capital; the ability of Amprius to maintain the listing of its securities on the New York Stock Exchange; the possibility that Amprius may be adversely affected by economic, business or competitive factors, including supply chain interruptions and developments in alternative technologies, and may not be able to manage other risks and uncertainties; the effect of macroeconomic factors, such as increased tariffs and related retaliatory actions, trade barriers, economic downturns and other business interruptions affecting the global economy and capital markets, such as uncertainty in the global markets, inflation, recessionary trends, or changes in spending by government agencies and contractors, abrupt political changes, geopolitics, currency fluctuations, embargoes, shortages, terrorist activity, armed conflict and public health emergencies on Amprius’ business; and changes in domestic and foreign business, market, financial, political and legal conditions. For more information on these risks and uncertainties that may impact the operations and projections discussed herein can be found in the documents Amprius filed from time to time with the SEC, all of which are available on the SEC’s website at www.sec.gov. If any of these risks materialize or Amprius’ assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this letter. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this letter. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.

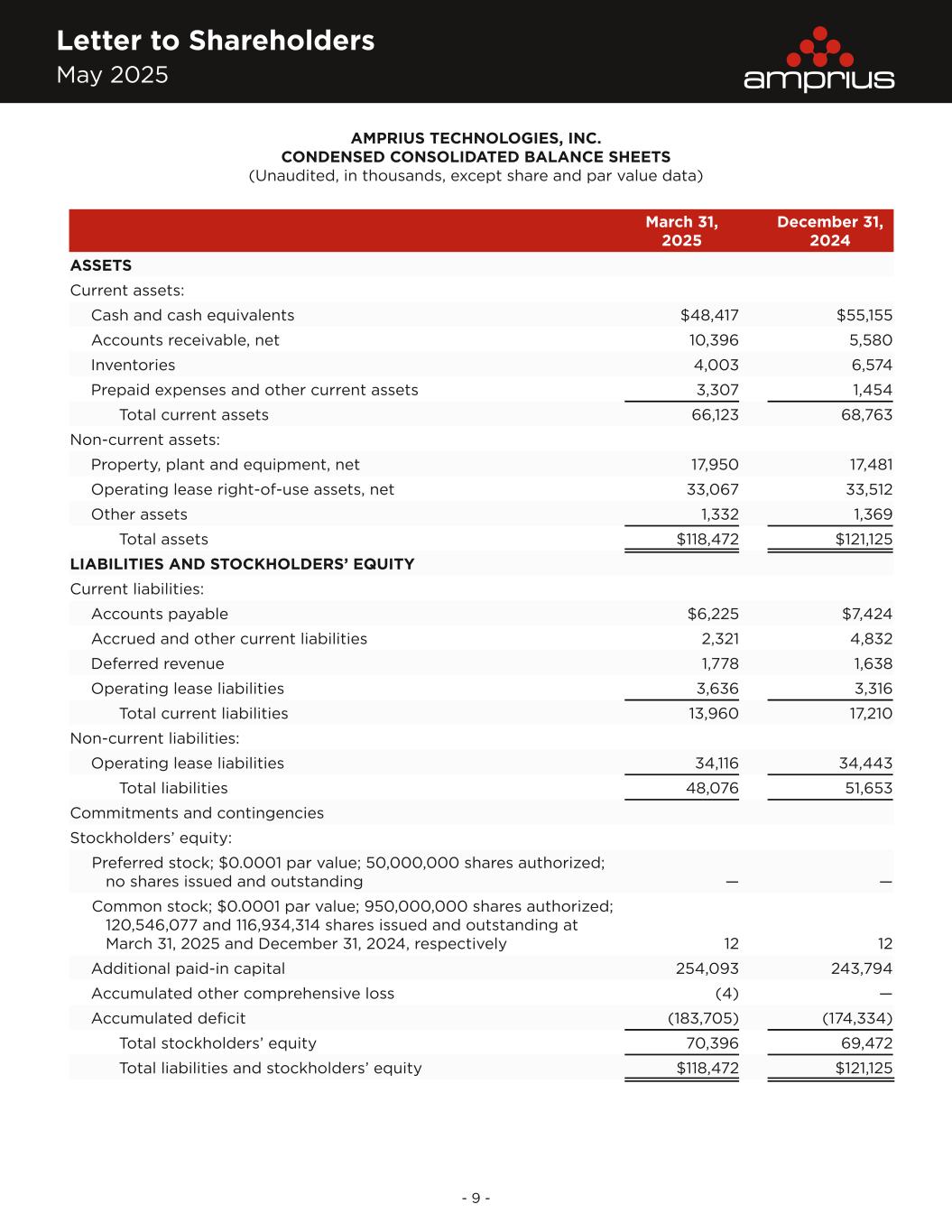

Letter to Shareholders May 2025 - 9 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited, in thousands, except share and par value data) March 31, 2025 December 31, 2024 ASSETS Current assets: Cash and cash equivalents $48,417 $55,155 Accounts receivable, net 10,396 5,580 Inventories 4,003 6,574 Prepaid expenses and other current assets 3,307 1,454 Total current assets 66,123 68,763 Non-current assets: Property, plant and equipment, net 17,950 17,481 Operating lease right-of-use assets, net 33,067 33,512 Other assets 1,332 1,369 Total assets $118,472 $121,125 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $6,225 $7,424 Accrued and other current liabilities 2,321 4,832 Deferred revenue 1,778 1,638 Operating lease liabilities 3,636 3,316 Total current liabilities 13,960 17,210 Non-current liabilities: Operating lease liabilities 34,116 34,443 Total liabilities 48,076 51,653 Commitments and contingencies Stockholders’ equity: Preferred stock; $0.0001 par value; 50,000,000 shares authorized; no shares issued and outstanding — — Common stock; $0.0001 par value; 950,000,000 shares authorized; 120,546,077 and 116,934,314 shares issued and outstanding at March 31, 2025 and December 31, 2024, respectively 12 12 Additional paid-in capital 254,093 243,794 Accumulated other comprehensive loss (4) — Accumulated deficit (183,705) (174,334) Total stockholders’ equity 70,396 69,472 Total liabilities and stockholders’ equity $118,472 $121,125

Letter to Shareholders May 2025 - 10 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in thousands, except share and per share data) Three months ended March 31, 2025 2024 Revenue $11,284 $2,336 Cost of revenue 13,645 6,781 Gross loss (2,361) (4,445) Gross margin (21)% (190)% Operating expenses: Research and development 2,003 1,581 Selling, general and administrative 5,307 4,293 Total operating expenses 7,310 5,874 Loss from operations (9,671) (10,319) Other income, net 300 433 Net loss ($9,371) ($9,886) Weighted-average common shares outstanding: Basic and diluted 117,969,812 90,029,320 Net loss per share of common stock: Basic and diluted ($0.08) ($0.11)

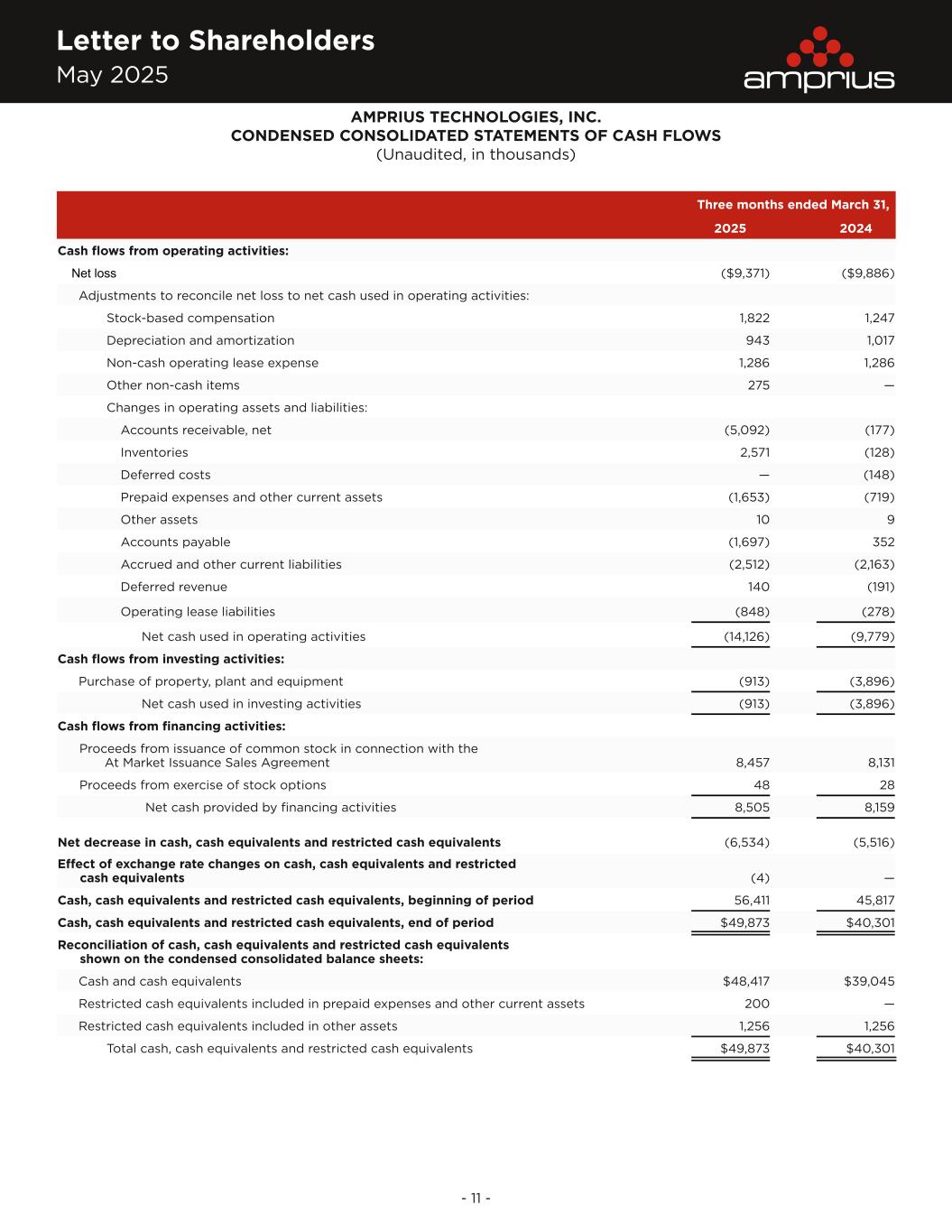

Letter to Shareholders May 2025 - 11 - AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, in thousands) Three months ended March 31, 2025 2024 Cash flows from operating activities: Net loss ($9,371) ($9,886) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 1,822 1,247 Depreciation and amortization 943 1,017 Non-cash operating lease expense 1,286 1,286 Other non-cash items 275 — Changes in operating assets and liabilities: Accounts receivable, net (5,092) (177) Inventories 2,571 (128) Deferred costs — (148) Prepaid expenses and other current assets (1,653) (719) Other assets 10 9 Accounts payable (1,697) 352 Accrued and other current liabilities (2,512) (2,163) Deferred revenue 140 (191) Operating lease liabilities (848) (278) Net cash used in operating activities (14,126) (9,779) Cash flows from investing activities: Purchase of property, plant and equipment (913) (3,896) Net cash used in investing activities (913) (3,896) Cash flows from financing activities: Proceeds from issuance of common stock in connection with the At Market Issuance Sales Agreement 8,457 8,131 Proceeds from exercise of stock options 48 28 Net cash provided by financing activities 8,505 8,159 Net decrease in cash, cash equivalents and restricted cash equivalents (6,534) (5,516) Effect of exchange rate changes on cash, cash equivalents and restricted cash equivalents (4) — Cash, cash equivalents and restricted cash equivalents, beginning of period 56,411 45,817 Cash, cash equivalents and restricted cash equivalents, end of period $49,873 $40,301 Reconciliation of cash, cash equivalents and restricted cash equivalents shown on the condensed consolidated balance sheets: Cash and cash equivalents $48,417 $39,045 Restricted cash equivalents included in prepaid expenses and other current assets 200 — Restricted cash equivalents included in other assets 1,256 1,256 Total cash, cash equivalents and restricted cash equivalents $49,873 $40,301