EX-99.1

Published on March 23, 2023

LETTER TO SHAREHOLDERS Q4 Fiscal 2022 March 2023

Letter to Shareholders March 2023 Company Overview Amprius Technologies develops and manufactures ultra-high energy density lithium-ion batteries based on our propriety silicon anode technology. Today, we’re able to produce industry-leading performance with up to 450 Wh/kg specific energy density, up to 1,150 Wh/L volumetric energy density, and up to 10C high power charging capability. Amprius batteries are also built for the toughest of situations, with the durability to pass the military’s stringent performance specification nail penetration test and the versatility to operate in an extremely wide temperature range of as low as -30°C and up to 55°C. Even with these innovative features, our ability to generate an extreme fast charge rate of 0-80% state of charge in approximately six minutes sets Amprius apart. It is our belief that there is no one else in the commercial market that can perform at these levels. In addition, we have amassed over 80 patents and over a decade of know-how in anode technology and manufacturing. Our business has four distinct advantages: • Unmatched technical and product performance • Years of product commercialization experience endorsed by industry leaders • Proven manufacturability, with a pathway to higher volume manufacturing capacity • A team of seasoned business operators with a solid track record Our near-term goal is to scale our manufacturing capabilities to achieve our long-term vision of becoming a mainstream battery solution with applications across all segments of electric mobility, including the aviation and EV industries. Looking at 2023, the next several months will be dedicated to expanding our existing capabilities to maintain our industry-best performance at scale. To date, we’ve already made significant progress toward that plan. Fellow Shareholders, This past year was one of great progress and many firsts for our company. Highlighted by significant technology breakthroughs, continued commercial successes, and major developments for our production capacity expansion, 2022 was arguably the most transformational year for Amprius since our founding. We are pleased to share our financial results and operational highlights with you below. As is our standard procedure, this shareholder letter will be followed by a conference call on which we will briefly summarize the main highlights before then hosting an interactive Q&A session.

Letter to Shareholders March 2023 Disruptive Technology Advancements Our focus on innovation is at the core of everything that we do. We are committed to advancing our capabilities to build on our leadership position and push the industry forward. Over the last several months, we’ve made significant advancements and achieved new technology breakthroughs. • 500 Wh/kg capable batteries: Earlier today, we announced that our upgraded 500 Wh/ kg capable batteries have had their capacities verified by an independent third-party, a crucial step in the product development timeline. Although not yet available to the market, demand for this next generation of battery is growing, and we are making great progress toward eventual commercialization. Based on current estimates, we expect to ship prototypes to select customers this year. • Extreme Fast Charge: In October, we successfully demonstrated our batteries’ extreme fast charge ability through a video demonstration, where we were able to achieve a rate of 0-80% charge in less than ten minutes. This performance is ahead of the U.S. Advanced Battery Consortium 2025 goal of 0-80% in sub-15 minutes. In practice, this will allow vehicles and other applications to operate much more efficiently with less down time. • Nail Penetration Test: In December, we announced that an independent third-party testing lab has validated our 390 Wh/Kg polymer electrolyte cell by successfully passing the Military Performance Specification nail penetration test per the requirements of section 4.7.4.4. of the MIL-PRF-32383. The test is used to determine the feasibility of a specific product in combat scenarios and is an important benchmark to be considered for military applications. Growing our Blue-Chip Customer Base 2022 was a successful sales year for our aviation and defense segments. We signed new multi-year agreements with several aviation industry leaders and expanded our existing commitments with Airbus, the U.S. Army, and USABC, among others. In May, we were awarded funding for a second multi- year development program with the United States Advanced Battery Consortium for the development of low-cost EV batteries. This consortium is between Ford, GM and Stellantis, and is enabled by a cooperative agreement with the U.S. Department of Energy. We’re pleased to announce that we officially delivered the first set of reference cells in the fourth quarter. In July, we announced a three-year deal for Teledyne FLIR to use our batteries as they develop their Unmanned Aircraft System products. In October, we entered into a three-year cooperation agreement with BAE systems to develop lightweight high-energy batteries specifically for electrically powered flight applications. Altogether, these new wins and expansions amount to a 65% year-over-year boost in shipments. We believe our successful early efforts are now driving a positive flywheel effect, leading to new orders from new customers and expansion orders from existing customers. Path to Commercial Scale Above all, our goal of high-volume manufacturing capacity was front and center in 2022. As we prioritize our goals for the next several years, our primary focus will remain on expanding capacity to take advantage of the tremendous opportunities in our target markets. Today, we have more customer inquiries than our capacity can serve. We are diligently working to meet increasing demand and to ultimately achieve a sustainable cost structure at scale. We made several strategic moves that now have us on a clear path to achieve these goals. Listed on the NYSE: In September, we closed our business combination with Kensington Capital Acquisition Corp. IV to provide us with greater

Letter to Shareholders March 2023 access to capital via the public markets. Through that process, we also raised approximately $71 million net of expenses and added a strategic customer to our investor base in AeroVironment. We could not have asked for better partners than the Kensington team and have continued to work closely alongside them as we execute on our capital markets initiatives into 2023. More recently, we put in place a committed equity facility, which allows for an up to $200 million additional source of funding. Received commitments towards two cost-sharing grants from the U.S. government: • After a competitive process, Amprius was selected to receive two cost-sharing grants from the U.S. Department of Energy in October of 2022. The first is a $1 million grant from the U.S. Department of Energy’s Office’s (DOE) Advanced Manufacturing Office for the build out of our Fremont facility. • The second is a $50 million cost sharing demonstration grant selected for negotiation of award from the DOE’s Office of Manufacturing and Energy Supply Chains. Amprius is among the first set of companies to be selected for negotiation of awards to receive funding from President Biden’s Bipartisan Infrastructure Law to expand domestic manufacturing of batteries. Received our first large-scale anode production machine from centrotherm in October: This machine is now installed at our Fremont facility and is expected to increase our capacity for silicon anode production to approximately 2 MWh, or about ten times our current capacity, exiting 2023. Furthermore, it allows us to accelerate the development of our technological processes for building batteries at a gigawatt scale. This expertise is necessary as we prepare to begin construction of our high-volume manufacturing facility. To meet this greater production output, we recently expanded our facility in Fremont, California, effectively doubling our footprint in that location. Our expansion in Fremont is planned to improve our high-volume manufacturing processes and increase our capacity by 10x. Building Our High-Volume Manufacturing Facility In an important milestone for Amprius, earlier this month we officially announced our site selection in Brighton, Colorado as the location for our new 774,000 square foot gigawatt facility. We worked closely with the state of Colorado, the Colorado Economic Development Commission, Adams County, and the City of Brighton to align on terms that are mutually beneficial, which include a comprehensive incentive proposal. The initial phase of our buildout provides a potential of up to 5 GWh and is also expected to create over 330 new jobs. For subsequent phases, the site has expansion capabilities for up to a total potential manufacturing capacity of 10 GWh. Our commitment to Colorado allows us to establish our large-scale operation here in the United “We need more batteries to power the future, and now we will be manufacturing more of them right here in Colorado. We are excited to welcome Amprius to Colorado, bringing over 300 new good-paying jobs, and joining Colorado’s innovative and collaborative business community.” - Colorado Governor Jared Polis

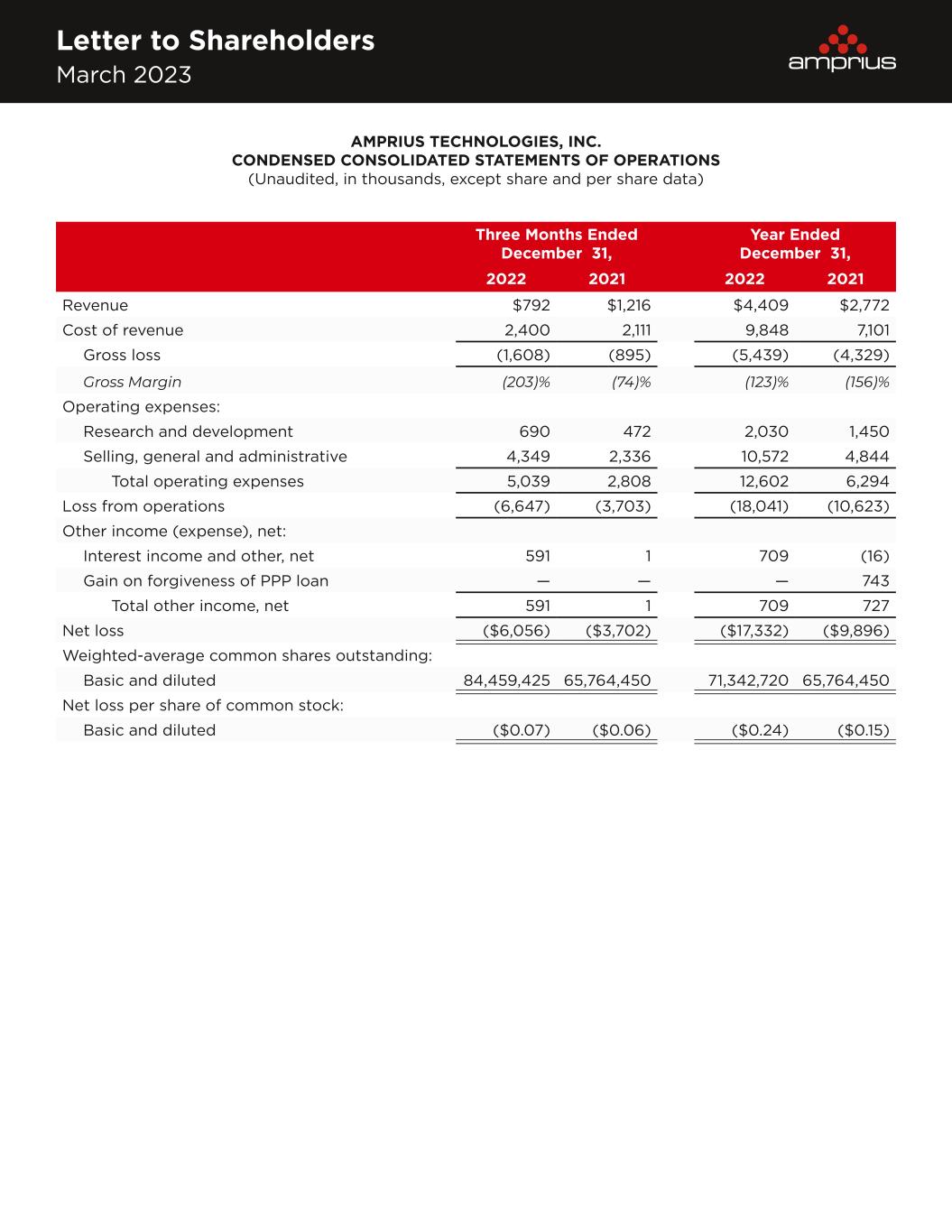

Letter to Shareholders March 2023 States, and ensure that Amprius batteries will be designed and made in the U.S. Just last month, Amprius was featured in a cover story from The Wall Street Journal, which offered great detail on the current global supply chain for battery production and highlighted the need for significant domestic expansion. We look forward to playing a pivotal role in the U.S.’s commitment to being a leader in the energy transition. To further support our Colorado buildout, we’ve added critical roles to lead our scale up and corporate marketing efforts as well as our legal and accounting divisions. In addition, we made a strategic decision to form two new business units: Amprius Lab and Amprius Fab. Amprius Lab, located in Fremont, will focus on advanced battery technology, product, and manufacturing process development; while Amprius Fab, located in Brighton, will focus on the large-scale fabrication of silicon anode batteries. To support this transition, Jon Bornstein, currently the Company’s COO, will take a new role to lead Amprius Lab as the division President. In the interim, I, Kang Sun, will serve as the acting President of Amprius Fab. Financial Performance In our financials, particularly in our revenue results, you will see data points that reinforce the strength of our customer development efforts as we scale. We believe that those results, especially when paired with our investments in both our Fremont capacity and gigawatt-hour scale capabilities, position the company well to achieve its growth and profitability potential. We closed out 2022 with $4.4 million in revenue. Product revenue was $2.4 million, including over 25 new customers to which we shipped batteries within calendar 2022. Within that set of customers, four are leading eVTOL manufacturers and two are global battery pack suppliers for the aviation sector. Also, we delivered commercial quantity shipments to AeroVironment and Teledyne Flir, and completed two flight sets for Airbus’s HAPS program, with a backlog of six more sets scheduled for future deliveries. Development services revenue totaled $1.8 million, driven by both the delivery of cells and the timing of other deliverables under multiple contracts. We also recognized the first portion of the $1.0 million DOE cost sharing grant revenue, which was $0.2 million. For 2022, our GAAP gross margin was negative 123%. Our gross margin displays variations period “We need more batteries for our clean energy future and we should build them right here in America. Thanks to our Bipartisan Infrastructure Law, Amprius is making Colorado the home for that future.” - U.S Senator John Hickenlooper

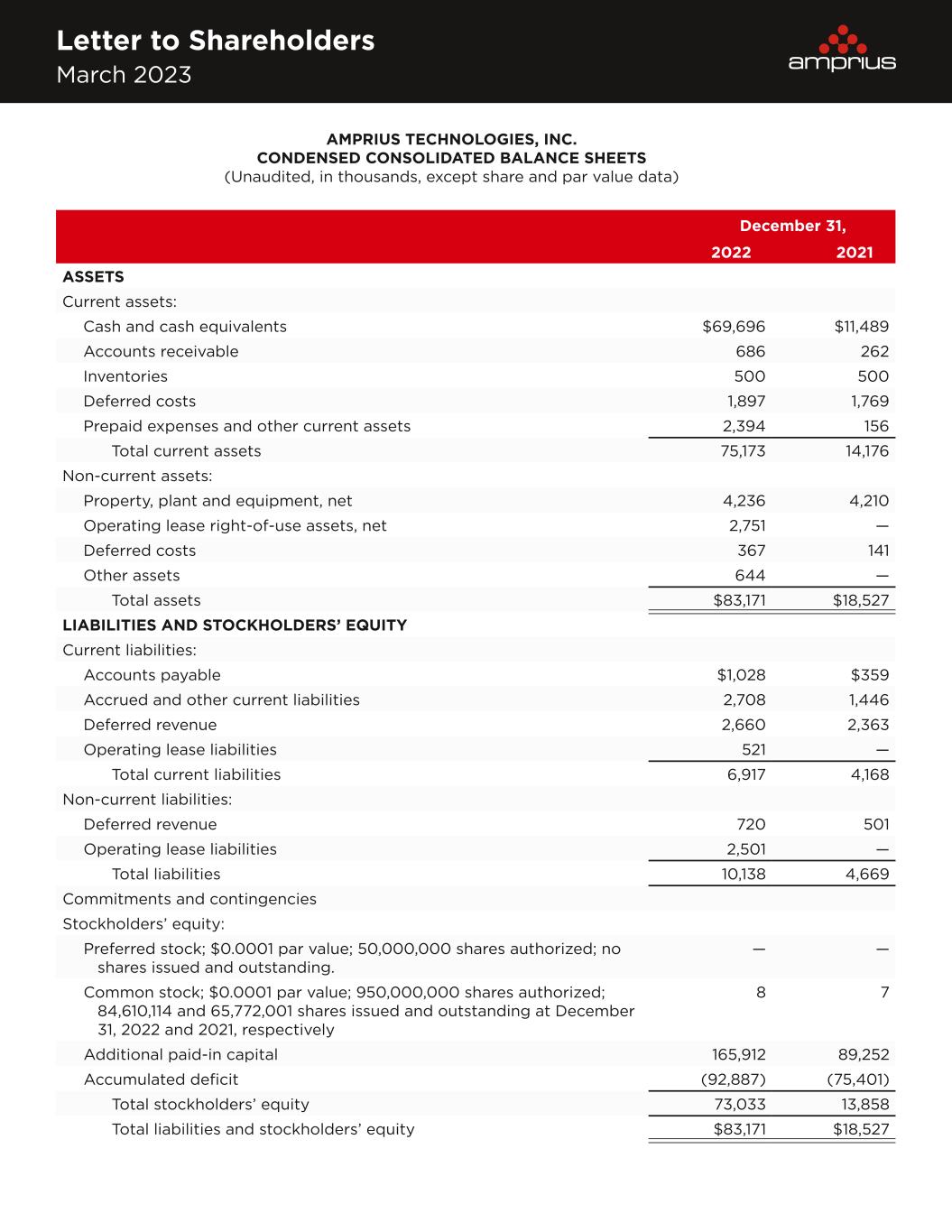

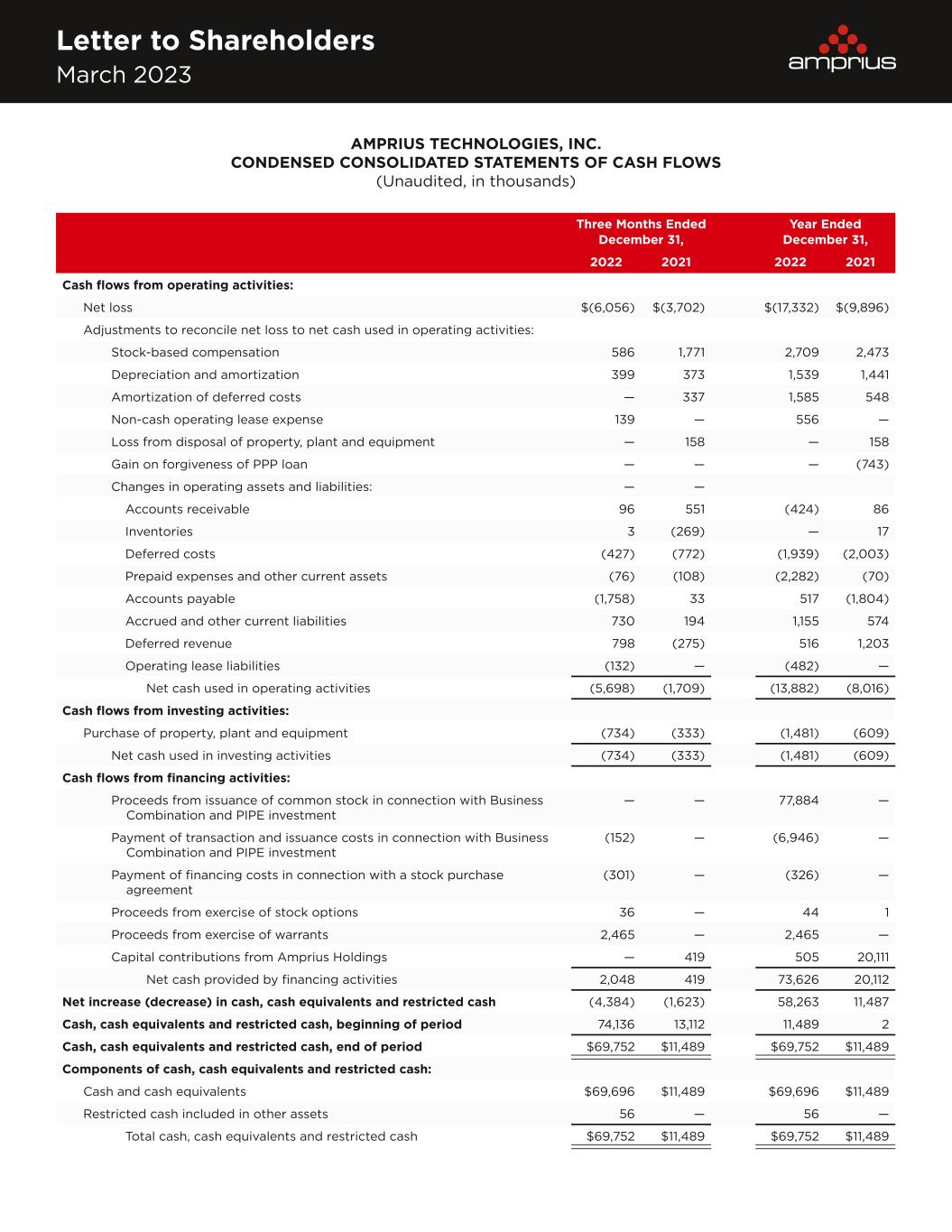

Letter to Shareholders March 2023 over period based on the mix of product and services. Moving now to our operating expense management, our GAAP operating expenses for 2022 were $12.6 million, with higher G&A expenses in Q3 and Q4 due to increased public company costs. Our 2022 GAAP net loss was $17.3 million, or a loss of $0.24 cents per share. Our shares outstanding at December 31, 2022 were 84.6 million, with 71.3 million weighted average shares of common stock outstanding for the year. As of December 31, 2022, there were 59 full time employees primarily based in our Fremont, CA location. Share-based compensation for 2022 was $2.7 million. Turning to the balance sheet, we exited 2022 with $69.7 million in cash and no debt, a net increase of $58.2 million from December 31, 2021. The key drivers of our cash activity for the year were: • $13.9 million used in operating activities • $1.5 million in capital expenditures, which represents our investments in our current manufacturing facility as well in opportunities to expand our footprint and accelerate our capacity to support customer qualifications and scale up • $73.6 million net cash provided by financing activities, driven by proceeds received in connection with the business combination and the PIPE investment, net of issuance costs, and proceeds from the exercise of stock warrants and options. Financial Outlook Moving to our outlook, we expect to continue to be limited by manufacturing capacity until we exit 2023 with the new 2 MWh capacity coming online. Regarding revenue, we have several ongoing development services programs with performance obligations that we expect to complete within 2023, which means that we expect increased revenue recognition weighted more heavily towards the latter part of the year. We expect that our G&A costs will continue at the higher rate we experienced exiting 2022, noting additional public company expenses. Also, we plan to continue to be lean on other operating expenses, strategically adding critical mass to the new business units that we announced and allocating the majority of our capital to scaling up our manufacturing. And, we expect higher capital expenditures going forward, as we continue to fully build out the 2 MWh capacity in Fremont, CA, while we in parallel design and construct our newly announced Brighton, Colorado gigawatt-hour scale facility. Our spending pattern is dependent on several factors outside of our control, including the timing of approval for rezoning for the Colorado site, so we expect to provide more specific projections as we have additional information to share. We expect that we will continue to have strong support from the U.S. Inflation Reduction Act (IRA) as we access Production Tax Credits at the anode and cell levels. In addition, we have received over ten million dollars in state and local incentive packages relating to our gigawatt-scale facility, which are the result of significant partnerships built in Colorado through our selection process. We believe that these tailwinds will further enhance our economics as we accelerate our scale to meet our massive market. With the strength of our balance sheet and multiple vehicles to generate additional funding through both equity, such as warrants and our Committed Equity Facility, and non-dilutive sources, such as grants, loans, and incentives, we believe we will have enough cash to execute on our strategic plan.

Letter to Shareholders March 2023 Overall, last year was a strong step forward for our business, and we believe we’re just getting started. We have secured the financial foundation necessary to support our initiatives, are building the capacity to become a leading commercial provider in the sustainable mobility sector, and have the team in place to execute our mission. Going forward, our strategy and focus remains unchanged. We expect to reach new production milestones in 2023, including reaching full capacity with our 2 MWh pilot line in Fremont by the end of the year. And we are continuing to build a pipeline of blue-chip customers to meet our planned expansion efforts, which have us operating at scale of hundreds of megawatts exiting 2024. Amprius has a tremendous opportunity ahead, with a product portfolio that positions us to both grow in the aviation market and expand to other industries seeking batteries with stronger performance and faster charge times. We look forward to advancing our technology, building our customer base, and further proving out our large-scale manufacturing process and parameters to capitalize on the robust market demand for next-generation batteries in the years ahead. The team at Amprius appreciates your continued support, and we look forward to what is ahead for our company and the battery industry. Summary Quarterly Conference Call and Webcast: Date: Thursday, March 23, 2023 Time: 5:00 PM ET (2:00 PM PT) Toll-Free Number: +1 866-424-3442 International Number: +1 201-689-8548 Webcast: Register and Join Dr. Kang Sun, CEO Sandra Wallach, CFO

Letter to Shareholders March 2023 AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited, in thousands, except share and par value data) December 31, 2022 2021 ASSETS Current assets: Cash and cash equivalents $69,696 $11,489 Accounts receivable 686 262 Inventories 500 500 Deferred costs 1,897 1,769 Prepaid expenses and other current assets 2,394 156 Total current assets 75,173 14,176 Non-current assets: Property, plant and equipment, net 4,236 4,210 Operating lease right-of-use assets, net 2,751 — Deferred costs 367 141 Other assets 644 — Total assets $83,171 $18,527 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $1,028 $359 Accrued and other current liabilities 2,708 1,446 Deferred revenue 2,660 2,363 Operating lease liabilities 521 — Total current liabilities 6,917 4,168 Non-current liabilities: Deferred revenue 720 501 Operating lease liabilities 2,501 — Total liabilities 10,138 4,669 Commitments and contingencies Stockholders’ equity: Preferred stock; $0.0001 par value; 50,000,000 shares authorized; no shares issued and outstanding. — — Common stock; $0.0001 par value; 950,000,000 shares authorized; 84,610,114 and 65,772,001 shares issued and outstanding at December 31, 2022 and 2021, respectively 8 7 Additional paid-in capital 165,912 89,252 Accumulated deficit (92,887) (75,401) Total stockholders’ equity 73,033 13,858 Total liabilities and stockholders’ equity $83,171 $18,527

Letter to Shareholders March 2023 Three Months Ended December 31, Year Ended December 31, 2022 2021 2022 2021 Revenue $792 $1,216 $4,409 $2,772 Cost of revenue 2,400 2,111 9,848 7,101 Gross loss (1,608) (895) (5,439) (4,329) Gross Margin (203)% (74)% (123)% (156)% Operating expenses: Research and development 690 472 2,030 1,450 Selling, general and administrative 4,349 2,336 10,572 4,844 Total operating expenses 5,039 2,808 12,602 6,294 Loss from operations (6,647) (3,703) (18,041) (10,623) Other income (expense), net: Interest income and other, net 591 1 709 (16) Gain on forgiveness of PPP loan — — — 743 Total other income, net 591 1 709 727 Net loss ($6,056) ($3,702) ($17,332) ($9,896) Weighted-average common shares outstanding: Basic and diluted 84,459,425 65,764,450 71,342,720 65,764,450 Net loss per share of common stock: Basic and diluted ($0.07) ($0.06) ($0.24) ($0.15) AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in thousands, except share and per share data)

Letter to Shareholders March 2023 AMPRIUS TECHNOLOGIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, in thousands) Three Months Ended December 31, Year Ended December 31, 2022 2021 2022 2021 Cash flows from operating activities: Net loss $(6,056) $(3,702) $(17,332) $(9,896) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 586 1,771 2,709 2,473 Depreciation and amortization 399 373 1,539 1,441 Amortization of deferred costs — 337 1,585 548 Non-cash operating lease expense 139 — 556 — Loss from disposal of property, plant and equipment — 158 — 158 Gain on forgiveness of PPP loan — — — (743) Changes in operating assets and liabilities: — — Accounts receivable 96 551 (424) 86 Inventories 3 (269) — 17 Deferred costs (427) (772) (1,939) (2,003) Prepaid expenses and other current assets (76) (108) (2,282) (70) Accounts payable (1,758) 33 517 (1,804) Accrued and other current liabilities 730 194 1,155 574 Deferred revenue 798 (275) 516 1,203 Operating lease liabilities (132) — (482) — Net cash used in operating activities (5,698) (1,709) (13,882) (8,016) Cash flows from investing activities: Purchase of property, plant and equipment (734) (333) (1,481) (609) Net cash used in investing activities (734) (333) (1,481) (609) Cash flows from financing activities: Proceeds from issuance of common stock in connection with Business Combination and PIPE investment — — 77,884 — Payment of transaction and issuance costs in connection with Business Combination and PIPE investment (152) — (6,946) — Payment of financing costs in connection with a stock purchase agreement (301) — (326) — Proceeds from exercise of stock options 36 — 44 1 Proceeds from exercise of warrants 2,465 — 2,465 — Capital contributions from Amprius Holdings — 419 505 20,111 Net cash provided by financing activities 2,048 419 73,626 20,112 Net increase (decrease) in cash, cash equivalents and restricted cash (4,384) (1,623) 58,263 11,487 Cash, cash equivalents and restricted cash, beginning of period 74,136 13,112 11,489 2 Cash, cash equivalents and restricted cash, end of period $69,752 $11,489 $69,752 $11,489 Components of cash, cash equivalents and restricted cash: Cash and cash equivalents $69,696 $11,489 $69,696 $11,489 Restricted cash included in other assets 56 — 56 — Total cash, cash equivalents and restricted cash $69,752 $11,489 $69,752 $11,489

Letter to Shareholders March 2023 Forward-Looking Statements This Letter to Shareholders includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, each as amended, including Amprius’ expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “will,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding Amprius’ ability to build a large-scale manufacturing facility and expand its manufacturing capacity, the number of jobs that will be created in the manufacturing process, Amprius’ ability to produce its products at a commercial level, Amprius’ future commercial products, the addressable market for Amprius’ batteries, the potential application and performance of Amprius’ batteries and Amprius’ financial and business performance. These statements are based on various assumptions, whether or not identified in this letter, and on the current expectations of Amprius’ management and are not predictions of actual performance. These forward-looking statements are not intended to serve as, and must not be relied upon by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Amprius’ control. These forward-looking statements are subject to a number of risks and uncertainties, including Amprius’ ability to successfully negotiate a lease agreement under reasonably acceptable terms; delays in permitting, construction and operation of production facilities; risks related to the performance of Amprius’ batteries; risks related to the rollout of Amprius’ business and the timing of expected business milestones; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of Amprius’ products; the termination of government clean energy and electric vehicle incentives or the reduction in government spending on vehicles powered by battery technology; the risk that our high volume tools do not achieve sufficient quality or yield or meet cost targets; and changes in domestic and foreign business, market, financial, political and legal conditions. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in the “Risk Factors” section of Amprius’ Quarterly Report on Form 10-Q filed on November 14, 2022 with the Securities and Exchange Commission (the “SEC”) and other documents filed by Amprius from time to time with the SEC, all of which are available on the SEC’s website at www.sec.gov. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this letter. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this letter. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required.